Financial institutions (FIs) worked quickly to ensure they could operate smoothly as the pandemic kept consumers at home and closed brick-and-mortar branches in Europe, the United Kingdom and the United States.

Many banks braced themselves for an oncoming surge in the number of consumers accessing their financial accounts online or via mobile banking apps, but safely and seamlessly providing that access remained tricky for many in the space.

This is because many legacy FIs in particular are still reliant upon legacy infrastructure, which is simply not designed to handle the sheer volume of data generated in today’s digital banking sphere. The use of the cloud to upgrade core banking platforms has become more intriguing to today’s FIs as they struggle to meet this increasing demand, but migration challenges to cloud-based platforms still abound.

In the June edition of the “Digital Banks And The Power Of The Cloud Tracker®,” PYMNTS examines how the pandemic is affecting cloud migration of legacy FIs as well as how the pandemic may be impacting the ongoing consumer shift to online and mobile banking tools. The Tracker also analyzes how the use of cloud technology can help FIs stay on top of that shift.

Developments Around the Cloud Banking World

Utah-based FI Continental Bank is one such entity tapping cloud technology to bring more flexibility to its financial solutions as the pandemic makes seamless digital services more critical. The bank will be working with a third-party cloud technology provider to develop a new digital core, which it will use to further support online banking for small- to medium-sized businesses (SMBs). It will be relying upon its new cloud-supported platform to craft newer products for quicker deposits and easier lending, according to company statements. Cloud technology aids in this endeavor by making it much easier to handle larger amounts of data and to process online transactions more quickly, and will thus allow Continental Bank to serve more SMBs.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Spanish bank CaixaBank is another FI looking to upgrade its online banking platform through the use of cloud-based technologies. The bank will be expanding its existing relationship with technology and software provider IBM to create digital products which will use the cloud to more easily collect and analyze greater volumes of customer data. CaixaBank will then tailor that data to provide more personalized insights to their customers. The insights will run off IBM’s cloud-based servers, which also make use of automated and artificial intelligence (AI)-supported solutions for greater efficiency.

Spanish bank CaixaBank is another FI looking to upgrade its online banking platform through the use of cloud-based technologies. The bank will be expanding its existing relationship with technology and software provider IBM to create digital products which will use the cloud to more easily collect and analyze greater volumes of customer data. CaixaBank will then tailor that data to provide more personalized insights to their customers. The insights will run off IBM’s cloud-based servers, which also make use of automated and artificial intelligence (AI)-supported solutions for greater efficiency.

Pacific National Bank (PNB), meanwhile, is using cloud core banking tools to support and launch a new digital-only financial brand which it is calling FACILE. The FI officially opened the digital platform to U.S. customers in late May. PNB is also teaming up with a third-party cloud technology provider for FACILE’s services, which are tailored to today’s more digitally-minded consumers. FACILE will be marketed as a competitor to other digital-only banks making headway in the U.S., such as Monzo and N26. It will use cloud technology to underpin FACILE’s offerings, especially the digital payment services it provides.

For more on these and other stories, visit the Tracker’s News & Trends.

How N26 Is Using Cloud Core Banking for Nimble Mobile Innovation

Consumers were already leaning on digital tools before the pandemic required them to obey stay-at-home orders and bank branches to either close or limit their hours. The pandemic accelerated this shift to mobile banking, and many customers both existing and new are choosing to interact with their FIs through their mobile phone screens as their primary channel, even as states reopen. This means that FIs must prepare to conduct seamless and personalized relationships with a high volume of consumers who are now mobile-first, a pivot that can be difficult when many FIs are still relying on older infrastructures.

Using the cloud as one’s banking core allows much more flexibility, says Lindsey Grossman, director of product for digital challenger bank N26, in an interview with PYMNTS.

To learn more about how N26 is employing cloud technology to create key flexibility on its online banking platform, visit the Tracker’s Feature Story.

Why the Pandemic Is Pushing Legacy F Is’ Cloud Migrations Forward

Is’ Cloud Migrations Forward

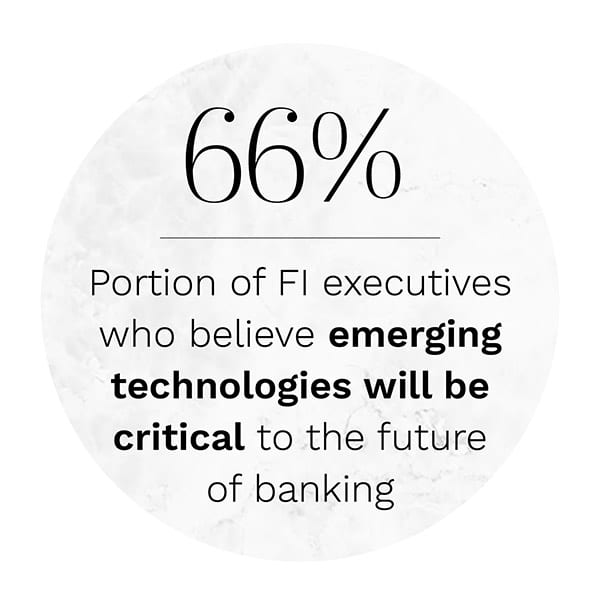

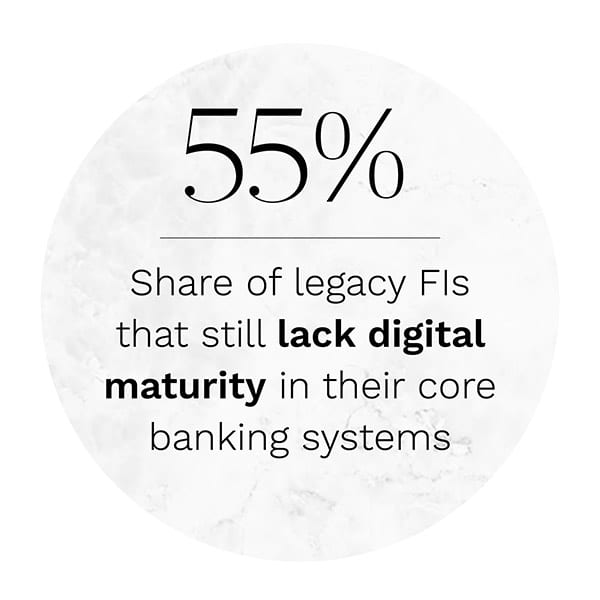

The rush to digital banking during the pandemic was not unexpected by the financial industry, but the ensuing surge of online transactions and requests still presented problems for many FIs, especially legacy institutions. Many of these institutions have not yet upgraded the core banking infrastructure they have been using to support the bulk of the interactions taking place on their platforms, with one recent study showing 55 percent of legacy banks still lacking digital maturity. This was already causing struggles for these FIs prior to the pandemic, but the virus’s impact has exacerbated many of these preexisting problems. Yet migrating legacy infrastructure to cloud-based platforms still may not be as easy as the financial industry may like.

To learn more about the challenges keeping legacy FIs from the cloud, visit the Tracker’s Deep Dive.

About the Tracker

The “Digital Banks And The Power Of The Cloud Tracker®,” a PYMNTS and NuoDB collaboration, examines the latest developments in digital banking, detailing how banks are using the cloud and other innovative tools to enhance and personalize finance.