Banks, credit unions and other financial institutions (FIs) were forced to stop more than $25 billion in fraud attempts in 2018 alone, but such efforts can often feel ineffective as fraud continues to grow regardless of FIs’ prevention measures. Sixty-one percent of FIs report that the volume of fraud they fight is increasing over time, and 59 percent report that the total value of fraud attempts they face is rising, as well.

Banks, credit unions and other financial institutions (FIs) were forced to stop more than $25 billion in fraud attempts in 2018 alone, but such efforts can often feel ineffective as fraud continues to grow regardless of FIs’ prevention measures. Sixty-one percent of FIs report that the volume of fraud they fight is increasing over time, and 59 percent report that the total value of fraud attempts they face is rising, as well.

FIs are turning to advanced technology such as artificial intelligence (AI) and machine learning (ML) to bring financial crime to heel, as these systems can analyze thousands of transactions and applications every second and pinpoint uncharacteristically large transactions, login attempts from multiple devices in different regions and other warning signs of fraud. Banks have reported increases in fraud detection rates of up to 50 percent through the use of AI and ML, but these tools are still only used by a minority of FIs around the world.

The August Preventing Financial Crimes Playbook explores the latest financial crime developments, including growing rates of identity theft, how an increasing number of consumer credentials are available on the dark web and how FIs are leveraging AI and ML to counter the diverse assortment of schemes fraudsters are deploying.

Developments Around The Financial Crimes Space

Developments Around The Financial Crimes Space

Banks’ security measures can go a long way toward preventing financial crime, but consumers must also be proactive when safeguarding their data. They seem to have much to learn, however, as a recent study of 2,000 bank customers found that four out of five could not consistently distinguish between legitimate bank messages and those sent by fraudsters. Many fake messages included spelling mistakes, requests for personal information and other telltale signs of deception, as well, revealing that banks must take measures to educate their customers on the warning signs of fraud.

Some fraudsters eschew stealing identities themselves and instead purchase stolen credentials from other bad actors online. A recent study from security firm Digital Shadows found that more than 15 billion such stolen credentials — 5 billion of which were unique — were available for purchase on dark web marketplaces. The number of bank account numbers, username-password combinations and other valuable information has increased by 300 percent since 2018, and they are ripe for use in financial crimes.

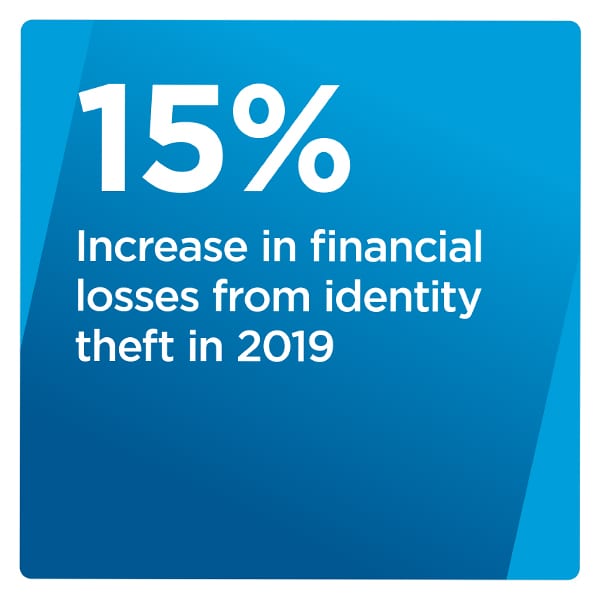

These leaked credentials are primarily used for identity theft, which a recent study found increased by 15 percent between 2018 and 2019. Losses due to identity theft totaled $16.9 billion after reaching a five-year low in 2018, with this rise attributed to an increase in account takeovers (ATOs). Just 12 percent of financial fraud was the result of ATOs in 2015, but they accounted for 53 percent in 2019.

study found increased by 15 percent between 2018 and 2019. Losses due to identity theft totaled $16.9 billion after reaching a five-year low in 2018, with this rise attributed to an increase in account takeovers (ATOs). Just 12 percent of financial fraud was the result of ATOs in 2015, but they accounted for 53 percent in 2019.

For more on these and other financial crime news items, download this month’s Playbook.

How AI And ML Are Fighting Rising Corporate Banking Fraud

Financial crime is a pervasive threat to FIs, with human analysts and static rules running the risk of being overwhelmed or generating false positives. Automated systems like AI and ML could give banks the edge they need to seamlessly stop fraud, however. In this month’s Feature Story, PYMNTS spoke with Beate Zwijnenberg, chief information security officer for ING Group, about how automated systems detect anomalous transactions that could indicate financial crime.

Deep Dive: How harnessing AI and ML boosts FIs’ fraud prevention efforts

Deep Dive: How harnessing AI and ML boosts FIs’ fraud prevention efforts

Banks deploy a wide variety of fraud prevention tools to protect themselves and their customers, but many of these tools have varying degrees of efficacy. Solutions based on human analysis can have false-positive rates of more than 90 percent, frustrating legitimate customers and even putting their loyalty into jeopardy. AI and ML can accelerate these fraud prevention initiatives and reduce customer friction, however. This month’s Deep Dive explores the advantages that AI and ML systems bring to fraud prevention and the obstacles that keep more banks from deploying such tools.

About The Playbook

The monthly Preventing Financial Crimes Playbook, a NICE Actimize collaboration, offers coverage of the most recent news and trends the financial crime prevention space.