Federal and state agencies were reminded this spring of just how outdated and outmoded their disbursement systems have become. The fiasco around distributing individual stimulus payments and Paycheck Protection Program (PPP) loans made it glaringly obvious that despite advances like instant P2P transfers in the consumer world, business disbursements lag.

A vexing situation to be sure, and one that’s being dealt with in a variety of ways as more players drive for a wholesale upgrade of existing disbursements infrastructure.

“For disbursements specifically, the opportunity is … for a more modern solution,” Drew Edwards, CEO at Ingo Money, recently told PYMNTS.

A growing group of financial institutions (FIs) are placing themselves at the forefront of the modernization push by engineering disbursements frameworks easily accessed via digital platforms, and which promise to improve the experience for payees and payors alike.

“In our recent surveys, we’ve found that there are a lot of businesses that believe they offer choice in disbursements, yet their customers don’t share that opinion,” Ingo Money Executive Vice President and Chief Product Officer Lisa McFarland told PYMNTS.

“That illustrates the idea that choice is in the eye of the beholder — or, in this case, the eye of the receiver,” McFarland said.

Advertisement: Scroll to Continue

For its part, Ingo Money proposes that a modern disbursements experience comprises eight elements, those being real-time (not batch) payments, cross-functional workflows, demonstrating value vs. cost, emphasizing payments choice, enabling cross-customer use cases, focusing on interoperable ecosystems (not proprietary), facilitating cross-channel touchpoints from home to smartphone to store, and full cross-border payments capabilities.

Underestimating Real-Time Requirements

To simplify, the common denominators of a modern disbursements experience come down to speed, security and choice, more or less in that order. Financial institutions should pay attention to the rapid evolution in this area, as it’s becoming a decisive factor post-COVID.

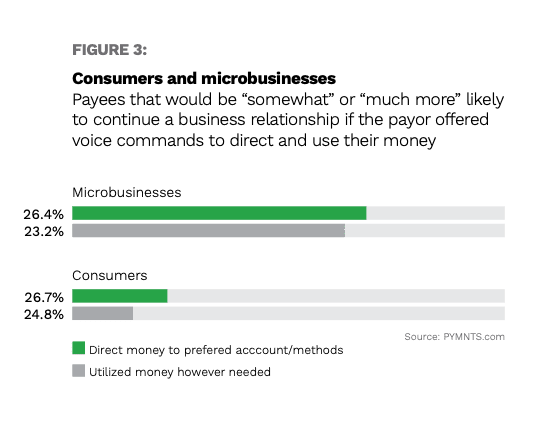

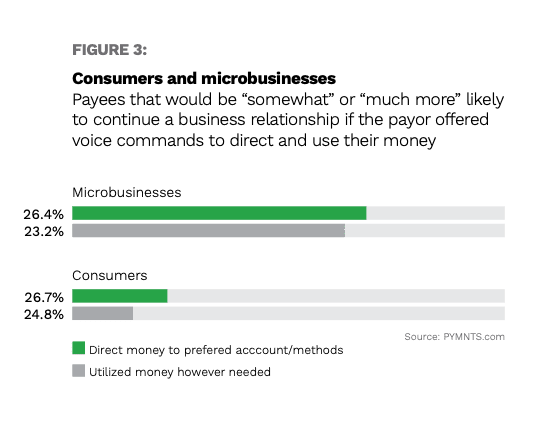

“More than 60 percent of consumers and microbusinesses that receive disbursements … say they would be more willing to continue a business relationship with companies … that offer free instant funds access, but only 30 percent would continue doing business with a firm that did not offer this payment option,” according to PYMNTS’ August 2020 Disbursements Satisfaction Report: Monetizing Payout Choice.

“Payors know this but greatly underestimate how much payees value instant payments.”

And observing that “… instant payments has plateaued over the past 12 months,” the August Disbursements Satisfaction Report found that “only 13 percent of consumers and 8 percent of microbusinesses get their money through an instant payment to a debit card, credit card, digital wallet or prepaid card” despite the wide availability of these payments tools and technologies.

Those numbers speak volumes about the work that remains to be done in disbursements.

Overcoming Flawed Perceptions

It wasn’t brand-name banks that took instant payments to the next level, and they haven’t exactly been leading the way when it comes to modernizing disbursements. That’s changing.

“The entire [digital payments] industry ends up being created outside the banks on products that should have been developed by them,” Ingo’s Edwards said. “The First Datas down to the Stripes built the eCommerce structure and left big banks playing catch-up and to partner.”

True though that may be, there’s a perception gap for FIs to overcome now regarding instant disbursement, as PYMNTS found that many offer it, but their customers remain unaware.

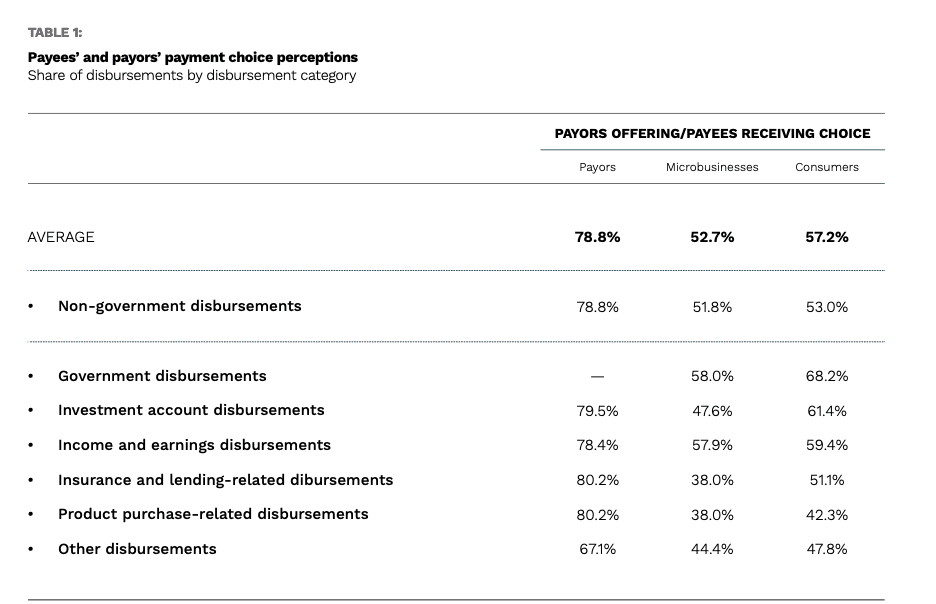

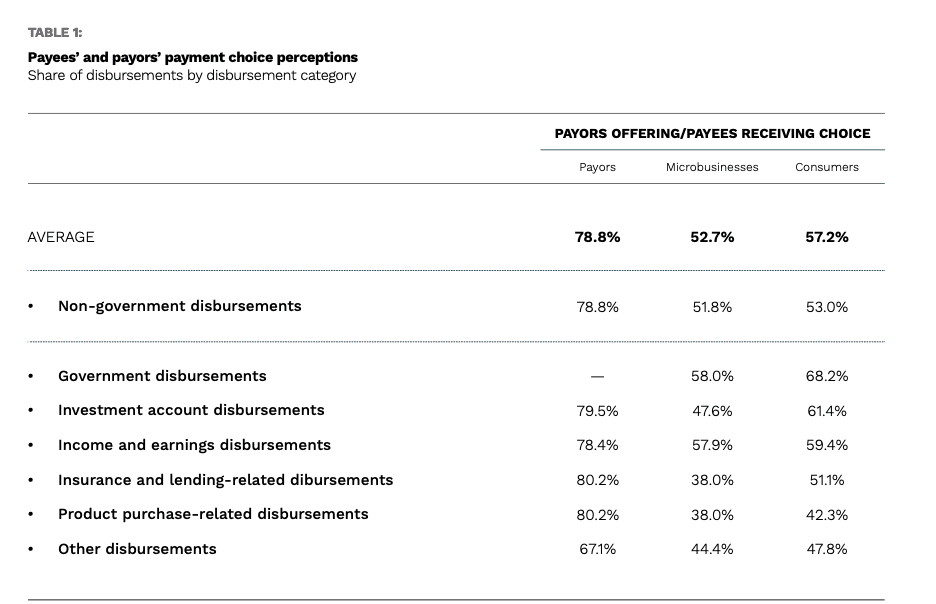

“Payees perceive that they have restricted payout choices — particularly when compared to the claims of payors. We found that 52 percent of consumers and 53 percent of microbusinesses said they can choose whether to receive their disbursements through a check, a deposit to a bank account, a credit card payment or any other payout method, yet payors say they give payout choices for almost 80 percent of disbursements,” the study states.

Real or imagined, FIs have to cross the modern disbursements divide quickly if they want to retain and gain customers against a force of FinTechs beckoning with instant money today.