The pandemic has shaken many consumers’, banks’ and merchants’ financial foundations, but microbusinesses have been hit especially hard.

These companies, which can be run by solo entrepreneurs or teams of up to 10 employees, make up 89 percent of all small-to medium-sized businesses (SMBs) in the United States. These firms are thus in the most economic danger, with 100,000 SMBs in the U.S. having permanently closed their doors due to pandemic-related costs.

Many of these SMBs are seeking aid and tools to help them better mana ge and understand their cash flows, and this is leading them to examine how they can more quickly send and receive disbursements. Instant payments are not always freely available to microbusinesses, however, which could cause them challenges as they attempt to keep their operations afloat.

ge and understand their cash flows, and this is leading them to examine how they can more quickly send and receive disbursements. Instant payments are not always freely available to microbusinesses, however, which could cause them challenges as they attempt to keep their operations afloat.

In the latest Disbursements Tracker®, PYMNTS analyzes how the pandemic is affecting SMBs — and microbusinesses, in particular — and how this impact is highlighting their needs for additional instant payment and disbursement support.

Around The Disbursements World

Advertisement: Scroll to Continue

Microbusinesses often have limited access to the real-time or instant payments they crave. These payments can be made and received using various methods, but one recent PYMNTS report found that just 8 percent of microbusinesses could accept them. The flexibility that instant payments offer is becoming increasingly crucial to companies and consumers alike, however, which means firms that fail to support such options could lose business and customers to competitors who do.

SMBs are also growing more concerned  about payment speed as the pandemic continues, with a recent study revealing that 39 percent of SMBs are spending at least five hours each week managing payment-related issues. Another 39 percent of those surveyed said they had experienced problems related to payments’ speed within the past 12 months. This indicates that instant payments support is becoming top of mind for many SMBs as they attempt to juggle the economic depression and cost inflations created by the global health crisis.

about payment speed as the pandemic continues, with a recent study revealing that 39 percent of SMBs are spending at least five hours each week managing payment-related issues. Another 39 percent of those surveyed said they had experienced problems related to payments’ speed within the past 12 months. This indicates that instant payments support is becoming top of mind for many SMBs as they attempt to juggle the economic depression and cost inflations created by the global health crisis.

Even government agencies are noticing the need for faster disbursements amid the current economic climate. The U.S. Federal Reserve, for example, has announced plans to speed up the development and eventual launch of its own real-time payments network, FedNow. Fed Board of Governors member Lael Brainard recently noted that supporting real-time payments could provide crucial benefits to SMBs during this time, allowing them to better understand their cash flows. FedNow is still set to be completely rolled out in 2023 or 2024, but the Fed has claimed it will launch features incrementally in the meantime.

For more on these and other stories, visit the Tracker’s News & Trends.

Why Instant Disbursements Are Essential For Microbusinesses During The Pandemic

Microbusinesses are reexamining their business models as their customers’ and partners’ payment preferences shift during the pandemic. These SMBs have been hit especially hard by the ongoing health crisis, meaning any hiccups in their payment processes could have devastating effects on their operations. Being able to transparently view their cash flows at all times is thus essential to enabling them to track outgoing and incoming disbursements, and this in turn is leading them to eschew more traditional, time-consuming disbursement methods.

Microbusinesses are reexamining their business models as their customers’ and partners’ payment preferences shift during the pandemic. These SMBs have been hit especially hard by the ongoing health crisis, meaning any hiccups in their payment processes could have devastating effects on their operations. Being able to transparently view their cash flows at all times is thus essential to enabling them to track outgoing and incoming disbursements, and this in turn is leading them to eschew more traditional, time-consuming disbursement methods.

In this month’s Feature Story, PYMNTS spoke with Caleb Benoit, founder of Illinois-based retail and wholesale coffee company Connect Roasters, to learn more about how digital disbursements have become crucial to microbusinesses’ financial well-being.

Deep Dive: Why Microbusinesses Need Instant Disbursements Support — Fast

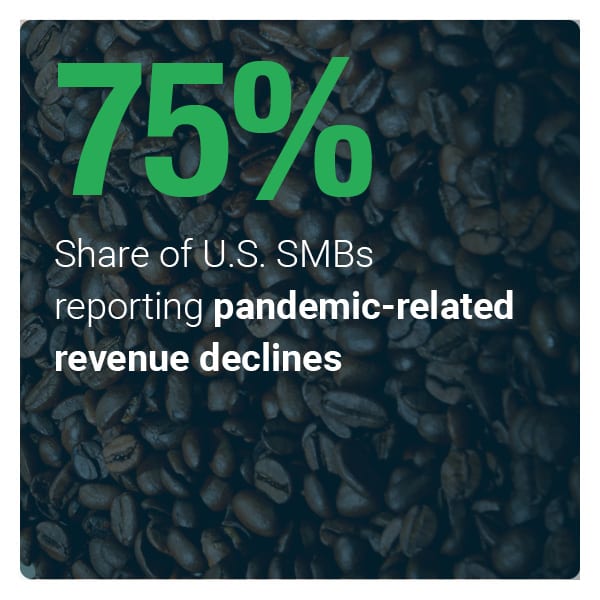

A significant portion of U.S. SMBs are battling the global health crisis’ economic impact, with one recent report finding that 75 percent of such businesses have seen their revenues dip in the past several months. This is magnifying the cash flow issues these business often experience, as late disbursements mean business owners cannot quickly send funds to their suppliers or to their employees. Breaking out of this pattern requires companies to embrace instant digital payment solutions, but there are several challenges that must be met before they can do so.

To learn more about why instant payments are crucial to SMBs and microbusinesses as the pandemic continues to affect their cash flows, visit the Tracker’s Deep Dive.

About The Tracker

The PYMNTS Disbursements Tracker®, powered by Ingo Money, is the go-to monthly resource for staying up to date on the trends and changes in the digital disbursements space.