Beyond bitcoin – that marquee name of crypto and its brethren, which have yet to escape wild price swings and speculative fervor – lies the prospect of CBDCs.

In terms of collaboration, as noted in this space, the Federal Reserve is working in collaboration with seven other central banks and the Bank for International Settlements (BIS) to bring together a framework that would smooth the path to digital currency issuance.

Frameworks, of course, offer guideposts and at least some movement toward standardization. In this case, digital currencies – no matter the provenance – should work well enough to be interchangeable with paper bills and metal coins. On the global stage, too, digital currencies should be fungible with one another – a dollar, for example, is worth 0.9 euros (at least at present).

The fiat (rendered in bits and bytes), if widely adopted, would represent a seismic shift in the transition to a cashless society. And we’re not talking about the myriad of cryptos that have popped up hither and yon, offered by private companies across what is still a Wild West for issuance (with no real set of security principles, yet) and scattered use cases.

The idea of a “general purpose” central bank digital currency (CBDC) is one that would transcend use cases, exchanges and piecemeal methods where, for example, (tangible) fiat on one side of a transaction is rendered into a digital form and then reconfigured to fiat on the other side of the process.

The BIS report issued this week that focuses on “foundational principles” defines a CBDC as “a digital payment instrument, denominated in the national unit of account, that is a direct liability of the central bank.”

Depending on where you look, the shift to cashless has been dictated by market forces, or by government guidance. In the case of the latter, India stands out, with demonetization efforts that stretch back just about four years. India, according to reports earlier this fall, is mulling a ban on cryptos in general, but may indeed look more deeply into a CBDC.

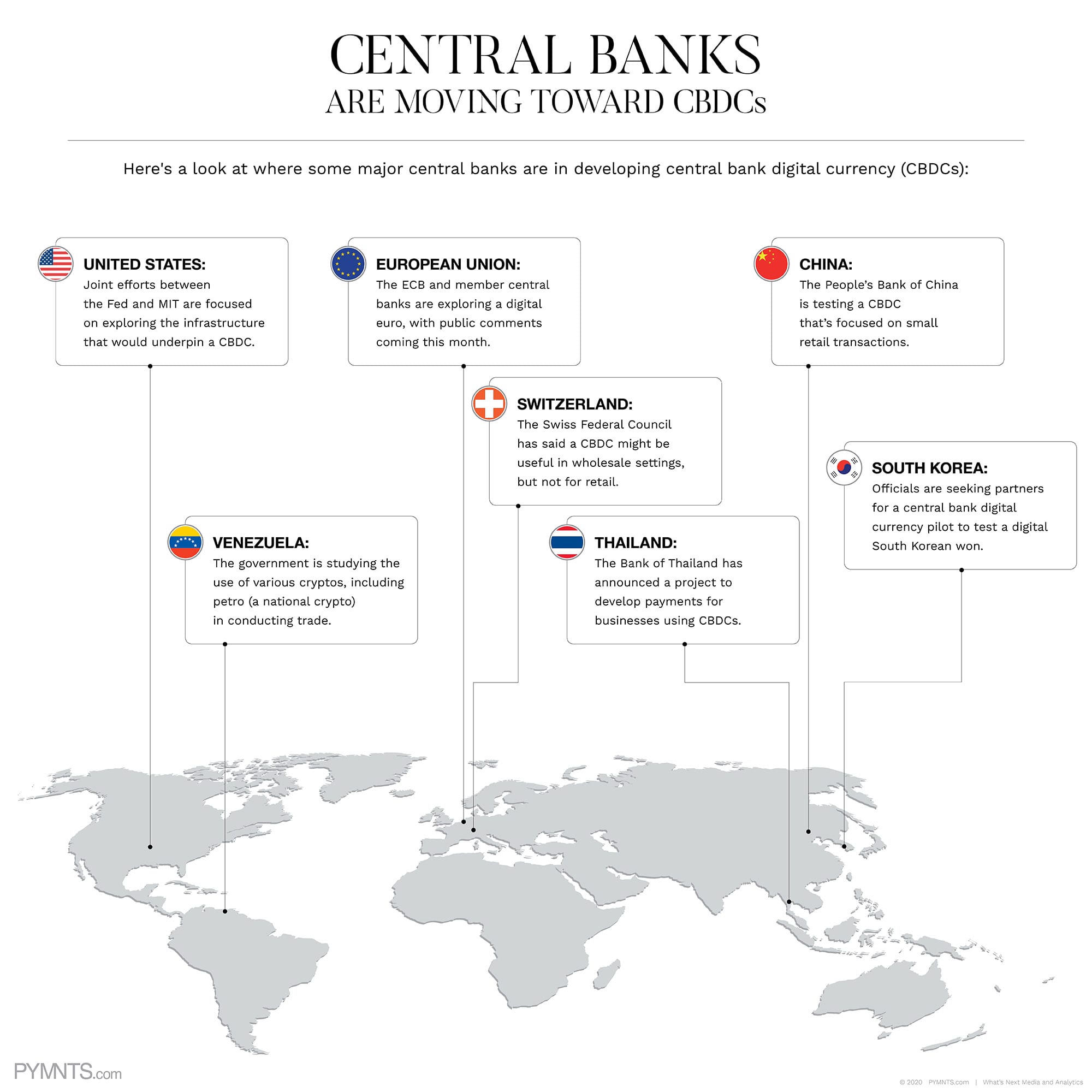

Thus far, there is really only one country, China, that is on the cusp of issuing a CBDC that could conceivably be adopted by the masses. Recent reports note that China – specifically, the People’s Bank of China (PBOC) – has said that a test of a CBDC has been focused on small retail transactions. That puts the world’s second-largest economy beyond the simple concept stage and possibly on the road to actual deployment.

The U.S., of course, is not standing still. The Federal Reserve Bank has been exploring a digital currency. And in an interview with Karen Webster, Jim Cunha, senior vice president of secure payments and FinTech at the Federal Reserve Bank of Boston, said that joint efforts between the Fed and MIT are focused on exploring the infrastructure that would underpin a CBDC — and, at the same time, will probe various use cases.

Beyond that, national efforts are piecemeal.

In one example, Venezuela is studying using various cryptos, including the petro (a national crypto) to conduct trade.

Korea’s central bank is seeking partners for its central bank digital currency pilot for a digital won.

The Bank of Thailand has announced a project to develop payments for businesses using CBDCs.

In Switzerland, the Swiss Federal Council said at the end of last year that a CBDC might be useful in wholesale settings, but not for retail.

More recently, the BIS/central bank efforts look toward a concerted collaborative approach that includes the European Central Bank, the Bank of Japan, the U.S. Fed, the Swiss National Bank and others.

Drilling down into the core features of a CBDC, the banks and the BIS said that CBDC systems “should offer instant or near-instant finality of settlement of transactions” and should be available 24/7/365. The systems should be interoperable, according to the framework, with private-sector digital payment systems (which, we presume, opens the door for retail use cases) and should be interoperable. That last point speaks to the necessity that CBDCs be convertible and interchangeable, across borders for transactions large and small.

No easy task, to be sure. But it’s one that gives the central banks some sort of structure and roadmap in reducing the fragmentation of the private crypto landscape – and brings digital dollars (and other currencies) onto the world stage.