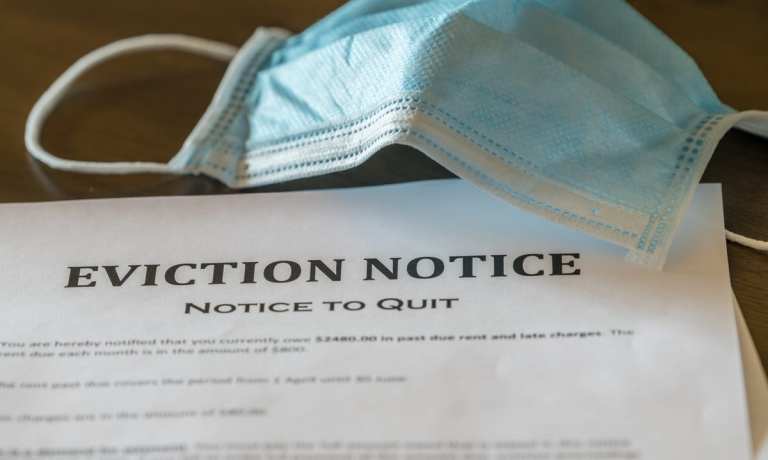

With federal protections on mortgage delinquencies and evictions that were put in place during the COVID crisis set to end December 31st, a growing backlog of non-payment by both owners and renters poses a major threat to the nation’s economic recovery.

This, as the latest delinquency data from July show the number of single family homeowners that are at least 120 days behind on their mortgage spiked to 1.4 percent.

“This was the highest rate in more than 21 years and double the December 2009 Great Recession peak,” said Dr. Frank Nothaft, chief economist at CoreLogic, the California-based real estate data firm that produced the report.

Nothaft also noted that the “spike in delinquency was all the more stunning” given the fact that it came just six months after the same barometer hit a “generational low of 0.1% in March.”

At the same time, Princeton University’s Eviction Lab reports another 3,535 eviction notices were filed last week in the 24 cities it tracks, bringing the COVID-era total since March to 92,619.

“Current policy responses to the pandemic may be insufficient to prevent a surge in evictions,” the Eviction Lab report concludes.

Advertisement: Scroll to Continue

From One Crisis To The Next

While a patchwork of federal, state and local initiatives were implemented early on in the pandemic, many of the programs, such as enhanced unemployment benefits or stimulus payments, have already come and gone, while others are winding down their final days of protections.

“Once these measures expire, however, millions of renters will owe significant amounts of back rent. For many, a displacement and eviction crisis will follow the public health crisis,” the Princeton group said.

As much as the federal government’s inability to reach a compromise over the size and scope of a second stimulus program is partly to blame, the privately-funded Eviction Lab points to the fact that the eviction problem is happening beneath the radar.

“The U.S. government does not collect eviction data, and most state governments don’t either. Instead, eviction records are housed within county court systems and can be very difficult to access,” the group’s report said.

Banks Watching Closely

Banks have clearly been following this trend closely and setting aside reserves in accordance with their particular economic outlooks and exposure.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

In reporting its third quarter results in mid-October for example, Bank of America CEO Brian Moynihan also said credit card delinquencies and mortgage delinquencies were both down last quarter in dollar amounts and as a percentage amount from a year ago, adding that BofA didn’t expect to see a meaningful increase in net charge-offs for several months.

Bank of America CFO Paul Donofrio further explained that since charge-offs don’t occur without bankruptcy or until they are 180 days past due, it was unlikely that BofA was going to see much of an increase showing up until mid 2021.

In September, JPMorgan CEO Jamie Dimon told a banking conference that while banks had built up their loss reserves this year under the Current Expected Credit Losses (CECL) rules. However, with an economic rebound that has been sharper than initially expected, it would not be unreasonable to expect reserve released in the fourth quarter, if things continue to improve.

On Friday, Florida-based mortgage data analytics firm Black Knight released its latest research which showed active forbearances rose by 31,000 or 1 percent last week, with only 50,000 forbearance removals, which was the lowest of any week during the recovery.

At the same time, Black Knight said as of Oct. 27, the number of active forbearances had ticked back up over 3 million again for the first time since early October, representing approximately 5.7% of all active mortgages, up from 5.6% from last week. Together, they represent $619 billion in unpaid principal.

Landlords Fight Back Locally

Although protections are still in place and could theoretically be extended after the election is over and settled, growing rent backlogs are seeing landlords heading to court before they do.

For example, in Pennsylvania last week, the Lancaster County Court of Common Pleas filed an administrative order that allows landlords to challenge federal non-eviction protections if they believe a tenant was not truthful when claiming them, Lancaster Online reported.

The report cites a local attorney representing property owners as saying the order “dramatically improves fairness to landlords” by providing an adequate remedy to address tenants who abused the process and filed reports that were demonstrably false.

At the same time, landlords in Ohio filed suit against the CDC last week, challenging the fairness of a September ruling that prevents the displacement of individuals in “economic distress.”

The K-Shaped Paradox

As much as the mounting distress for home renters and owners at the lower end of the spectrum is rising, the higher end of the market continues to flourish.

It’s a scenario that has created a K-shaped trend that Reuters labeled “the great divergence,” in which economists say the top continues to climb while those on the bottom see their prospects worsen.

But while one portion of the critical real estate sector, which accounts for an estimated 10 percent of GDP, is working, economists say its prospects are threatened as long as there is instability at the bottom.

Add as Preferred Source

Add as Preferred Source