Consumers’ banking habits have changed radically since the pandemic was first declared in March.

Consumers’ banking habits have changed radically since the pandemic was first declared in March.

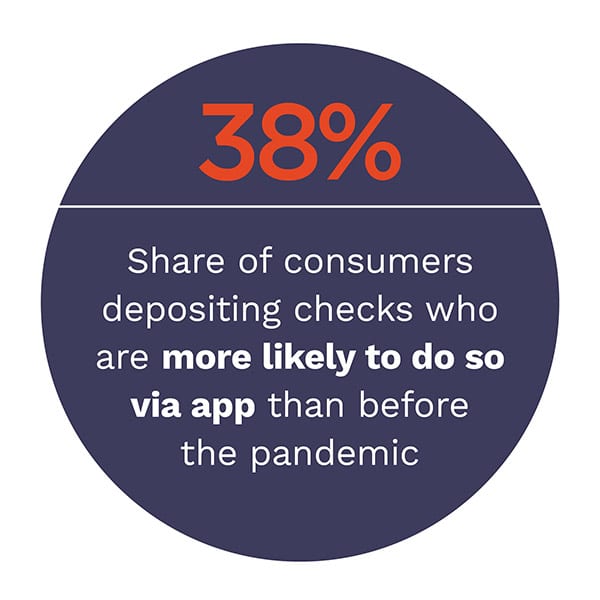

Not only are many account holders visiting brick-and-mortar branches less often than they did before the pandemic, but many are also more reliant on digital banking channels — particularly mobile banking apps — than they have ever been. PYMNTS research shows that consumers are 8.7 percent more likely to use mobile banking apps now than they were in 2019, and 51.1 percent of those users are engaging with their apps more often than they did before the pandemic began.

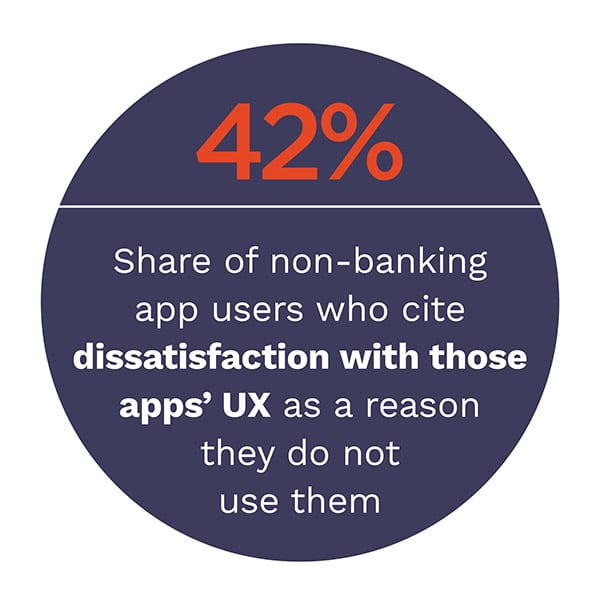

Many inroads for mobile banking were made during the past several months, but banking app adoption rates are still lower than they should be. There are roughly 47.7 million consumers in the United States (or 42.4 percent) who do not use mobile banking apps because they are dissatisfied with those apps’ user experience (UX). This indicates that although consumers by and large appreciate and enjoy the ease and convenience of being able to bank from their mobile devices wherever they please, there are still many improvements that banks, credit unions (CUs) and other financial institutions (FIs) must make before mobile banking apps become more ubiquitous.

Many inroads for mobile banking were made during the past several months, but banking app adoption rates are still lower than they should be. There are roughly 47.7 million consumers in the United States (or 42.4 percent) who do not use mobile banking apps because they are dissatisfied with those apps’ user experience (UX). This indicates that although consumers by and large appreciate and enjoy the ease and convenience of being able to bank from their mobile devices wherever they please, there are still many improvements that banks, credit unions (CUs) and other financial institutions (FIs) must make before mobile banking apps become more ubiquitous.

How can FIs improve their mobile banking apps’ UX shortcomings, and which features will go the farthest in encouraging more of their customers to download and use those apps for their everyday banking and payment needs?

The Mobile Banking App Report: Tapping Authentication To Boost User Engagement, a PYMNTS and Entersekt collaboration, aims to provide a holistic assessment not only of how consumers are using their mobile banking apps to manage their payments and finances, but how their reliance on mobile banking apps has changed since the onset of the pandemic. PYMNTS surveyed a census-balanced panel of 2,581 U.S. consumers about whether they used mobile banking apps, why they used those particular apps, and why they are either satisfied or dissatisfied with those apps to find out where FIs can improve their mobile banking app UX to boost engagement.

how their reliance on mobile banking apps has changed since the onset of the pandemic. PYMNTS surveyed a census-balanced panel of 2,581 U.S. consumers about whether they used mobile banking apps, why they used those particular apps, and why they are either satisfied or dissatisfied with those apps to find out where FIs can improve their mobile banking app UX to boost engagement.

PYMNTS research shows that although consumers are generally satisfied with using their mobile banking apps for making routine transactions like bill payments and check deposits, they find those apps lacking when it comes to making major account changes, such as opening new accounts and adding names to their existing accounts. Almost nine out of 10 app users are very or extremely satisfied with using those apps to deposit checks, in fact, compared to six in 10 who express similar satisfaction levels with using those apps to add or remove users from their accounts.

Satisfaction with the ease of changing accounts via app is so low, in fact, that 30.7 percent of consumers who add or remove people from their accounts would rather do so in person at brick-and-mortar branches. It speaks to consumers’ broader dissatisfaction that they would still prefer to make such changes in person, even if doing so means risking contagion.

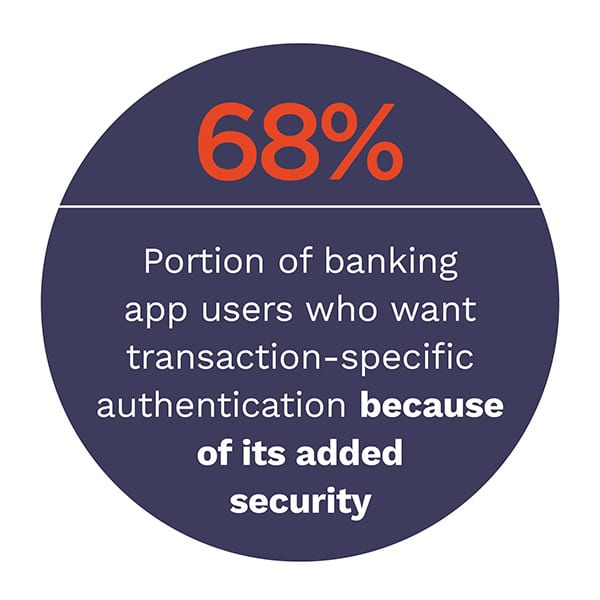

All hope is not lost for banks looking to improve their apps’ UX, however. Providing users with more control over their apps’ authentication systems can go a long way in improving their satisfaction. According to PYMNTS research, 25.8 percent of consumers would be more likely to use mobile banking apps if those apps offered more authentication options, and 24.7 percent would be more willing to use apps if they could add authentication controls for specific transactions.

All hope is not lost for banks looking to improve their apps’ UX, however. Providing users with more control over their apps’ authentication systems can go a long way in improving their satisfaction. According to PYMNTS research, 25.8 percent of consumers would be more likely to use mobile banking apps if those apps offered more authentication options, and 24.7 percent would be more willing to use apps if they could add authentication controls for specific transactions.

Authentication controls could be pivotal in enticing more consumers to use mobile banking apps, but they are just one of many features that consumers say could help make the prospect of banking via app more appealing. The Mobile Banking App Report: Tapping Authentication To Boost User Engagement highlights the key ways in which FIs can improve their UX to encourage users to download and engage with their apps rather than visit in-branch.

To learn more about the improvements consumers want to see from mobile banking apps, download the report.