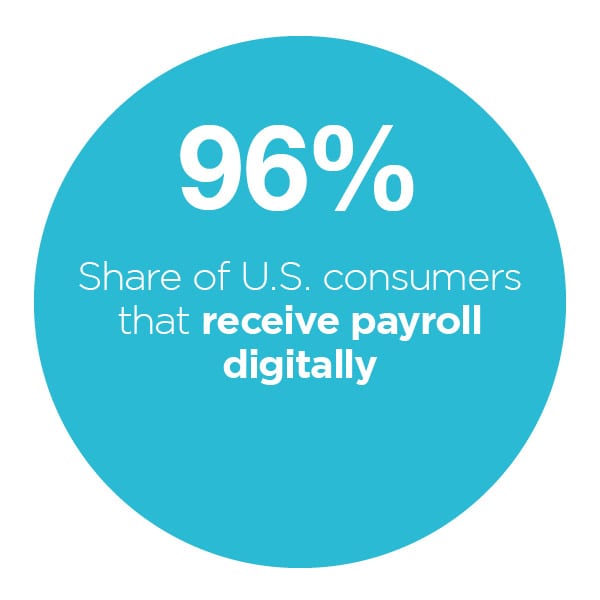

Delivering funds smoothly to employees in different nations is therefore essential, and it may require firms to migrate from paper checks to digital tools, especially those that suit the needs of employees who do not have bank accounts. The November/December Smarter Payments Tracker® examines how firms are putting payroll apps and prepaid cards to use to resolve frictions for their global workforces.

Around The World Of Smarter Payments

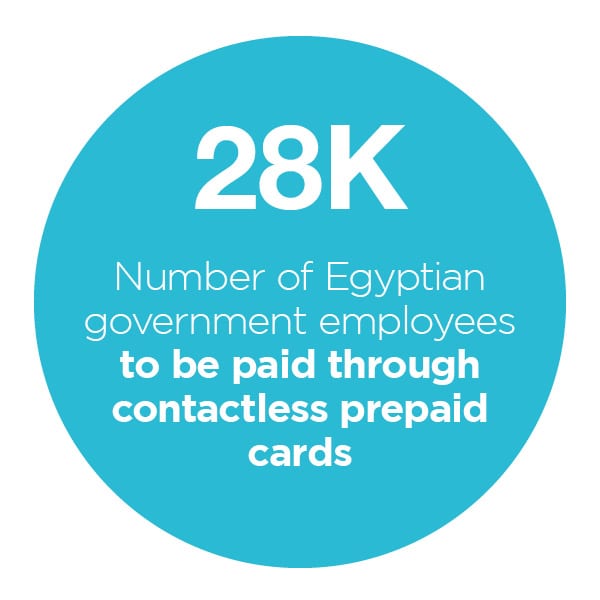

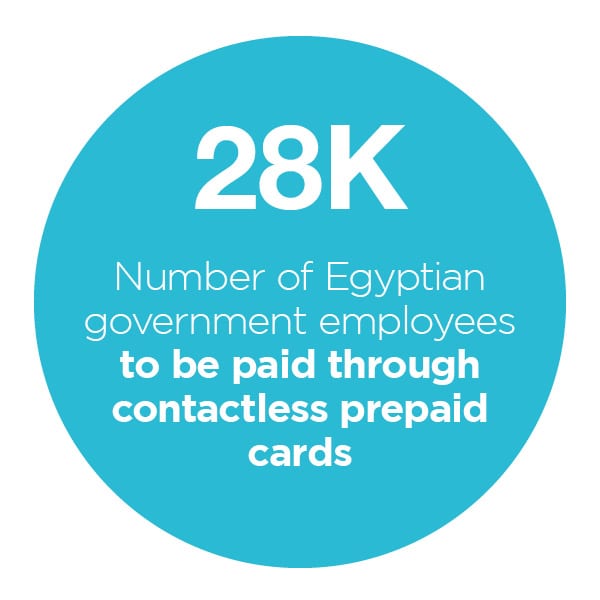

Payroll cards are gaining steam in Egypt, where the government announced plans to deliver prepaid cards to 28,000 public employees who will be able to use the tools to receive payroll sent via domestic banking rails. The workers can then use these cards to make retail payments in-stores and online, as well as collect cash at the ATM. The effort comes as part of a larger governmental push to expand residents’ access to eCommerce and reduce the amount of cash that needs to be printed.

Payroll cards are gaining steam in Egypt, where the government announced plans to deliver prepaid cards to 28,000 public employees who will be able to use the tools to receive payroll sent via domestic banking rails. The workers can then use these cards to make retail payments in-stores and online, as well as collect cash at the ATM. The effort comes as part of a larger governmental push to expand residents’ access to eCommerce and reduce the amount of cash that needs to be printed.

Prepaid cards are also being leveraged to streamline corporate purchasing, with firms providing these tools to employees so that the workers can make business-related purchases. The companies can use artificial intelligence (AI)-powered capabilities to track the cards’ use in real time and ensure that only appropriate items are purchased using company funds.

Distributed ledger technologies (DLT) could also play a greater role in supporting businesses that want to deliver funds across borders to their workers. That is because the European Union is working to develop a regulatory framework that would guide how DLT should be used to facilitate digital transactions. These policies could inform businesses on how they can securely and compliantly leverage DLT to send money internationally, and recent reports  anticipate that the EU could adopt DLT legislation by 2024.

anticipate that the EU could adopt DLT legislation by 2024.

Advertisement: Scroll to Continue

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Find more about these and all the rest of the latest headlines in the Tracker®.

How Mobile Apps Are Easing Retail Payments In India

Businesses looking to launch operations in India and reach local consumers must understand the payments needs and preferences at play. Cash has long dominated domestic retail transactions, but this is changing as the pandemic drives consumer interest in exploring digital options like mobile payment apps, says Karthik Raghupathy, head of business development and strategy at eCommerce payment system and digital wallet provider PhonePe. In the Feature Story, Raghupathy explains factors that encourage consumers to keep using these apps and how mobile payments can reduce frictions for merchants as well.

Get the full story in the Tracker®.

Deep Dive: How Prepaid Cards Ease Employees’ Payroll Pains

Employers that were accustomed to delivering payroll checks may find that this method is more difficult to use than ever during a time when accounts payable (AP) departments are working from home and are not in-office to print checks. Changes to the postal services slowed down mail delivery, further introducing challenges for companies. Issues like these are prompting employers to look for easier, digital ways to pay and ones that are accessible to employees who lack bank accounts for accepting direct deposits. This month’s Deep Dive examines these problems, as well as how delivering payroll onto prepaid cards can help businesses tackle such challenges.

Check out the Tracker® to read more.

About The Tracker

The Smarter Payments Tracker®, done in collaboration with Nium, details the latest mobile payment trends impacting payroll, employee spending and retail transactions.

Companies that are looking to launch offices in more countries and serve customers in new markets need to be able to easily pay staff in those locations. The economic downturn caused by the COVID-19 pandemic has made it even more important that firms deliver payroll quickly, as employees are facing greater financial strains that may make them more eager for prompt salary disbursements. Companies also often need their workers to make business expenditures and may find staff are now less willing or able to make these purchases out of pocket than wait for compensation.

Companies that are looking to launch offices in more countries and serve customers in new markets need to be able to easily pay staff in those locations. The economic downturn caused by the COVID-19 pandemic has made it even more important that firms deliver payroll quickly, as employees are facing greater financial strains that may make them more eager for prompt salary disbursements. Companies also often need their workers to make business expenditures and may find staff are now less willing or able to make these purchases out of pocket than wait for compensation.

Add as Preferred Source

Add as Preferred Source