Old School, New School: TCU Pairs AI and Outreach to Personalize Members’ Experiences

Credit unions (CUs) have been riding high in recent years, with one October report finding that global CU membership hit an all-time high of 291 million last year.

The space has added 107 million members over the past decade, with 17 million joining just in 2019. This represents 59% growth over the past 10 years, much of it buoyed by a surge in sign-ups across the Oceania region.

There are several reasons for this robust growth, not the least of which are the member-centric services and products CUs provide. A separate October report found that while churn is expected to almost double in the financial sector by 2022, CUs are expected to go against this trend because they offer lower fees and better terms for products than do many of their competitors.

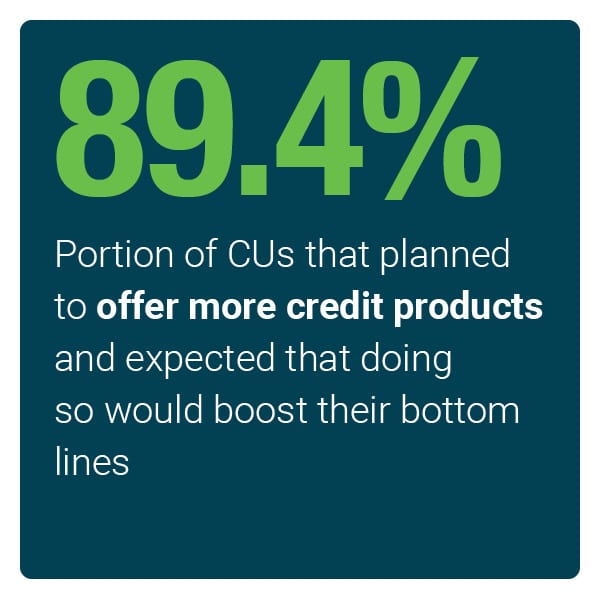

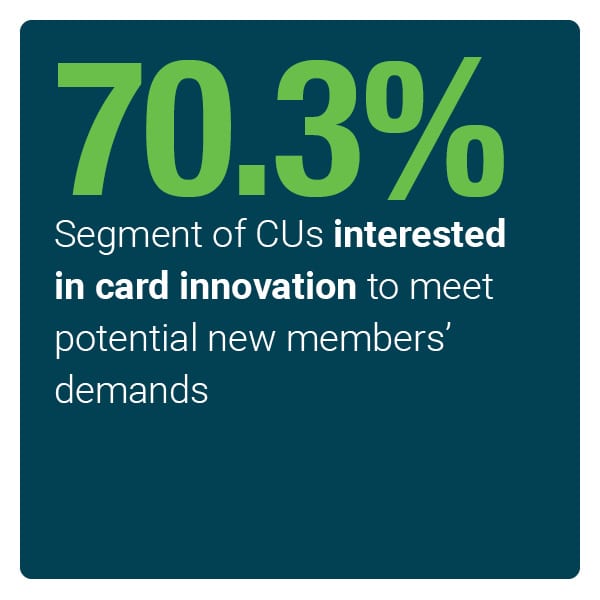

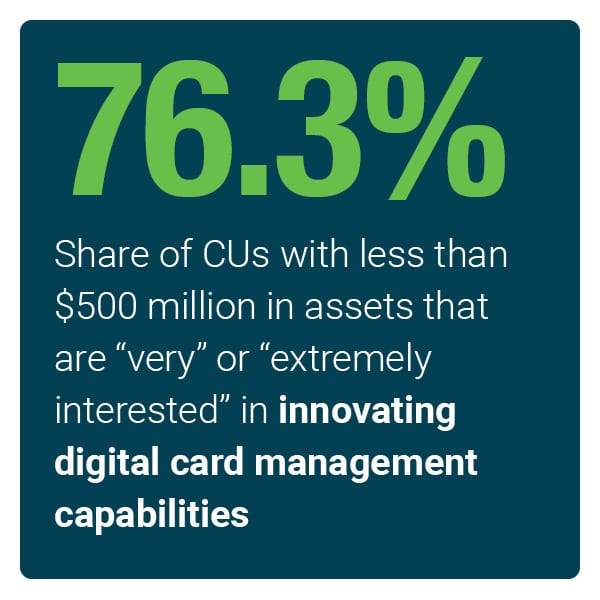

This does not mean that CUs can simply rest on their laurels, however. Avoiding stagnation and competing with  other financial providers means that they must invest in new digital technologies and solutions in addition to playing to their traditional strengths, such as low rates and exceptional customer service. Evidence suggests that one of the most effective ways they can continue to engage their member bases is to roll out personalized services, such as financial management and budgeting tools, card management options and targeted marketing initiatives.

other financial providers means that they must invest in new digital technologies and solutions in addition to playing to their traditional strengths, such as low rates and exceptional customer service. Evidence suggests that one of the most effective ways they can continue to engage their member bases is to roll out personalized services, such as financial management and budgeting tools, card management options and targeted marketing initiatives.

The November “Credit Union Tracker®” examines the tools and solutions CUs can use to personalize their approaches to meeting members’ needs both now and after the pandemic has passed.

Around the Credit Union World

Keeping up with members’ demands can be a tall order for CUs, especially for smaller CUs that lack the resources and staffing levels of larger organizations. Many are still taking innovative approaches to rolling out new high-tech solutions by turning to third-party providers, however. Alabama-based digital experience platform provider DeepTarget, for example, released several machine learning (ML) algorithms designed to help CUs and community financial institutions (FIs) boost customer service, process more transactions and open more accounts. The algorithms also leverage predictive modeling that can determine how likely certain members are to open select accounts based on demographic information.

Building and maintaining members’ trust is another crucial factor in determining CUs’ success, and one survey revealed that turning to biometric authentication measures could be just what CUs need to achieve this. It found that more than two-thirds of consumers would tap mobile-based authentication measures such as fingerprint, face or voice recognition technologies to safeguard their accounts. CU members stand to benefit greatly from such solutions, as the study reported that 51% them of them have had their identities  stolen and 68% have been targeted by debit or credit card fraud.

stolen and 68% have been targeted by debit or credit card fraud.

Some organizations are keeping members secure by partnering to provide the latest cutting-edge solutions. Credit union service organization PSCU, for one, teamed up with FICO Customer Communications Services on a state-of-the-art fraud alert platform that will guard CUs and their members as card-not-present (CNP) transactions become more commonplace. The system is intended to allow PSCU’s credit unions to reach out to members immediately if anything is amiss, a capability that could prove especially useful as more consumers leverage digital channels for their purchases.

For more on these stories and other CU headlines, read the Tracker’s News and Trends.

How Tapping AI and Automation Could Help CUs Meet Members’ Needs

Digital banking remains a hot topic for consumers during the pandemic, but CUs can face significant hurdles in meeting the needs of different generations. Some CUs are using artificial intelligence (AI) and other advanced technologies to analyze members’ habits and better discern whether to offer digital or in-person preferences suited to their individual tastes.

In this month’s Feature Story, Dan Rousseve, senior vice president of Teachers Credit Union, discusses AI’s critical role in helping the CU examine members’ needs and roll out the products and  services that matter most to them.

services that matter most to them.

Deep Dive: Why Personalized Services Are Fast Becoming a Necessity for CUs

CU members are known for their loyalty, but that loyalty goes only so far if CUs fail to offer the products and services members require in their daily financial lives. This means launching tailored services that can help them conveniently satisfy their debit, bill paying, direct deposit and other goals is essential rather than optional.

This month’s Deep Dive explores how CUs can personalize the products and services they provide and turn to new solutions and partnerships to bring consumers the digital capabilities they seek.

About the Tracker

The “Credit Union Tracker®,” a PYMNTS and PSCU collaboration, is your go-to monthly resource for updates on trends and changes in the credit union industry.