Corporate buyers and sellers continue to struggle with disruptions to cash flow and administrative processes that are being caused by the pandemic.

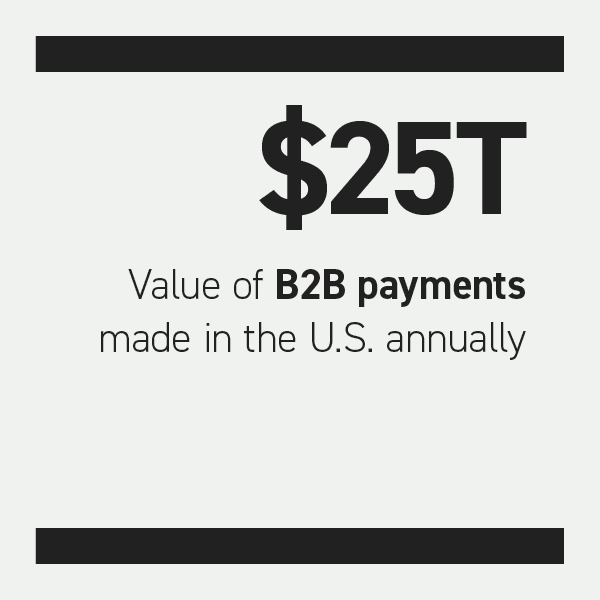

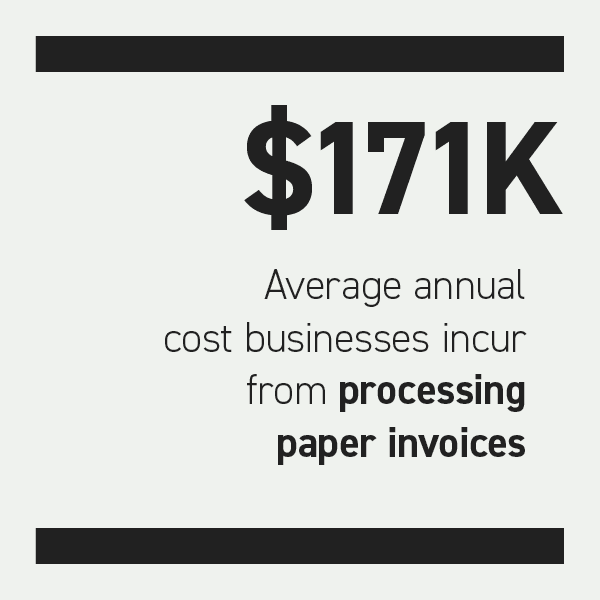

This may make it more important than ever for firms to be able to use alternatives to expensive, slow-moving paper checks. B2B transactions are increasingly shaking free of paper-based methods as companies have moved operations online this year. Tools like virtual cards are now drawing interest as businesses look for transaction methods that can deliver more speed, cost savings and transparency.

The December “CFO’s Guide To Digitizing B2B Payments” examines why virtual cards’ foothold in the B2B commerce space is growing and how straight-through processing tools can further remove frictions.

Around The B2B Payments World

Around The B2B Payments World

Wells Fargo is taking heed of corporate interest in virtual cards and has launched its own digital supplier payment tool. The new offering is intended to give buyers precise knowledge over when their payments will reach suppliers, thus helping them better control and manage their working capital.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Companies are also using virtual cards to deliver funds to staff who are working from home. These employees may need to make purchases on the companies’ behalf, so they need tools that they can easily and quickly receive and start using.

Card payments could relieve some long-standing cross-border payment pains, too, according to Nick Reid, director of B2B partner development at Conferma Pay. These transactions are typically routed among a variety of financial institutions (FIs) as they pass through the correspondent banking network to reach their intended countries, but each bank included in this chain adds fees, driving up costs. Card payments do not involve so many intermediary steps, however, helping streamline the process and reduce expenses, Reid told PYMNTS in an interview.

IBM Payments On The Future Of Virtual Cards

Businesses are digitizing many tasks as they adjust to employees working from home. Sending paper checks in the mail is becoming a less favorable way of transacting with suppliers, and more corporate buyers are instead showing interest in virtual cards’ abilities to provide swift payments while safeguarding sensitive cardholder details.

In this month’s Feature Story, Sridhar Narayanan, chief architect at IBM Payments Center, and Mike Cook, the firm’s senior partner and head, explain the growing interest in virtual cards and what FIs and FinTechs must keep in mind when creating secure virtual card onboarding experiences. They also discuss how this tool compares to other emerging B2B payment technologies.

Deep Dive: How Virtual Card Automations Cut Through B2B Payment Frictions

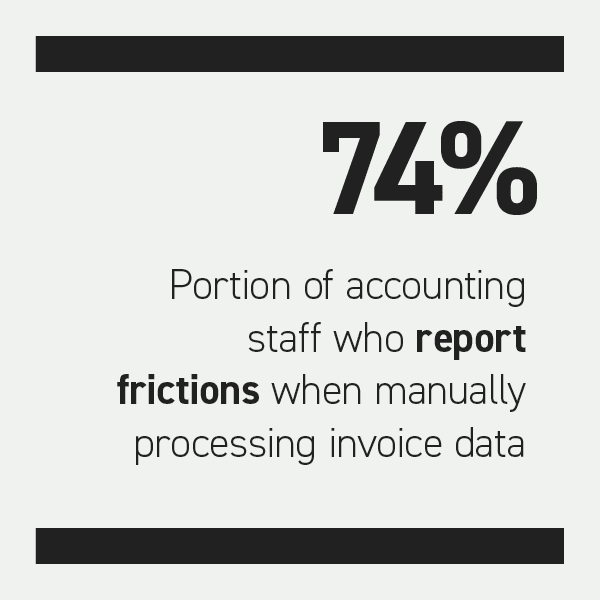

Corporate buyers are looking to navigate the global economic crisis by identifying more cost-effective ways of transacting, while suppliers are seeking to get paid promptly. These kinds of concerns may lead businesses to abandon paper checks for virtual cards, but there is one significant hurdle to widespread card uptake: Some vendors cannot easily process the card details. Suppliers may instead fall back on manually keying in card codes and matching payments to orders, which is cumbersome.

This month’s Deep Dive examines how straight-through processing solutions can help companies unlock the benefits of virtual cards.

About The Report

The “CFO’s Guide To Digitizing B2B Payments,” powered by Comdata, details how businesses are using virtual cards to pay each other more securely and conveniently during the pandemic.