First National Bank of Omaha: AR Integrations Ease Payments Reconciliation Pains

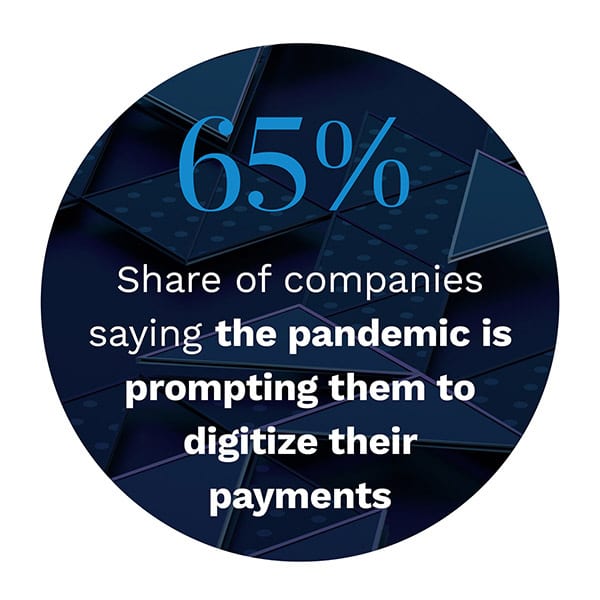

Many businesses have found paper checks difficult to manage during the pandemic and have sought out alternative payment approaches to better suit their needs. Firms have increasingly turned their attention to accounts payable (AP) and accounts receivable (AR) digitization and automation efforts that can move money faster and with less manual intervention. Some companies are embracing account-to-account (A2A) payments, which transfer money between buyers’ and vendors’ bank accounts, to give them the speed they need.

Many businesses have found paper checks difficult to manage during the pandemic and have sought out alternative payment approaches to better suit their needs. Firms have increasingly turned their attention to accounts payable (AP) and accounts receivable (AR) digitization and automation efforts that can move money faster and with less manual intervention. Some companies are embracing account-to-account (A2A) payments, which transfer money between buyers’ and vendors’ bank accounts, to give them the speed they need.

Vendors are concerned not only with prompt payments but also with receiving useful payments-related data in an easy-to-process format. This is leading some to search for AR and AP tools that can integrate with their back-end systems to help them more easily flow in detail-rich payments information. The Next-Gen AP And AR Digitization Report examines how businesses are updating and strengthening their payments and reconciliation processes to suit the new digital business landscape.

Vendors are concerned not only with prompt payments but also with receiving useful payments-related data in an easy-to-process format. This is leading some to search for AR and AP tools that can integrate with their back-end systems to help them more easily flow in detail-rich payments information. The Next-Gen AP And AR Digitization Report examines how businesses are updating and strengthening their payments and reconciliation processes to suit the new digital business landscape.

Around The AR And AP Landscape

Slow payments have become a serious problem, with an recent report finding that the quantity of uncollected receivables rose from 1 percent in 2019 to 4 percent in 2020. The study also noted a 72 percent year-over-year increase in delayed invoices. Companies left waiting for their money may find it difficult to pay their bills, making such delays especially painful and pushing them to seek out faster, more efficient business-to-business (B2B) payments to reduce these problems.

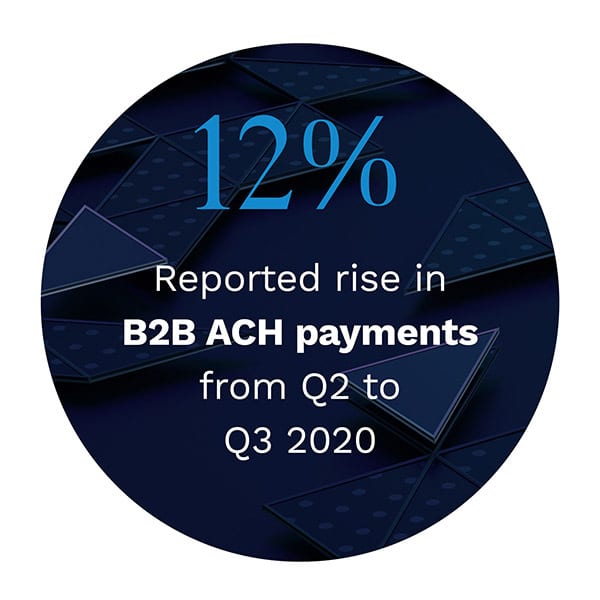

A recent study from Nacha, which operates the Automated Clearing House (ACH) network, found that firms stepped up their ACH payments use in 2020. The organization reported a 12.4 percent rise in B2B transactions over the ACH network between Q2 and Q3 2020, for example. ACH payments arrive and settle within several days, meaning the funds reach vendors significantly faster than they would if they were sent via checks.

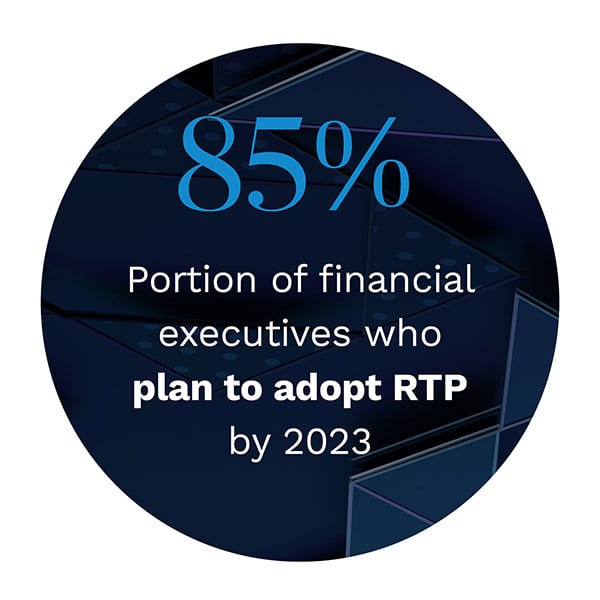

Some companies look to further accelerate payments, and FinTechs are playing a role in connecting businesses and banks to immediate payment rails. Some are offerings tools that help financial institutions (FIs) connect to the Real-Time Payments (RTP) network offered by The Clearing House, for example. Banks that connect to the service can then extend access to their business customers, which could make real-time payments more widespread across the B2B landscape.

Some companies look to further accelerate payments, and FinTechs are playing a role in connecting businesses and banks to immediate payment rails. Some are offerings tools that help financial institutions (FIs) connect to the Real-Time Payments (RTP) network offered by The Clearing House, for example. Banks that connect to the service can then extend access to their business customers, which could make real-time payments more widespread across the B2B landscape.

Find out more about these stories and the rest of the latest headlines in the Report.

How Payments Integrations Can Help Firms Manage AR, AP Data

Businesses are looking for solutions that can help them easily accept payments and match them to their corresponding invoices. Too many firms employ disjointed AR processes that see staff manually juggling different platforms, which results in slow reconciliation, said Jason Hagan, director of treasury services product strategy for First National Bank of Omaha (FNBO). In the Feature Story, Hagan explains how businesses can integrate their back-end systems with their banks’ payments platforms to access smoother transactions and how using RTP can give companies access to much-needed rich, standardized payments data.

Get the full story in the Report.

Deep Dive: Why Some Firms Are Turning To Rapid A2A Payment Methods

Deep Dive: Why Some Firms Are Turning To Rapid A2A Payment Methods

The shift to remote work has inspired some businesses to abandon paper checks in favor of digital solutions, and A2A payment methods like ACH, Same-Day ACH, RTP and wires can deliver money straight to vendors’ accounts. Businesses selecting these new payment tools must also consider how they can offer vendors the detailed payments-related data they need. The Deep Dive examines the A2A options available to businesses and analyzes how firms are making their selections.

Read more in the Report.

About The Report

The Next-Gen AP And AR Digitization Report, a PYMNTS and Transcard collaboration, explores how businesses are digitizing payments during the pandemic as well as how they are streamlining their accounts receivable and accounts payable to meet new workflow demands. It also examines B2B account-to-account payments can reduce frictions and how enterprise resource planning (ERP) system integrations could ease data processing and reconciliation.