The year 2020 was a big one for buy now, pay later (BNPL) arrangements in retail, as a perfect storm of occurrences pushed consumers online and had them seeking new ways to pay that gave them better control over their money.

The holiday season, however, is now officially over. The long return season has ended and retail is settling back to normal — or at least as normal as things are going to get for as long as the pandemic is still around. PYMNTS has tracked what the early days of that return will look like, surveying 2,278 consumers about what their shopping habits look like today in terms of when they shop, where they shop, how often they shop and their chosen payment mechanisms.

The data show that consumers have been pulling back on spending, and BNPL usage is easing off accordingly – but transparent and easily controlled spending tools are becoming more relevant than ever, particularly for some demographics. These shoppers are taking a fresh look at when credit cards, debit cards and BNPL options best serve their needs and circumstances.

The Seasonal Slowdown

Now that the holiday season is over, people are shopping less. Consumers made an average of 2.6 online purchases in November and spent $261 on their most recent purchases; as of January, they $54 less, on average, than they did before the holidays, and made 0.2 fewer weekly purchases. Average ticket amounts for in-store purchases were also down by $56, as the weekly purchase count dropped by 0.3 on average.

Now that the holiday season is over, people are shopping less. Consumers made an average of 2.6 online purchases in November and spent $261 on their most recent purchases; as of January, they $54 less, on average, than they did before the holidays, and made 0.2 fewer weekly purchases. Average ticket amounts for in-store purchases were also down by $56, as the weekly purchase count dropped by 0.3 on average.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

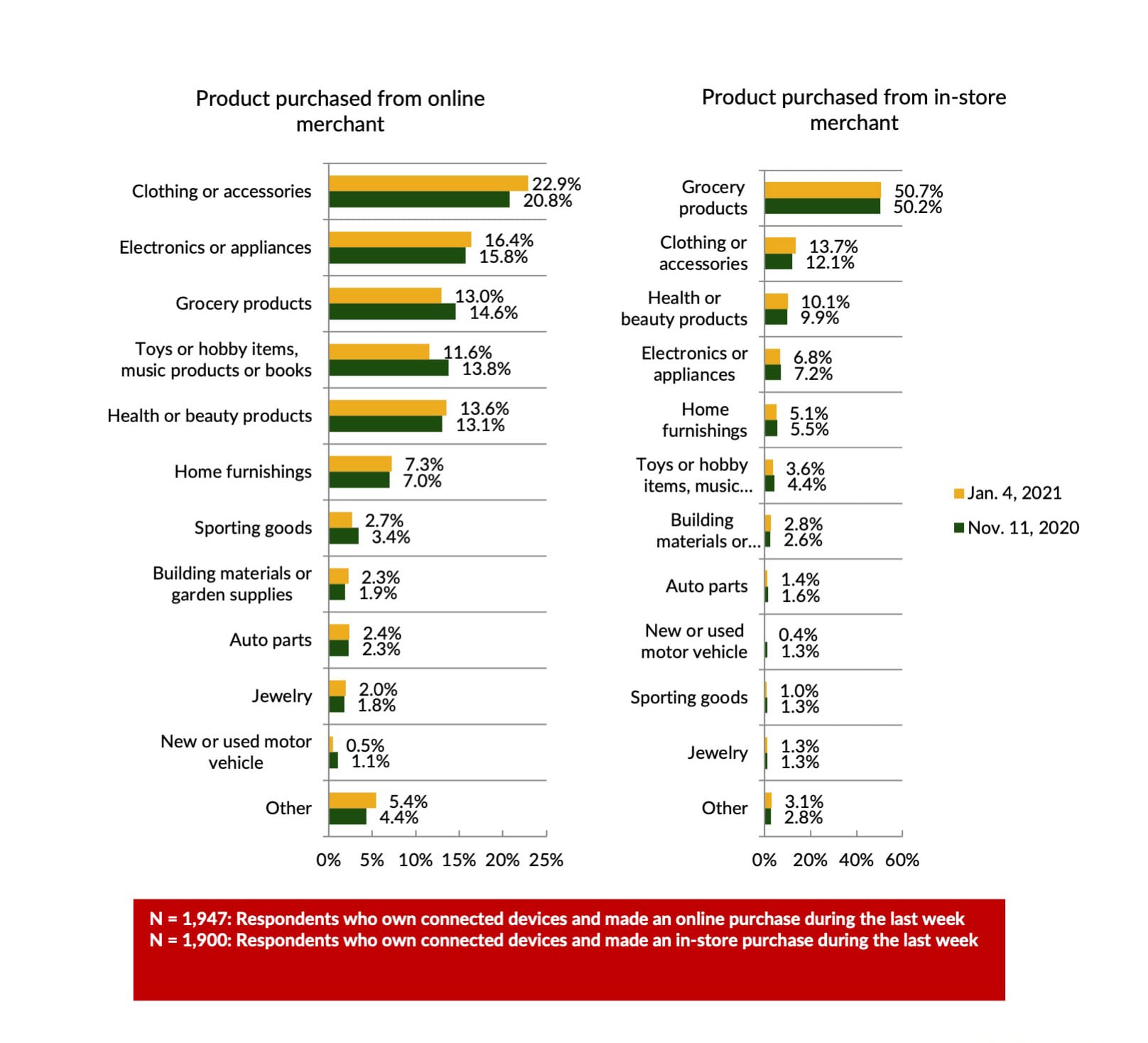

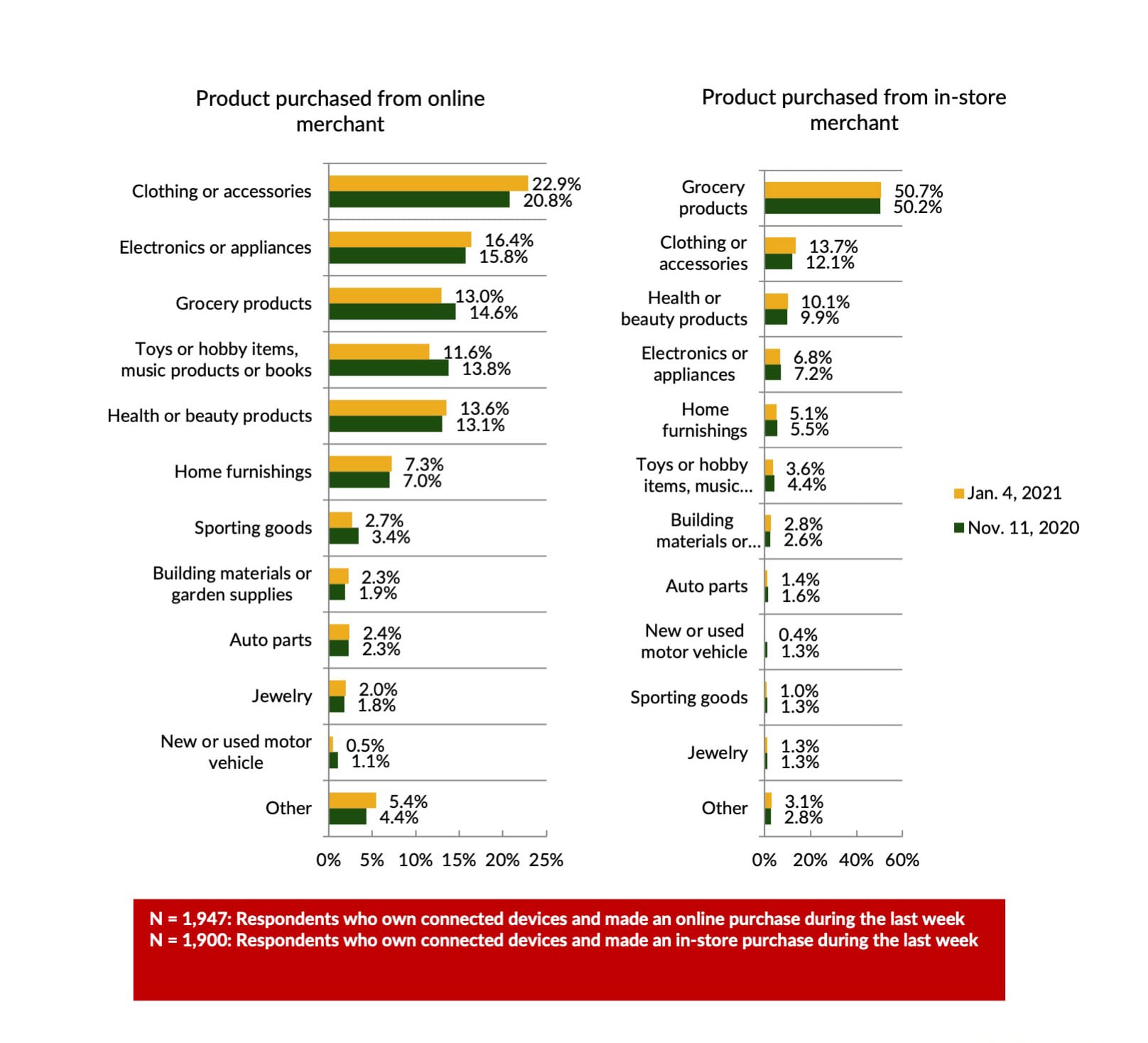

Although consumers were shopping less, what they were buying didn’t vary much. Some categories showed declines – online purchases of toys, hobby items, music products or books decreased by 2.2 percentage points after the holidays, while clothing and accessories purchases increased from a 21 percent share to 23 percent. Physical purchases were largely confined mainly to grocery buys, and the share who did such shopping was approximately 50 percent for both timeframes.

Advertisement: Scroll to Continue

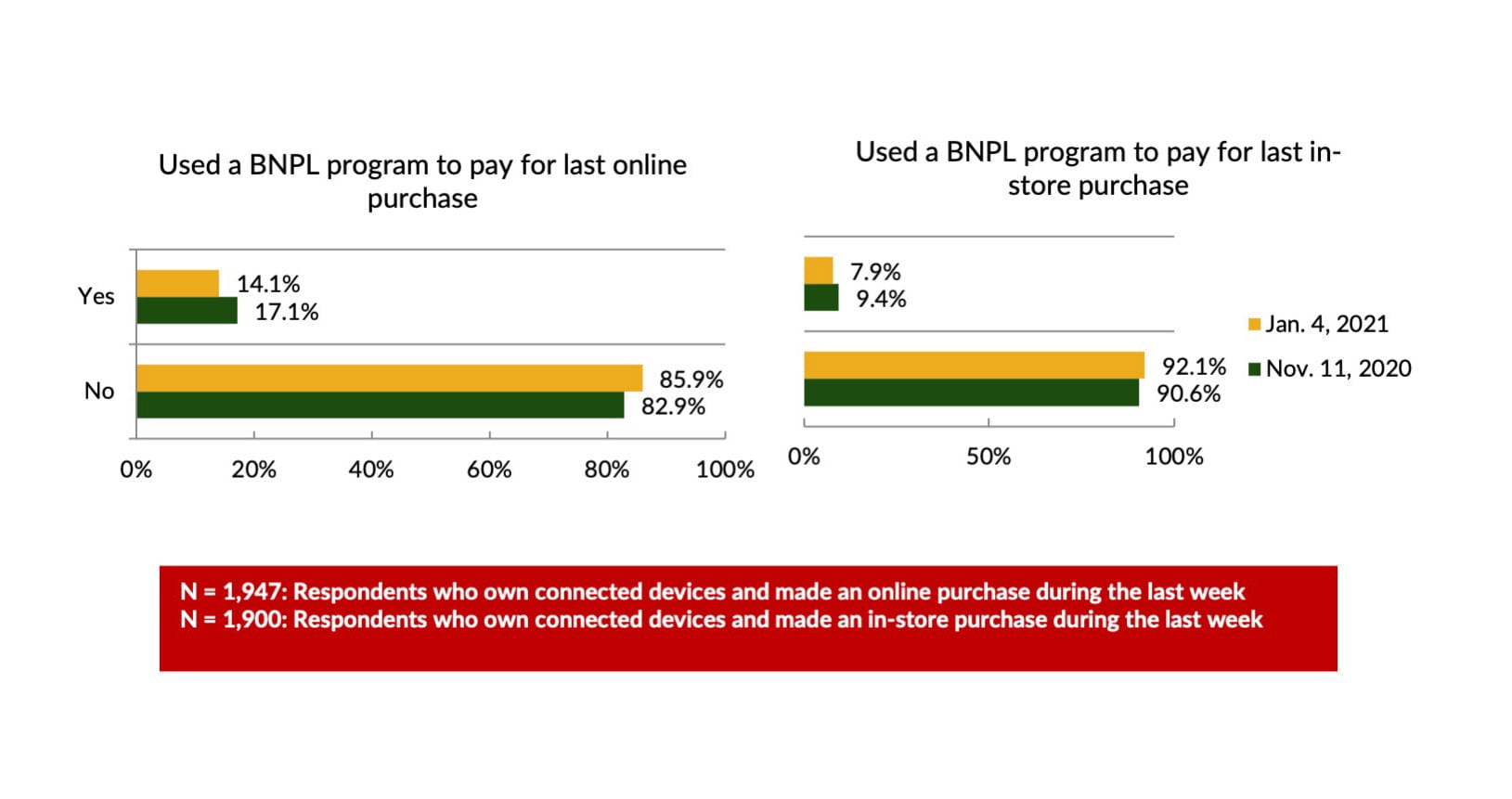

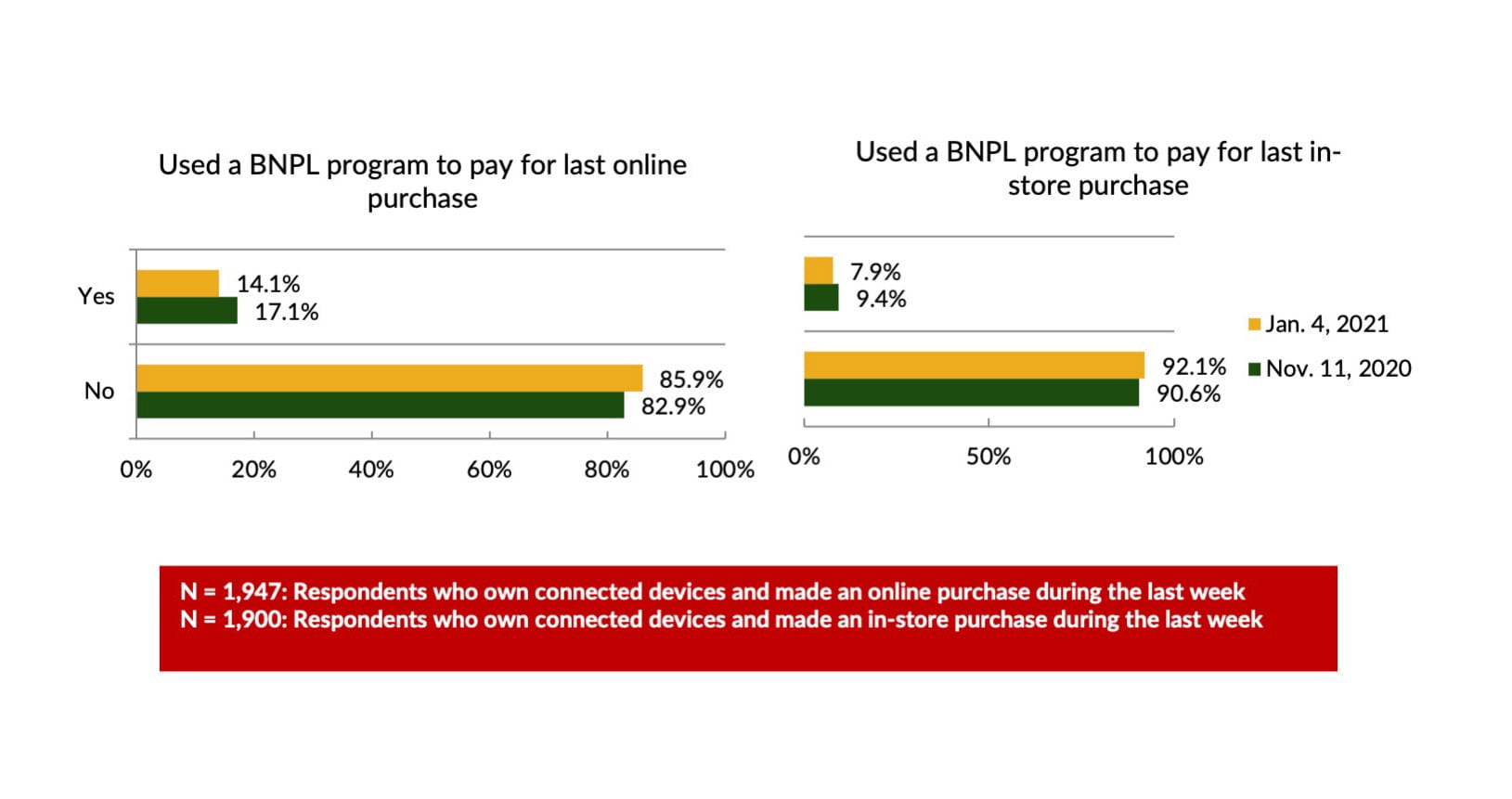

That dip in purchasing touched BNPL, which also dropped after the holidays. According to the report, 17 percent of consumers used a BNPL program to pay for their last online purchases in November, falling to 14 percent in January. Among in-store purchases, usage also fell from 9.4 percent to 7.9 percent.

However, the new data also demonstrated that BNPL is becoming an increasingly important option for the financially constrained consumer. According to the data, roughly 60 percent of consumers are living paycheck to paycheck, and the vast majority (74 percent) report having less than $15,000 in savings. Those with no savings tend to be more financially constrained. They also tend to be middle-aged, less educated and more likely to have children. This “financially at risk” group represents 38 percent of the sample of consumers surveyed for the report.

However, the new data also demonstrated that BNPL is becoming an increasingly important option for the financially constrained consumer. According to the data, roughly 60 percent of consumers are living paycheck to paycheck, and the vast majority (74 percent) report having less than $15,000 in savings. Those with no savings tend to be more financially constrained. They also tend to be middle-aged, less educated and more likely to have children. This “financially at risk” group represents 38 percent of the sample of consumers surveyed for the report.

According to the data, BNPL tends to be particularly popular with consumers living paycheck to paycheck, comprising 87 percent of those who used BNPL for their last in-store purchase. This is also the case with online shoppers, as over ⅔ of those who reported making their last digital purchase with BNPL also reported living paycheck to paycheck.

Financial stability also seemed to influence where consumers shop, with the financially stable favoring shopping in-store at Costco and paycheck-to-paycheck shoppers favoring Amazon. Financially constrained respondents stood out among those who make online purchases at Target, according to the study data.

And those increased options for financially constrained consumers, particularly as the global economy struggles to recover from the damage wrought by COVID-19, are looking ever more important. Because constrained consumers are notably cutting their spending, according to the data. Respondents who live paycheck to paycheck decreased their average retail spending by $92.65 and $79.79 for online and in-store purchases, respectively, from November to January. Their weekly purchases fell as well, by 0.2 and 0.3 on average, for online and in-store purchases, respectively.

Respondents living more comfortably spent around the same amount during the holidays as they did in January and maintained the average number of online purchases, but in-store purchases decreased by 0.3. The economy can’t recover if consumers aren’t feeling comfortable enough to spend. If BNPL is helping them do that, it could shape up to be more than a useful tool for consumers – it could also be essential for an economy that is struggling to get back on its feet.

Now that the holiday season is over, people are shopping less. Consumers made an average of 2.6 online purchases in November and spent $261 on their most recent purchases; as of January, they $54 less, on average, than they did before the holidays, and made 0.2 fewer weekly purchases. Average ticket amounts for in-store purchases were also down by $56, as the weekly purchase count dropped by 0.3 on average.

Now that the holiday season is over, people are shopping less. Consumers made an average of 2.6 online purchases in November and spent $261 on their most recent purchases; as of January, they $54 less, on average, than they did before the holidays, and made 0.2 fewer weekly purchases. Average ticket amounts for in-store purchases were also down by $56, as the weekly purchase count dropped by 0.3 on average. Add as Preferred Source

Add as Preferred Source

However, the new data also demonstrated that BNPL is becoming an increasingly important option for the financially constrained consumer. According to the data, roughly 60 percent of consumers are living paycheck to paycheck, and the vast majority (74 percent) report having less than $15,000 in savings. Those with no savings tend to be more financially constrained. They also tend to be middle-aged, less educated and more likely to have children. This “financially at risk” group represents 38 percent of the sample of consumers surveyed for the report.

However, the new data also demonstrated that BNPL is becoming an increasingly important option for the financially constrained consumer. According to the data, roughly 60 percent of consumers are living paycheck to paycheck, and the vast majority (74 percent) report having less than $15,000 in savings. Those with no savings tend to be more financially constrained. They also tend to be middle-aged, less educated and more likely to have children. This “financially at risk” group represents 38 percent of the sample of consumers surveyed for the report.