NEW REPORT: All-in-One Payment Solutions Help SMBs Future-Proof Bottom Lines

Small- to medium-sized businesses (SMBs) and the accounts payable (AP) and accounts receivable (AR) executives that manage the payments and invoices that they receive know they would benefit from streamlined payments processes — but the pathway to frictionless payments is not well understood.  While most SMBs and payments executives agree that an all-in-one payment solution allowing streamlined business-to-business (B2B) transactions would be desirable, adoption rates are low — due, in part, to the gap in understanding how it would work and how they can be integrated into existing systems.

While most SMBs and payments executives agree that an all-in-one payment solution allowing streamlined business-to-business (B2B) transactions would be desirable, adoption rates are low — due, in part, to the gap in understanding how it would work and how they can be integrated into existing systems.

The Future of Business Payables Innovation: How New B2B Payment Options Can Transform the Back Office, a PYMNTS and Plastiq collaboration, examines how businesses can adopt a proactive strategy to transform AP/AR processes and remove friction from B2B payments. The report is based on a survey of 500 SMBs with revenues between $500k and $100 million and AP/AR executives with SMBs as clients.

Key finding from this report include:

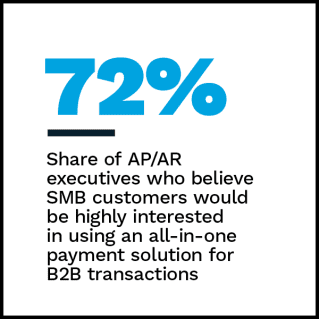

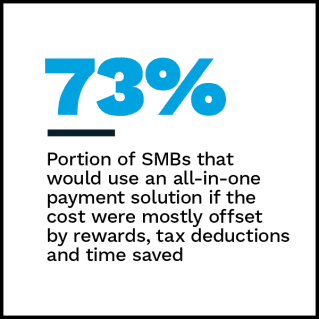

• Most AP/AR executives believe an all-in-one payment solution would immediately benefit SMBs. Executives and SMBs agree that more efficient payments processes are needed and see a benefit in using a single payment tool to manage transactions. Eight out of 10 executives and six out of 10 SMBs believe all-in-one payment solutions will save SMBs time immediately.  Fifty-nine percent of SMBs feel they would save time, and 52% say they would find it easier to manage cash flows if they did so. Additionally, 41% of SMBs say that such solutions would simplify receivables tracking, 37% believe they would offer the ability to reconcile data automatically and 32% say they would improve working capital.

Fifty-nine percent of SMBs feel they would save time, and 52% say they would find it easier to manage cash flows if they did so. Additionally, 41% of SMBs say that such solutions would simplify receivables tracking, 37% believe they would offer the ability to reconcile data automatically and 32% say they would improve working capital.

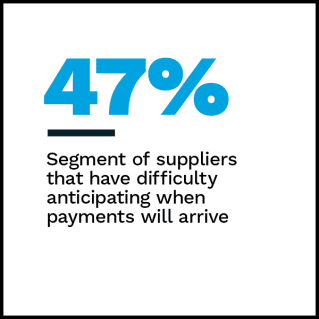

In addition, many SMBs mention that inefficient payment processes have a meaningful impact on cash flow management, as erratic payment processing times can impact financial planning.

• More than half of SMBs see an all-in-one payment platform as a way to simplify financial management. SMBs surveyed believe that a single payment solution for all B2B transactions would offer improved visibility over cash flows and support better AP/AR tracking, crucial for financial strategies. That visibility is also essential for supplier relationships: Businesses that depend on a network of suppliers or vendors need to be able to rely on fast, frictionless payments to avoid delays that can impact business operations.

Suppliers and buyers need flexibility in how they receive and send payments. Some of the most popular current payment methods, such as debit and automated clearing house (ACH) payments, are insufficient in limiting payments friction for both sides of B2B transactions.

Suppliers and buyers need flexibility in how they receive and send payments. Some of the most popular current payment methods, such as debit and automated clearing house (ACH) payments, are insufficient in limiting payments friction for both sides of B2B transactions.

• SMBs’ knowledge of all-in-one solutions may be a key barrier to seamless B2B payments. According to our research, many businesses expressed doubts about integrating the technology with existing systems. Four out of 10 SMBs state they used an all-in-one payment platform, but they are most likely unaware of how they can leverage it to manage all of their AP and AR processes.

This gap in knowledge means many businesses may turn to a third-party solution that manages the integration process for them, especially when available technical resources are limited.

To discover how businesses can optimize payments experiences through an all-in-one payment solution, download the report.