Automation can improve efficiency, speed and accuracy in accounts receivable (AR), reducing days sales outstanding (DSO) and expediting payments. It also streamlines complex, error-prone accounts payable (AP) processes that many firms use.

“Solving Accounts Payables’ Top Frictions With Automation,” a PYMNTS and Corcentric collaboration, drew on a survey of 100 chief financial officers at U.S.-based firms across 13 industry segments. It examined the enterprise adoption of specialized AP automation software and how it impacts firms’ purchasing and AP workflow efficiencies.

Findings captured in the study showed that almost all firms surveyed faced disruptions in their purchase order and invoice payment processes — the source-to-pay cycle — within the previous six months. On average, firms encountered disruptions in nearly three out of the eight areas across the source-to-pay continuum.

Shipping issues emerged as the most reported disruption, affecting 69% of firms. Following were invoice errors or discrepancies (25%) and order quality and accuracy disputes (24%). Payment-related issues were the least experienced disruption, affecting 14% of firms.

The study also highlighted a correlation between the size of firms and the specific AP frictions they faced. Small firms, with annual revenues between $250 million and $750 million, were more likely to experience order quality and accuracy disputes compared to larger firms. On the other hand, mid-size firms in the $750 million to $1.5 billion revenue range were more prone to invoice errors and discrepancies.

Embracing digital technologies and automation can help fill these gaps, the study noted, enabling “firms to speed up the source-to-pay cycle by reducing days of delay in various stages of the AP workflow.”

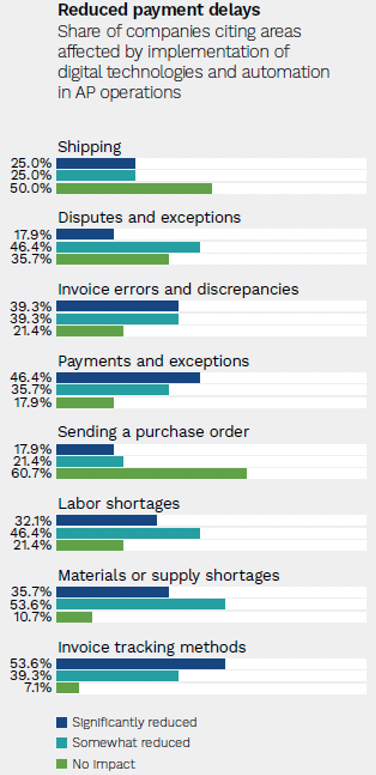

Among firms using digital technologies or automation to support AP operations, 93% cited reduced days of delay in invoice tracking as a leading improvement that automation enabled, with nearly half attributing the reduction in tracking invoice delays to automation software.

Additionally, 54% of CFOs reported improvements in invoice tracking methods because of AP automation, while 46% of respondents said automation software had reduced delays around payments and exceptions.

The data also revealed that 39% of respondents saw a drop in delays caused by invoicing errors and discrepancies, and nearly 36% and 25%, respectively, credited automation with reducing delays around materials or supply shortages and in shipping.

Larger firms generating more than $1.5 billion in revenue were more likely to report reduced days of delay in all AP operations due to automation, as larger firms have automated a greater portion of their AP processes compared to smaller firms.