Only One-Third of Firms Use Critical AP/AR Automation Tools

Accounts receivable (AR) and accounts payable (AP) workflows rely on labor-intensive, manual processes prone to human error and delays — but specialized software and automation are changing that.

Digital technologies act as engines for efficiency, speed and accuracy, enabling companies’ AR teams to reduce their days sales outstanding and receive payments faster. Automation also helps streamline AP workflows, reducing days of delay in purchase orders and invoice payment processing, also known as the source-to-pay cycle. Eight in 10 chief financial officers (CFOs) with automated AP/AR processes reported significant reductions to friction and disruption.

PYMNTS’ research found that all CFOs recognize the need to automate their AP and AR processes, yet automation adoption remains nascent. Few firms have invested in specialized technologies for these processes. Thirty-three percent and 28% reported having some automation to support their AR and AP workflows, respectively. Firms are more likely to have invested in digital technologies and automation in fraud and risk management.

“Why CFOs Recognize the Need to Automate AP/AR Workflows,” a PYMNTS and Corcentric collaboration, examines the current enterprise adoption of specialized AP/AR automation software and how it affects firms’ AP/AR workflow efficiency. We surveyed 100 CFOs at United States-based firms across 13 industry segments generating $250 million or more in annual revenues between May 3 and May 16.

More key findings from the study include the following.

More than half of CFOs see a definite need to automate AP and AR further, yet few have invested in specialized automations that fully streamline AP/AR workflows.

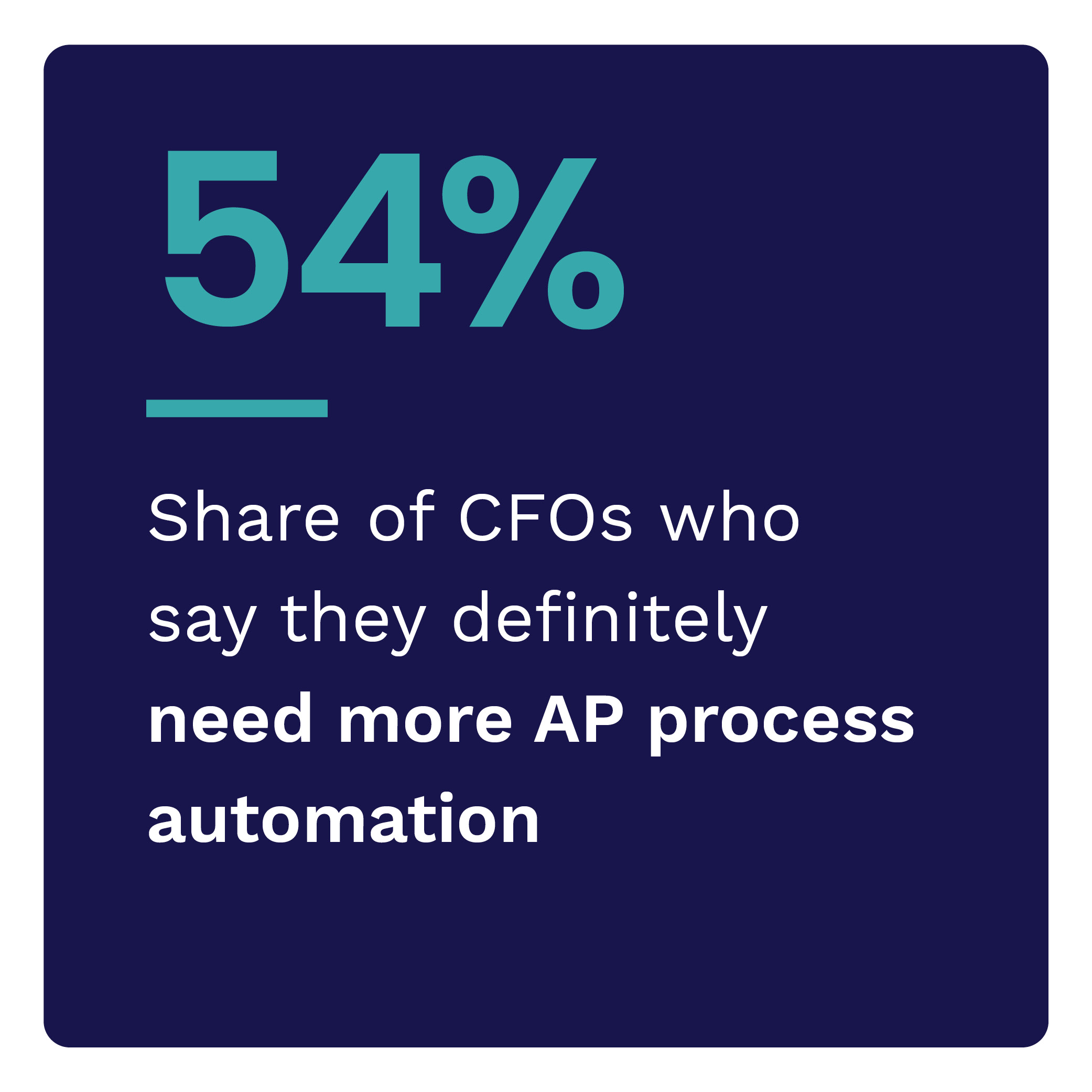

PYMNTS’ research found that 64% of CFOs reported they definitely need more automation for their AR processes, and 54% said they definitely need more automation for AP processes. The remaining CFOs said they probably need more automation, showing a difference in the sense of urgency related to investing in these processes.

CFOs’ recognition of the need to automate AP/AR workflows has not resulted in investment beyond early adopters, however.

CFOs have prioritized investments for fraud and risk management automation. They credit those applications for the reduction of delays involving payment and invoice tracking.

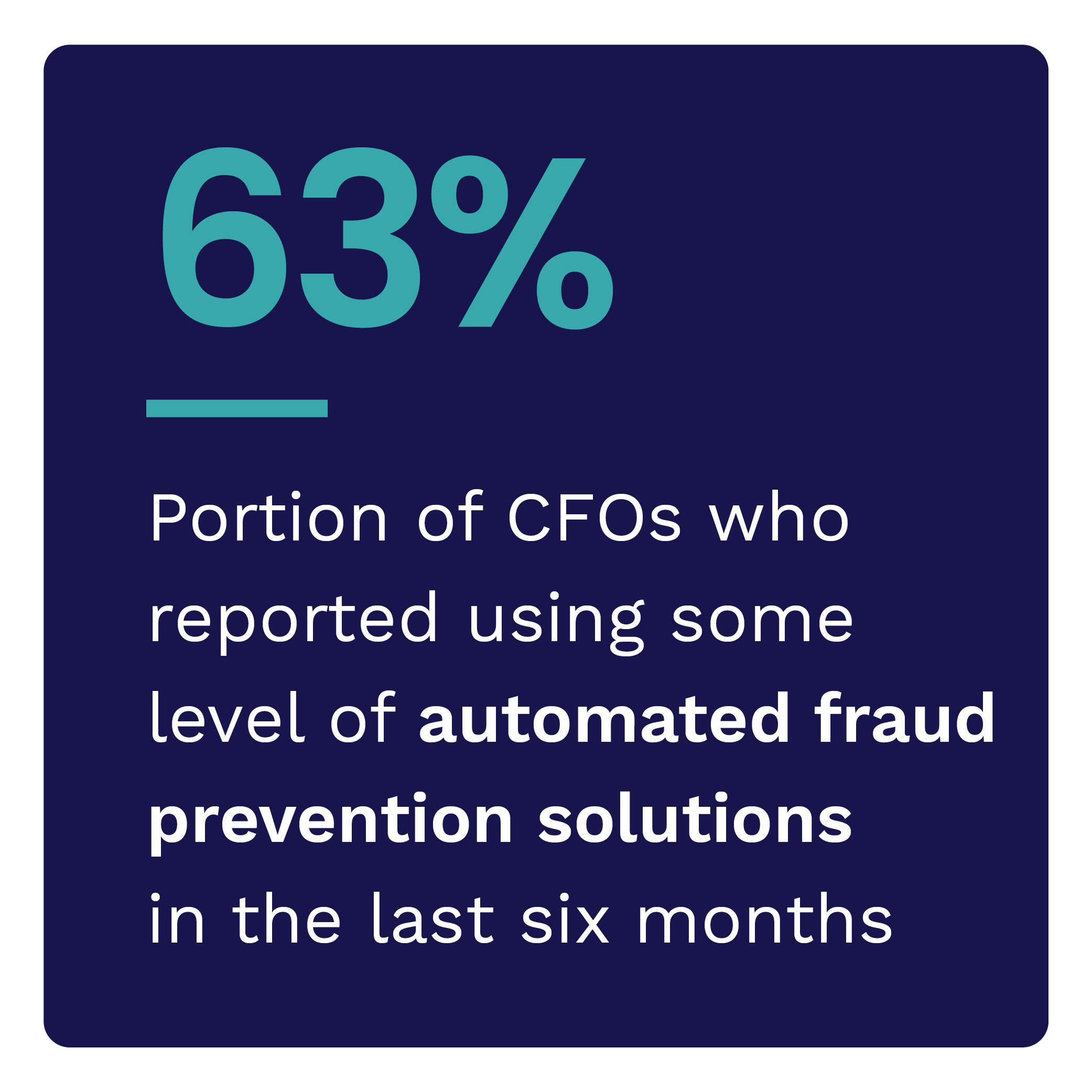

The use of digital technologies and automation to support fraud and risk management is widespread. Sixty-three percent of CFOs surveyed reported using some automation for fraud prevention in the last six months. Digital technologies and automation for fraud and risk management have provided other benefits, such as reduced delays. Seventy-one percent of CFOs credited fraud and risk management automation for reducing days of delay and exceptions related to payments, and 95% credited automation for reducing days of delays in invoice tracking.

Firms credit investments in automation for making or receiving payments with significantly reducing payment frictions and reducing delays in invoice tracking.

Automated fraud protection and risk management processes are not alone in improving financial operations. At firms that have used digital technologies and automation to streamline AP processes, 82% of CFOs reported reduced days of delay and exceptions related to payments, with 46% citing significantly reduced days of delay. PYMNTS explored how automation has improved various operations, from receiving purchase orders to tracking invoices to managing labor and material shortages.

Firms must leverage automation beyond fraud and risk management and integrate these AP/AR digital technologies into their operations to reap its benefits. Download the report to learn more about how automation can help streamline AP/AR processes.