Mid-sized firms are as eager as their large enterprise counterparts to fully automate their accounts payable (AP) and accounts receivable (AR) processes; however, research shows the majority of them are way behind the curve.

According to PYMNTS Intelligence study “Accounts Payable and Receivable Trends: What’s Next in Automation,” a collaboration with American Express, only 5% of the midsize firms surveyed have completely automated their AP/AR systems.

But most mid-sized companies plan to catch up quickly.

By fully automating AP and AR systems, companies of all sizes can benefit by having greater visibility into their financial data, improved cash flow management, improved forecasting abilities and a more accurate picture of their working capital.

More than 60% of the 412 mid-size companies — for this study, those with annual revenues between $3.5 million and $15 million — we surveyed have already taken steps to automate their AP/AR processes. Specifically, 64% have at least partially automated their AP disbursements, while 65% have done the same for their collections processes.

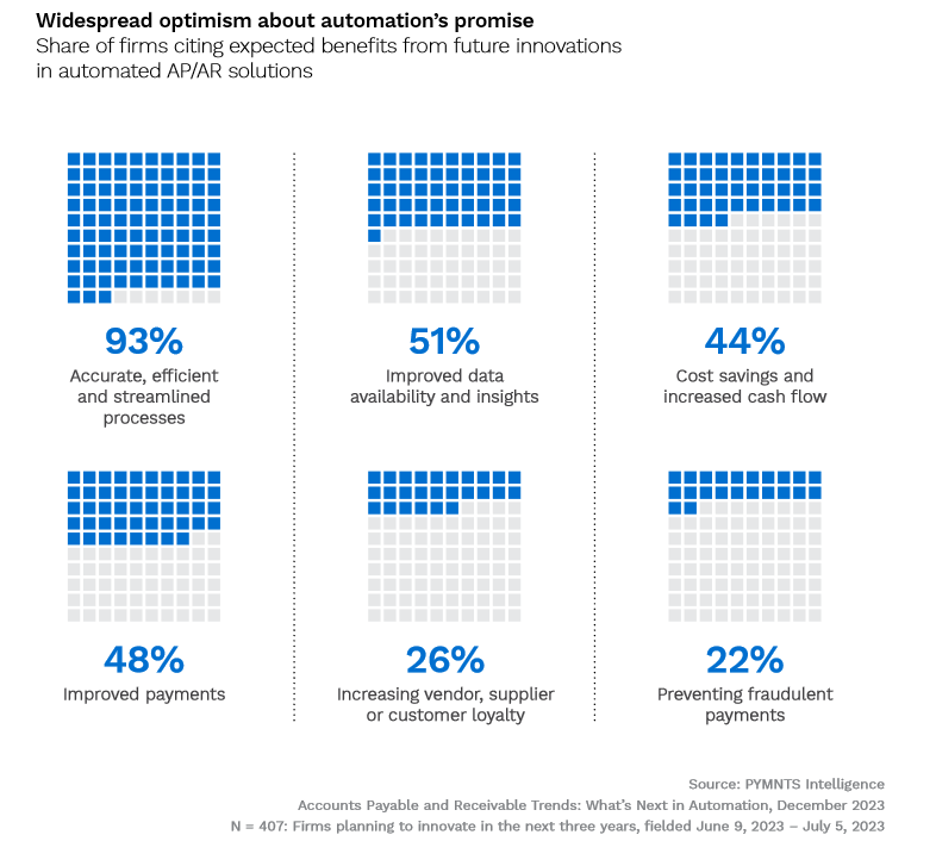

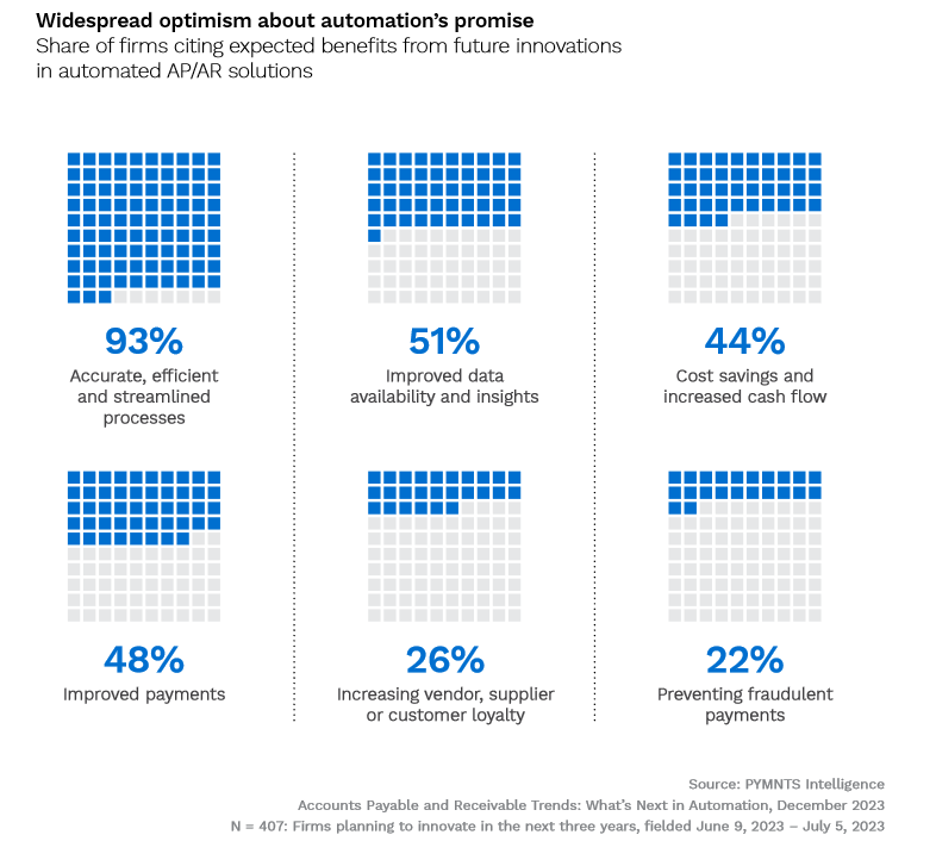

Apparently, they are happy with the results. Ninety-three percent say they plan further AP/AR automation because, they say, doing so will result in more accurate, efficient or streamlined processes.

Advertisement: Scroll to Continue

This enthusiasm helps explain why 44% of mid-sized firms anticipate seeing greater savings and increased cash flow thanks to automation. Fifty-one percent believe AP/AR automation will lead to improved data, that in turn, will provide them with unprecedented transaction insights that were previously unavailable. Additionally, respondents believe the precision the new data will offer will help reduce inaccuracies that may prove beneficial later when doing financial and compliance-related reporting.

Forty-four percent of the firms also expect to see cost savings and enhanced cash flow over the next three years; while a slightly larger group, 48%, anticipate seeing their payment processes not only get faster but biome more reliable payments while opening up a broader array of payment options down the road.

Twenty-six percent, meanwhile, believe AP and AR automation will help strengthen relationships with customers and vendors, resulting in greater loyalty with both. Twenty-two percent say automated systems will also cut down on fraudulent payments.

The vast majority of the mid-sized firms that have begun automating their AP/AR systems have clearly realized the value in doing so, which is likely why they are ready to double down. The 2% of companies surveyed that have no plans whatsoever to automate AP processes may have to rethink their strategies as they see competitors take advantage of these benefits instead.