Quora CEO Says AR Automation Blunts Cash Flow Impact of Remote Work Environment

Last year, the entire business world experienced a sea of change when remote work became the new normal due to social distancing and stay-at-home guidelines. With the pandemic now more than 18 months in and temporary changes quickly becoming new habits, workers have grown used to remote work, and many feel like they prefer it to commuting to the office daily.

Last year, the entire business world experienced a sea of change when remote work became the new normal due to social distancing and stay-at-home guidelines. With the pandemic now more than 18 months in and temporary changes quickly becoming new habits, workers have grown used to remote work, and many feel like they prefer it to commuting to the office daily.

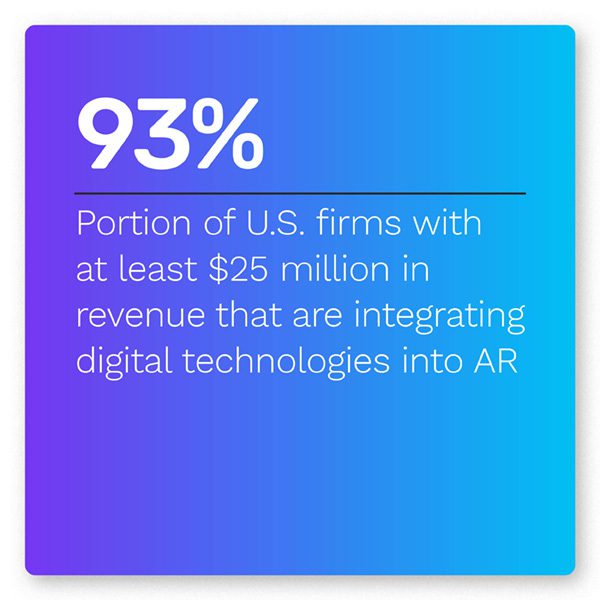

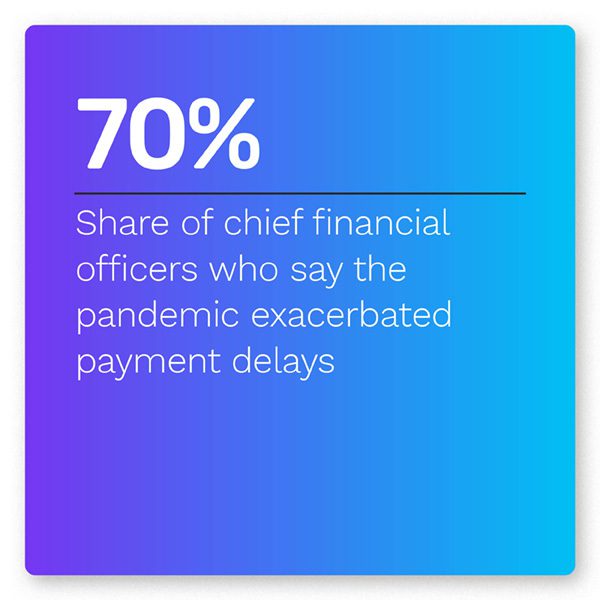

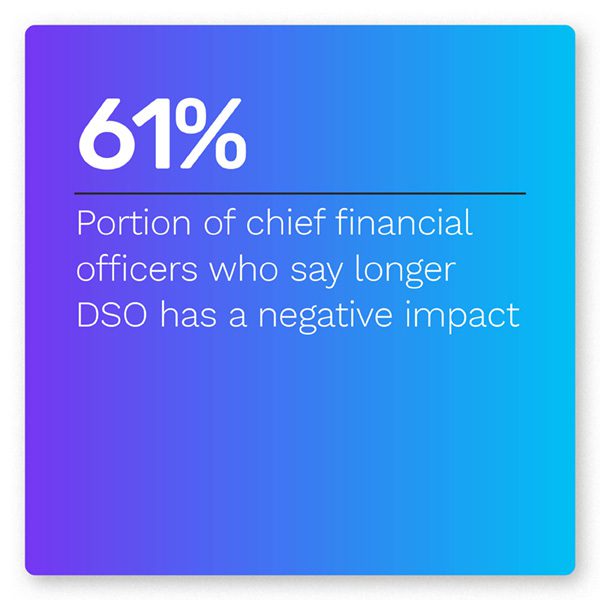

Remote work has been a difficult change for accounts receivable teams to cope with, however. Three-quarters of companies with annual revenues between $25 million and $100 million said that late payments have gotten worse since the pandemic began. At the same time, 60% of small businesses reported an increase in their days sales outstanding (DSO). These late payments and DSO increases stem from the lack of communication and in-person collaboration that remote work often brings. AR automation could be a key method of improvement, however, as more than 87% of firms that deployed AR automation reported faster processing speed, with 79.3% saying it improved their team efficiency and 74.8% reporting a better customer experience.

In the October Working Capital Playbook®, PYMNTS explores the latest in the world of accounts receivable, including the challenges that AR teams face in remote work environments, how AR automation can help close the performance gap, and new partnerships and integrations in the AR industry.

Developments From Around the World of Accounts Receivable

The ongoing pandemic is one of many factors fueling change in the world of AR. A recent report found that 83% of firms have changed their AR processes since the beginning of the pandemic, with 70% planning to deploy automation to aid their accounting teams. This push for automation can be explained by the slowness of manual AR procedures, which have been found to slow payments collection by up to 67%.

Companies that have invested in AR automation to speed up accounting processes have had positive reviews so far. A recent study from PYMNTS found that four-fifths of companies reported AR automation has improved the efficiency of their accounting teams, and three-quarters said that their overall customer experience had improved. Results varied by industry, with the energy sector seeing the most improvement at 95% of respondents.

Companies that have invested in AR automation to speed up accounting processes have had positive reviews so far. A recent study from PYMNTS found that four-fifths of companies reported AR automation has improved the efficiency of their accounting teams, and three-quarters said that their overall customer experience had improved. Results varied by industry, with the energy sector seeing the most improvement at 95% of respondents.

One example of AR improvement comes from the U.K.-based commercial law firm gunnercooke, which partnered with YayPay to implement its automation solution. The YayPay system works by consolidating real-time data from enterprise resource planning (ERP), customer relationship management (CRM) and other accounting sources and presenting it on dashboards to AR staff. The YayPay partnership was part of gunnercooke’s larger initiative to digitize many of its existing procedures, according to a press release.

How Quora Leveraged AR Automation to Adjust to Remote Accounting

The pandemic-driven shift to remote work affected countless industries, resulting in cybersecurity gaps, reduced efficiencies and various other downstream effects. Many companies’ AR processes were also significantly affected, but those that leveraged automation have managed to weather the impact better than most and have largely kept their operations afloat. In this month’s Feature Story, PYMNTS spoke with Adam D’Angelo, founder and CEO of question-and-answer site Quora, about how automated AR processes and an emphasis on digital payments have helped the company seamlessly transition to a work-from-home paradigm with minimal aftereffects.

Deep Dive: How AR Automation Could Mitigate Remote Work Challenges

Remote work has become the new normal for many offices, as employees grow used to the new conditions initially brought on by social distancing and stay-at-home orders. Accounts receivable has become much more complicated due to this new paradigm, however, and the downstream effects like delayed payroll could be catastrophic. In this month’s Deep Dive, PYMNTS explores how remote work has affected the AR industry and how automation could help accounting departments keep up with the evolving industry.

About the Playbook

The Working Capital Playbook®, done in collaboration with YayPay, is your go-to monthly resource for updates on trends and changes in accounts receivable.