Deal making spotlights the inroads digital technologies are poised to make in the grocery space.

U.K.-based online grocery firm Ocado has reportedly been attracting interest from several would-be suitors, as reported by several news outlets including CNBC, and the roster includes Amazon among other Big Tech companies.

At this writing, Ocado shares were up more than 32% in intraday trading. The company’s operations are focused on robots and software that in turn are used to help get groceries to consumers’ doorsteps.

The omnichannel evolution of grocery has been anything but a straight path. The vertical increased its digital adoption by more than 25% in 2022, which includes both consumer-facing and back-end processes that strive to improve logistics.

Ocado’s latest fiscal year earnings results show that revenues were up 0.6% year on year to 2.5 billion pounds (about $3.2 billion), while its pre-tax loss grew to 500 million pounds (about $637 million) from 177 million pounds (about $225 million) in the previous year. But drilling down a bit, the revenues tied to its technology solutions were up 59%. Management stated that the channel shift from brick-and-mortar to “eCommerce in grocery” is now resuming from a higher base, spurred by the pandemic.

As for the battle of the giants, there has been intense competition between Amazon and Walmart for share of online grocery spending (and delivery).

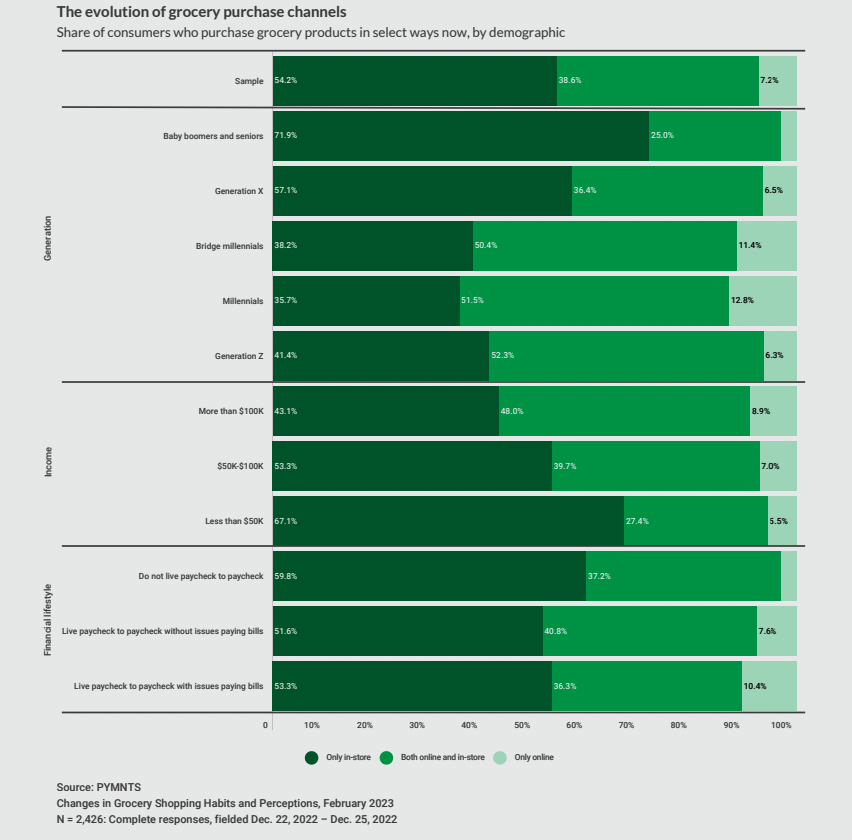

The greenfield opportunity to stock the pantry through digital channels is a significant one, especially in the United States. In “Changes in Grocery Shopping Habits and Perception,” PYMNTS found that only 7.2% of consumers buy all their groceries online. But that’s a huge jump from the minuscule 0.2% who had done so before the pandemic.

The push toward omnichannel buying has been a strong one. Before the pandemic, almost two-thirds of consumers opted for only brick-and-mortar channels to get their food items and staples; now that tally stands at 54%, indicating either an omnichannel pivot or a purely digital one, the study found.

The digital shift has been deep and wide. Most consumers, no matter the generation, use both online and in-store settings to buy groceries. And the data showed that a significant percentage of high-earning households are doing so.

The implication here is that even with inflationary pressures in the mix, even with the re-opening of economies, the convenience of ordering and having groceries delivered with a few clicks of a button has its own, lasting allure.

Ocado may — or may not — be swallowed by a deep-pocketed Big Tech denizen. Long after the rumors are confirmed or put to rest, consumers’ use of digital channels looks set to prove long-lasting.