What will it be tonight — pizza, burgers or Thai? Nothing beats having dinner delivered straight to your door after a long day, and food delivery aggregators such as DoorDash and Uber Eats offer a convenient way to order-in that has many restaurant customers reaching for their smartphones.

What will it be tonight — pizza, burgers or Thai? Nothing beats having dinner delivered straight to your door after a long day, and food delivery aggregators such as DoorDash and Uber Eats offer a convenient way to order-in that has many restaurant customers reaching for their smartphones.

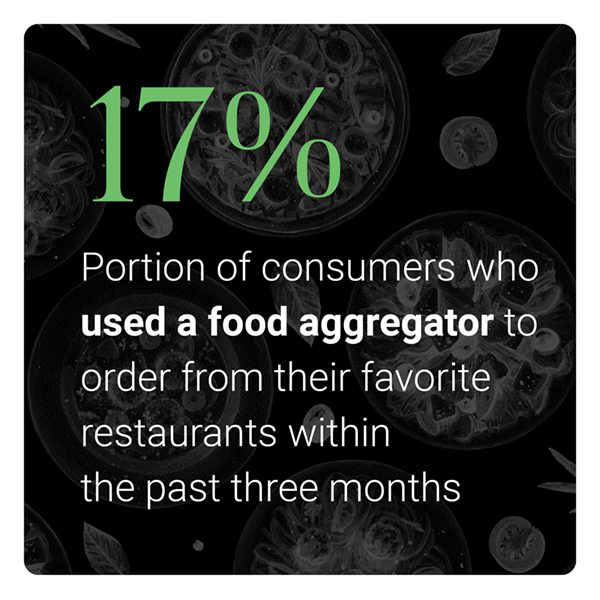

Most United States consumers who regularly purchase food from restaurants — whether dine-in, delivery or take-out — do not regularly use food aggregators, however. PYMTS latest research finds that just 17% ordered delivery from their favorite table-service restaurant or quick-service restaurant (QSR) via aggregator in the last three months, compared to nearly half who placed orders the “old-fashioned” way, either through the restaurant’s website or app (44%) or by phone (42%).

This is one of the key findings in the Digital Divide Report, Aggregators: The Cost Of Convenience edition, a PYMNTS and Paytronix collaboration. We conducted a survey between Sept. 2 and 9 of 2,213 U.S. adults who purchase food from restaurants at least once a month to learn about their ordering preferences and spending habits. This report focuses on food delivery aggregators, a disruptive force in the restaurant industry that have become a go-to method of ordering for some consumers but that many others avoid.

This is one of the key findings in the Digital Divide Report, Aggregators: The Cost Of Convenience edition, a PYMNTS and Paytronix collaboration. We conducted a survey between Sept. 2 and 9 of 2,213 U.S. adults who purchase food from restaurants at least once a month to learn about their ordering preferences and spending habits. This report focuses on food delivery aggregators, a disruptive force in the restaurant industry that have become a go-to method of ordering for some consumers but that many others avoid.

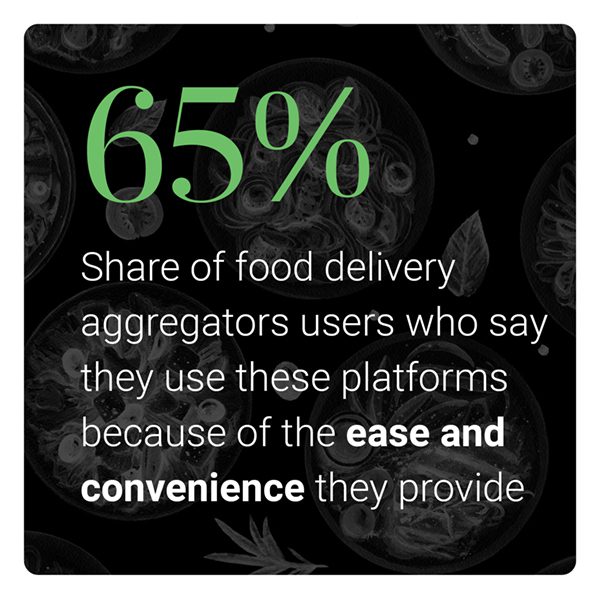

PYMNTS research showed that the central variable is the question of convenience versus cost. Nearly two-thirds of respondents who recently used an aggregator said that “ease and convenience” is a key reason for ordering via these platforms, while only a small share said that they find aggregators cheaper than other methods.

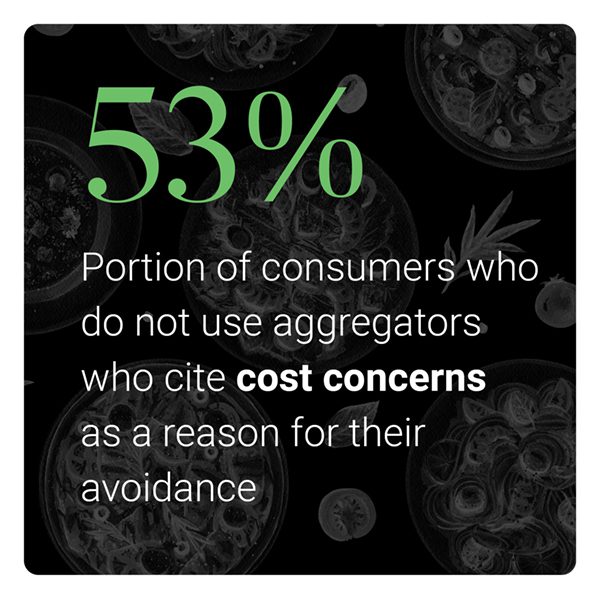

More than half of respondents who do not use aggregators, meanwhile, said that cost-related reasons, such as high delivery fees, deter them. PYMNTS found that consumers do spend more on average per order via aggregators than when ordering directly from restaurants. For example, they pay 10% more when ordering from their favorite QSR by aggregator than through the restaurant’s website or app.

To learn more about restaurant customers’ ordering preferences and where aggregators fit in, download the report.