In a year where consumers are cutting costs at every corner, it may have been reasonable to assume that food-focused aggregators have seen their heyday.

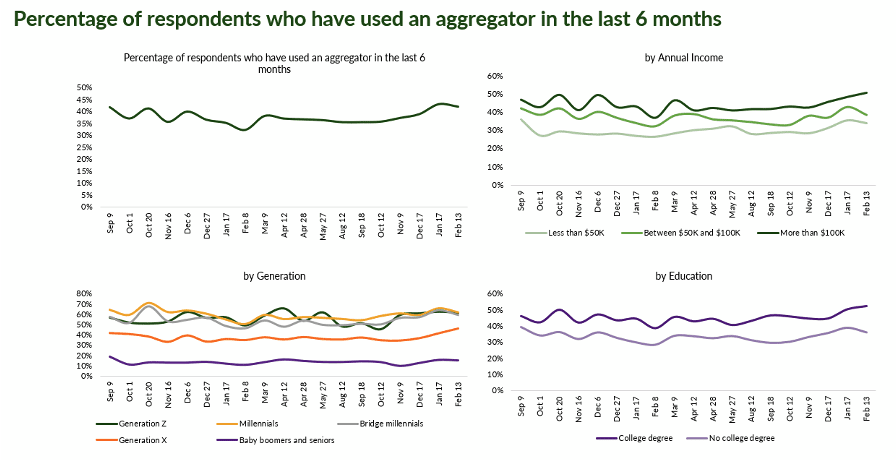

These platforms, connecting customers to participating restaurants, have historically charged service and delivery fees that can sometimes add up. However, as evidenced by proprietary data created in preparation for PYMNTS’ February “Connected Dining Report,” consumers’ use of aggregators has held relatively firm and is generally trending up.

The most solid aggregator users, perhaps not surprisingly, are consumers earning more than $100,000 annually. Some of aggregators’ continued consumer utilization may be due to the sector’s willingness to pivot to meet consumers’ changing needs and preferences, from lockdowns to inflation. Some companies that had grown their reach across borders pulled back into their home turf. Others are exploring expanding into the so far mostly unpenetrated suburban market.

Among the major U.S. aggregators, DoorDash seems to be strategizing its success around diversification, and the company’s varied moves illustrate how aggregators as a whole are positioning themselves for the future. With a focus on growing its subscription DashPass service to be on a par with Netflix or Amazon, the company committed during a November earnings call to not raising the program’s fees anytime soon. The firm has also partnered with Starbucks as the coffee giant seeks to expand its delivery choice for consumers beyond its branded app and long-running partnership with Uber Eats.

Venturing beyond food, DoorDash in September announced partnerships with both Dick’s Sporting Goods and Big Lots in a broader retail on-demand delivery push. Through its effort with Dick’s, the aggregator will deliver inventory from more than 700 of the retailer’s 850 stores across the country. The Big Lots partnership offers delivery from more than 1,400 of the closeout retailer’s stores nationwide in an effort to lure savings-conscious customers.

The aggregator has also rolled out a discounted benefits program, dubbed Merchant Benefits, aimed at small- to medium-sized restaurants and their staff that includes tools and perks.

Earlier this year, DoorDash announced it would be getting into the returns business with the launch of its “Package Pickup” program. Consumers can request drivers to pick up prepaid UPS, FedEx and U.S. Postal Service packages to be dropped off a designated location.

The aggregator has also launched a co-branded Mastercard in partnership with Chase. Cardholders are offered cash back on DoorDash-placed orders as well as a free year of DashPass to boost subscriptions.

What does the future hold for the aggregator space? Some say drones to speed up delivery time; others think a shift to servicing B2Bs is a more natural move. Whichever direction the sector goes, there certainly seems to be more to come.