It’s hard to keep the world’s biggest eCommerce retailer down even in a troubled economy, and Prime Day tends to bear that out as it did in 2022, although inflation pressures were present.

For the PYMNTS study “Prime Day 2022: Inflation Hits, But Amazon Still Wins,” we surveyed nearly 2,200 Amazon and Walmart subscribers in July, contrasting how consumers spent during the July Amazon sales event compared to the June Walmart+ Weekend sales blowout.

What we found supports much of what we know to be true about Amazon Prime members and their predilection for higher-ticket items, as the data shows.

Get Your Copy: Prime Day 2022: Inflation Hits, But Amazon Still Wins

Grocery is one category where Walmart continues to hold a lead over its eCommerce rival, even though slightly more consumers bought grocery items on Prime Day.

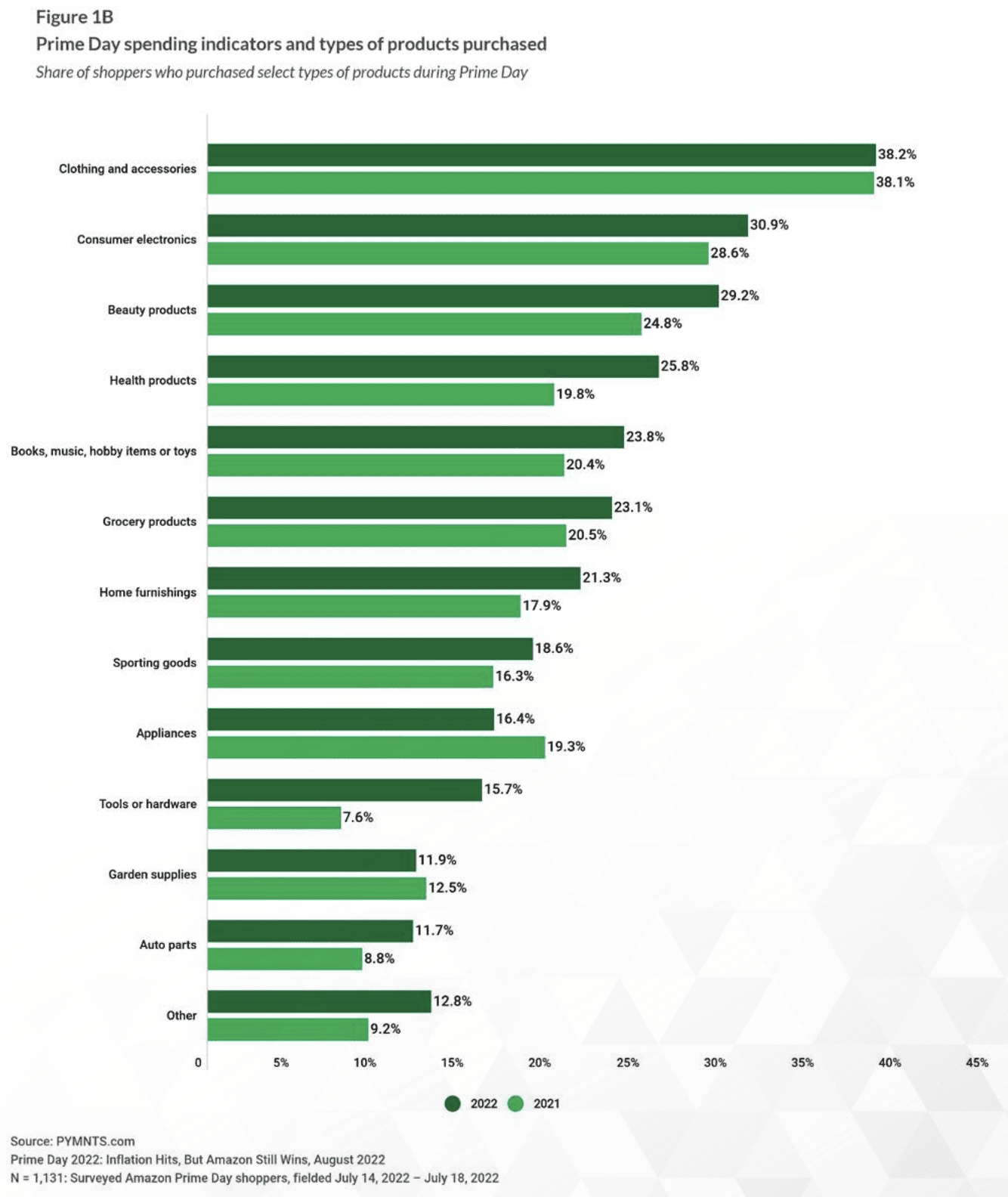

As the study states, “Only 23% of Prime Day shoppers bought groceries — roughly half the 45% rate of their Walmart+ Weekend counterparts. Conversely, shoppers buying electronics were more apt to do so on Prime Day (31%) over Walmart+ Weekend (24%).”

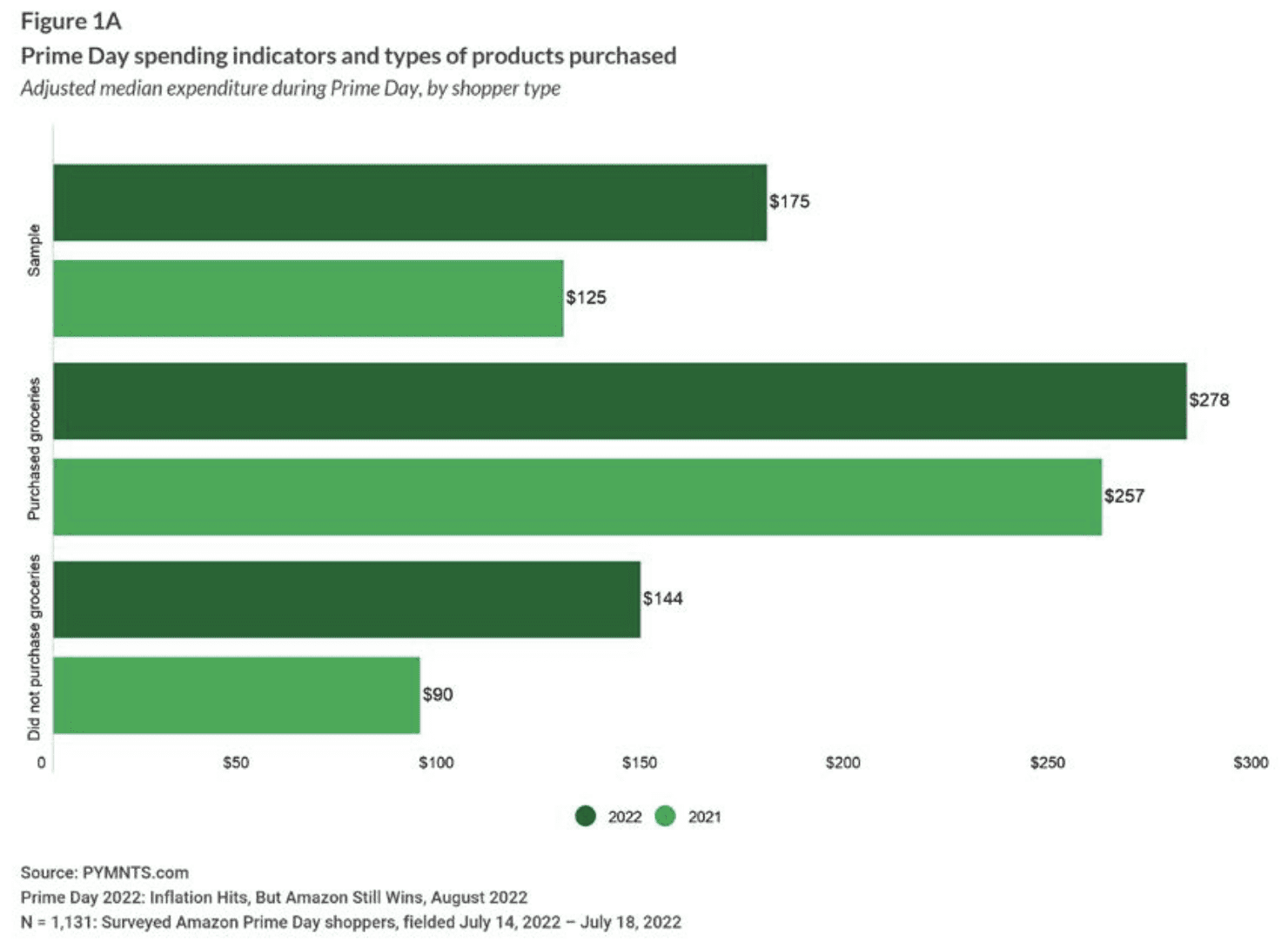

We found that Prime Day shoppers averaged a slightly higher spend more this year, though big-ticket items did see a reduction. Median receipts jumped to $175, up 40% from 2021, and 74% of shoppers spent less than $500.

Per the study, “As in previous years, millennials and high-income subscribers out-spent others on Prime Day. They racked up median receipts of $230 (up 46% from 2021) and $262 (up 51% from 2021), respectively.

“Notably, Prime members who live paycheck to paycheck and face challenges paying their bills increased their median spending by 28%, rising from $174 in 2021 to $222 in 2022, as inflation likely pushed them to bring forward spending to secure savings.”

See It Now: Prime Day 2022: Inflation Hits, But Amazon Still Wins