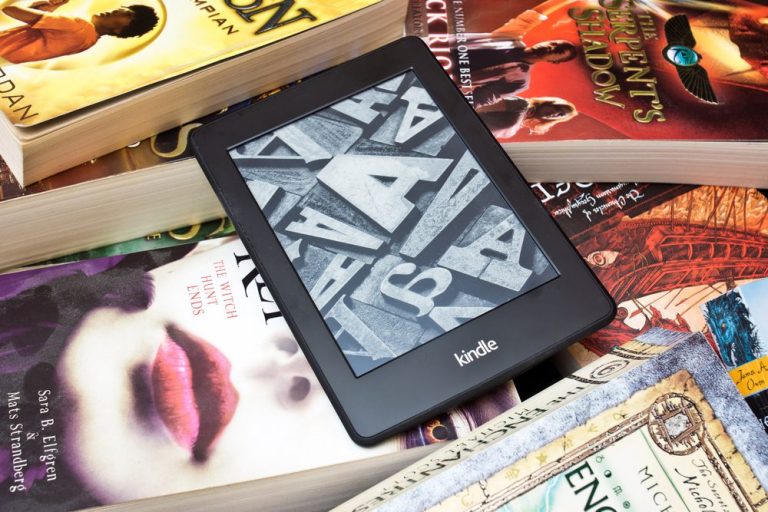

It’s hard to recall, at least for some of us, that eCommerce has its roots, in some respects, in the stacks, so to speak — where selling books eventually, over decades, led to always-on, global interactions between buyers and sellers.

In the year 2023, eCommerce holds sway, and devices in our collective hands ensure that we can satisfy every impulse to shop, compare prices, and get items delivered to the doorstep, sometimes within an hour.

This week’s news that Amazon is shuttering the U.K.-based Book Depository underscores how the online juggernaut has recalibrated, and still is revamping, its business model.

As reported, the online bookseller, an early Amazon competitor snapped up in 2011, is taking orders through April 26, and will provide support for those orders through the third week of June. In terms of scale and reach, Book Depository has shipped books from the U.K. to customers across 100 countries.

Eyeing Cost Cuts with Books in Focus

Amazon had telegraphed the move, at least in part, noting in recent posts from CEO Andy Jassy that layoffs would be coming across several divisions, including the books business. In doing so, we’d note that Amazon is trimming costs, yes, but bringing different “brands” (added to the company through acquisitions) more fully in-house.

Advertisement: Scroll to Continue

The company has also been closing physical locations here and across the pond (physical bookstores have been a casualty). As Amazon is scaling back its cashierless Go stores, there’s more emphasis on seamless omnichannel commerce. Getting that fluid cross-channel momentum in place is a work in progress. As Amazon told PYMNTS per a company spokesperson in reference to the closing of several Amazon Go locations, “like any physical retailer, we periodically assess our portfolio of stores and make optimization decisions along the way.”

Amazon traces its genesis back to the early 1990s and Jeff Bezos’s garage. And its first forays were in online bookselling, taking on everyone from Barnes & Noble to Borders to B. Dalton.

And now, as PYMNTS data has shown, the company has a commanding lead in eCommerce, taking roughly half of all digital retail spending. And more recently, the company has been targeting its efforts to bring outside merchants onto the platform — and into the ecosystem — with logistics and fulfillment thrown into the mix and Buy With Prime getting a boost, too. Streaming media and music, and original content would have been scarcely imaginable decades ago when selling and shipping books seemed a disruptive business model.

A chapter ends — at least in the book business — and for Amazon, the story of constant re-invention continues.