Category by category, the jousting for share of consumer spending is a pitched battle for Amazon and Walmart.

One holdout, beauty and wellness, where the two firms have been running neck and neck, may tilt toward Amazon’s favor.

In a note, Morgan Stanley contended that by 2025, Amazon will have a 14.5% share of the beauty category, compared to Walmart’s projected 13% share, Bloomberg reported Tuesday (June 20).

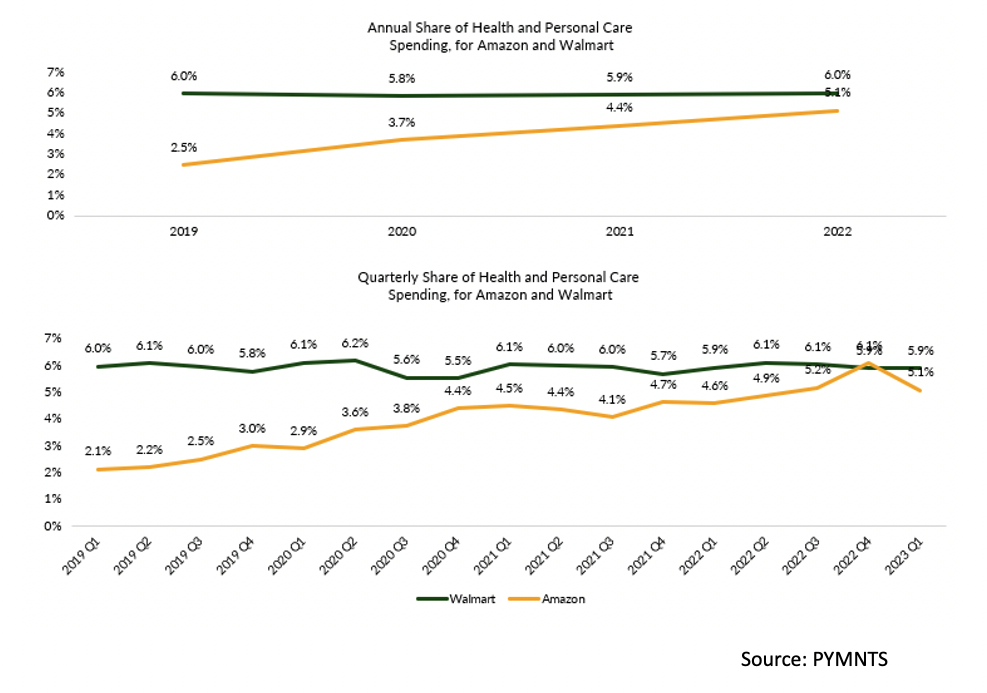

As tracked by PYMNTS year over year and quarter over quarter, the companies have been running neck and neck in the overall health and beauty segments. At the end of the most recent quarter for which we have compiled data, Amazon had 5.1% of sales here, topped by Walmart with 5.9% of the category.

But Amazon’s share in the pre-pandemic days of 2019 stood at a low 2.1% — and the march has been generally upward ever since. There was a slight dip in the latest report, in part because traffic has returned to brick-and-mortar locations as economies have reopened.

At a high level, Amazon’s dominance remains on full display, as PYMNTS estimated that the company’s share of overall discretionary spending stood at more than 22%, overshadowing Walmart’s 6.7% for the most recent reading. The gap widens when one considers the share of eCommerce spending allocated to each company, roughly 48% for Amazon versus about 6.7% for Walmart.

At a high level, Amazon’s dominance remains on full display, as PYMNTS estimated that the company’s share of overall discretionary spending stood at more than 22%, overshadowing Walmart’s 6.7% for the most recent reading. The gap widens when one considers the share of eCommerce spending allocated to each company, roughly 48% for Amazon versus about 6.7% for Walmart.

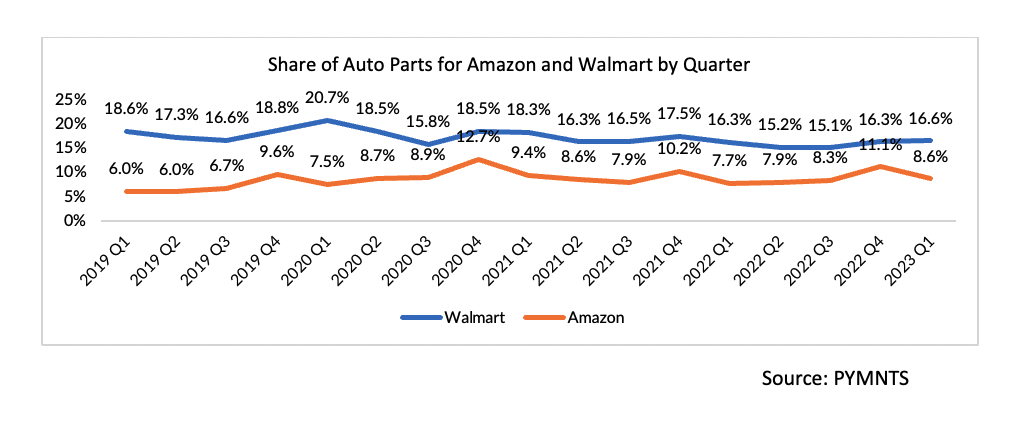

Drill down a bit, and there are still a few other categories where Walmart dominates. One example lies with auto parts, where it might make sense to have a more tactile experience than in other areas of spending. After all, these can be high-ticket items, and having the right part — and fit — are critical considerations.

So, too, is a similar outpacing seen with food and beverage (grocery), where the data showed that Walmart has a bit more than 19% of spending, and Amazon trails well behind with about a 2% share. But in apparel, there’s been a reversal of fortune. Amazon had a 4% share, and Walmart had 5.7% in 2016. Fast forward to today, and Amazon has overtaken Walmart, with respective 15% and 7.3% shares.

So, too, is a similar outpacing seen with food and beverage (grocery), where the data showed that Walmart has a bit more than 19% of spending, and Amazon trails well behind with about a 2% share. But in apparel, there’s been a reversal of fortune. Amazon had a 4% share, and Walmart had 5.7% in 2016. Fast forward to today, and Amazon has overtaken Walmart, with respective 15% and 7.3% shares.

Earlier this year, PYMNTS CEO Karen Webster noted the yawning gaps signal that despite the great re-openings, “Walmart doesn’t seem to be able to convert enough of the 100 million or 120 million U.S. people who walk into a Walmart store each week into shoppers who walk out with much more than food in their baskets.”

In part, there’s enough overlap to keep customers loyal to Amazon even if they are shopping with Walmart. PYMNTS found that as of early 2023, 87% of Walmart+ members — the cohort of loyal customers Walmart wants to grow — also belong to Amazon Prime.