Its overall, global operating income grew from $4.8 billion in Q1 2023 to $15.3 billion in 2024.

By the numbers, Amazon reported a net sales increase of 13% to $143.3 billion, up from $127.4 billion in the same quarter the previous year. This growth remained steady at 13% after adjusting for a $0.2 billion adverse impact from changes in foreign exchange rates. Sales from the North America segment rose by 12% to $86.3 billion, while the international segment saw a 10% increase to $31.9 billion, which adjusts to an 11% increase without the foreign exchange impact. Amazon Web Services (AWS) experienced a 17% increase in sales, reaching $25 billion.

Within the operating income numbers, the North America segment’s operating income increased to $5 billion from $0.9 billion, and the International segment turned a previous loss of $1.2 billion into a $0.9 billion profit. AWS’ operating income rose to $9.4 billion from $5.1 billion.

Net income for the quarter was $10.4 billion, or $0.98 per diluted share, up from $3.2 billion, or $0.31 per diluted share, in the prior year. The net income number includes a $2 billion pretax valuation loss from the investment in Rivian Automotive, compared to a $0.5 billion loss in the first quarter of 2023.

But that wasn’t what the gathered analysts were on its earnings call to hear. They wanted to hear about Amazon’s AI spending, a line item that sunk Meta’s earnings last week.

Advertisement: Scroll to Continue

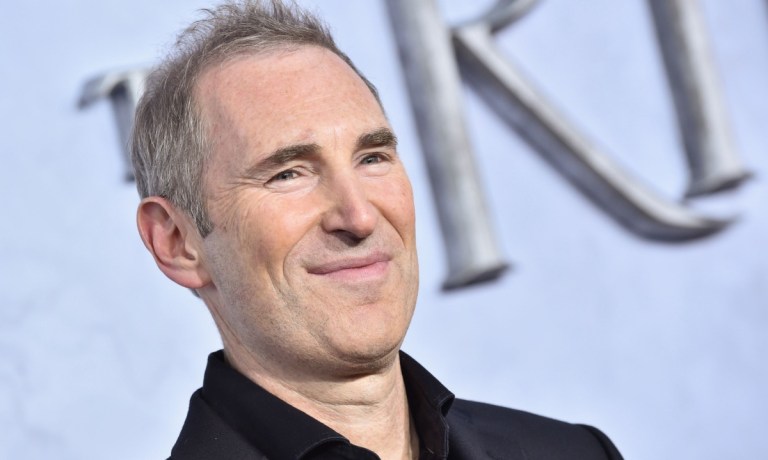

“We see considerable momentum on the AI front where we’ve accumulated a multibillion-dollar revenue run rate already,” CEO Andy Jassy told the analysts gathered for the earnings call.

“You’ve heard me talk about our approach before, and we continue to add capabilities to all three layers of the GenAI stack [starting] at the bottom layer, which is for developers and companies building models themselves. We see excitement about our offerings.”

The only clue Jassy was giving Wall Street about AI spend was when he was confronted twice about the company’s pattern in investing heavily in capital expenditures in one quarter and then prioritizing earnings and profit in the next. It was clear he wants to have it both ways.

“You have seen a pendulum shift sometimes between profitability and investment,” he said. “I think we’re at the stage now where we’re doing both at the same time continually. So we are more apt to talk about the specific investments that we’re making and how that might impact our short-term outlook.”

Jassy also covered other business segments, particularly in advertising and AWS. He emphasized the ongoing opportunities to enhance cost structures, especially in retail operations. He was bullish on the growth prospects for AWS, noting its $200 billion revenue run rate and its small share — just over 5% — of the global IT spend that remains largely on-premises. He expressed confidence that this proportion will eventually shift in favor of cloud computing.

He placed GenAI within that context, likening its impact to that of the cloud and even the internet. He elaborated that unlike the transition from on-premises to cloud, which requires substantial effort, generative AI workloads designed for the cloud could redefine user experiences from the ground up, marking a significant shift and opening up further opportunities for growth and innovation.