HSBC On The Next Phase Of Treasury APIs

Business to business (B2B) application programming interfaces (APIs) are helping smooth the flow of data between companies, including businesses and their financial services software as well as between banks and their corporate clients. The value of the technology is evidenced by the vast number of APIs that businesses use and consume. Companies each made an average of 363 APIs available publicly in 2018, for example.

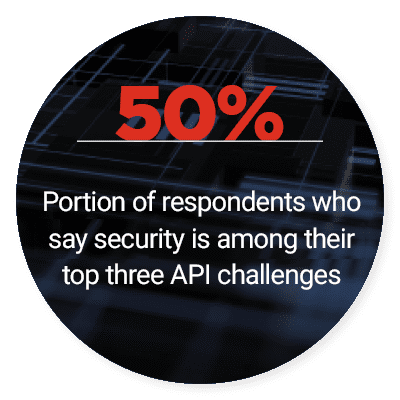

APIs can become major targets for hackers and fraudsters, however, and businesses need to step up their API security in response. The March “B2B API Tracker®,” explores how B2B APIs are improving services and what it takes to keep the technology safe from bad actors.

B2B APIs are helping businesses better serve the consumer and corporate clients. Banking services and money transfer app Revolut recently partnered with an open banking API provider to provide new services to account holders, for example. The collaboration enables Revolut customers to view data about all their different banks and bank accounts all in one spot in the app, thus supporting easier financial management.

Another new integration connects those seeking home loans with more personalized information. Australian financial institution (FI) Bankwest created an API to enable it to link up with home loan platform Lendi. This connection enables the lending platform to draw on bank customer information that lets it present consumers with more customized loan offerings. Lendi also provides personalized evaluations about the would-be borrowers’ likelihoods of being approved for the various loans.

Other banking integrations seek to revamp B2B payments. Singapore-based bank DBS is offering an API-powered payment service that lets companies scan QR codes on invoices to then immediately pay suppliers via the city-state’s near-real-time payments rail. This rapid, digital payment method is expected to move B2B payments away from reliance on bank transfers and cash, accelerating the speed of transactions.

For more on these and all the rest of the latest B2B API headlines, download the Tracker.

How Banking APIs Help Businesses Pay Faster, Invest Better

How Banking APIs Help Businesses Pay Faster, Invest Better

Middle-market companies are increasingly joining larger enterprise counterparts in demanding their banks provide them with treasury APIs. These solutions are enabling businesses of all sizes to access faster payments and real-time account status information, thus improving cash management. Even those helpful supports are far from all the benefits that banking APIs can unlock for users, according to Diane S. Reyes, global head of liquidity and cash management for HSBC, and Nadya Hijazi, the FI’s head of eCommerce for global payments and cash management and global trade and receivables finance.

In this month’s Feature Story, Reyes and Hijazi explain how the next stage of banking APIs could lead the way to thwarting faster payments fraud and proactively alerting clients about new investment opportunities.

Read the full story in the Tracker.

Deep Dive: Confronting APIs’ Authentication, DDoS Security Threats

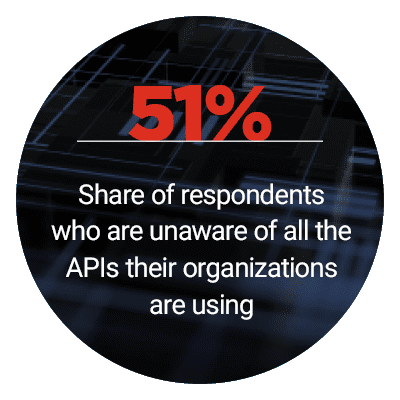

Businesses are flocking to API s. They use them internally to improve communications among systems, provide them externally to third parties and leverage outside APIs to access more capabilities. Fraudsters are also eager to access the data these APIs can provide, however, and companies need to step up their security measures accordingly.

s. They use them internally to improve communications among systems, provide them externally to third parties and leverage outside APIs to access more capabilities. Fraudsters are also eager to access the data these APIs can provide, however, and companies need to step up their security measures accordingly.

Too many businesses lack comprehensive monitoring of all the APIs they offer or of suspicious activities being conducted with those APIs, for example. Businesses must be able to detect unauthorized access, distributed denial of service (DDoS) attacks and other key forms of attack. This month’s Deep Dive examines top fraud attempts leveraged against business APIs and strategies for defending against them.

To get the full scoop, download the Tracker.

About the Tracker

The “B2B API Tracker®,” powered by Red Hat, serves as a monthly framework for the space, providing coverage of the most recent news and trends across the B2B API ecosystem.