On Monday (Sept. 18), Bank of America announced that it is giving its virtual service adviser CashPro Chat an AI-centered upgrade. The upgraded CashPro Chat now features the same AI technology as Erica, the bank’s virtual financial assistant, and will enable business clients to quickly access information about their accounts and transactions, and easily navigate CashPro functionality.

Bank of America’s move to upgrade CashPro Chat reflects the industrywide adoption of AI in banking. AI assistants are no longer limited to answering frequently asked questions; they are becoming personalized tools that enhance customer experiences and provide fraud protection.

Major players like Morgan Stanley have also embraced the trend and announced similar moves. On Monday (Sept. 18), the FI said it will launch an AI-powered assistant for financial advisers and their support staff, developed in collaboration with OpenAI’s GPT-4.

This bespoke solution provides financial advisers with quick access to the bank’s extensive database of research reports and documents, as well as addresses queries related to markets, recommendations and internal processes.

The AI assistant is just the beginning of the bank’s plans for generative AI solutions. Another tool called Debrief is being piloted; it automatically summarizes client meetings and generates follow-up emails. It is an indication that these AI-powered tools have the potential to significantly enhance productivity and streamline workflows within financial institutions.

Advertisement: Scroll to Continue

Consumer Sentiments on Workplace AI

Consumers have mixed sentiments about the impact of AI on their work and daily lives. While some worry about the loss of human interaction and privacy breaches, others see the benefits of increased productivity and efficiency.

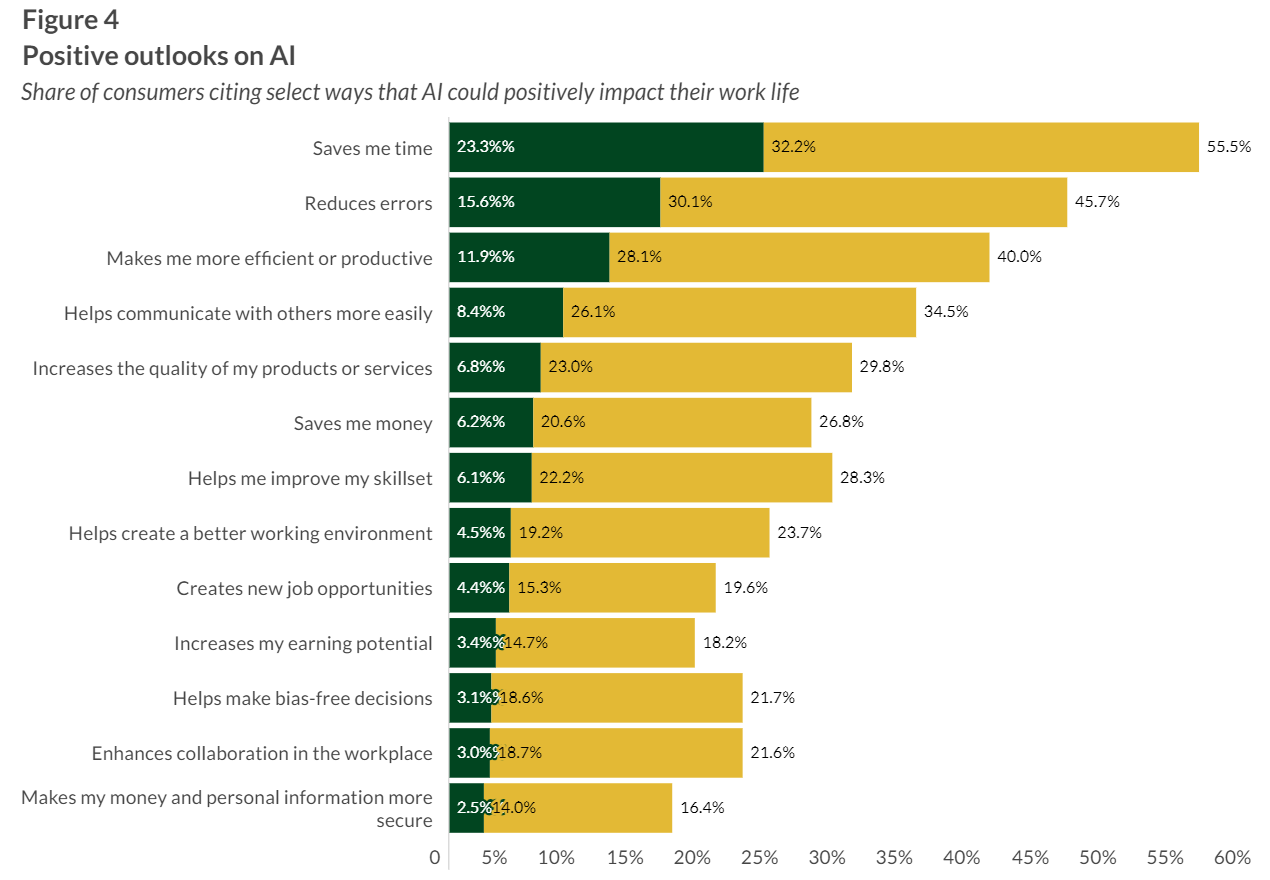

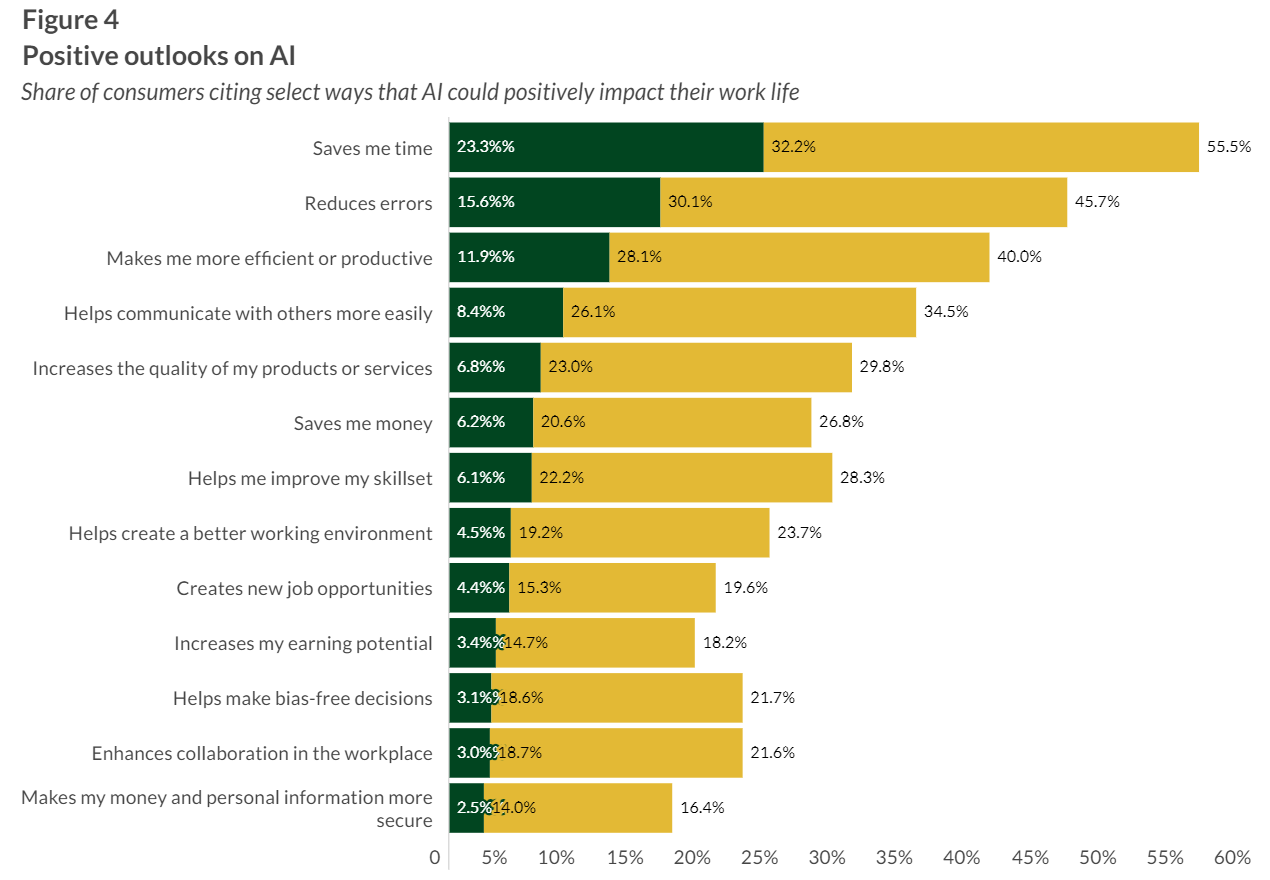

Take the workplace for example. While work is the area where consumers show the least interest in AI involvement, consumers also recognize the positive influence the technology can have on their work-life, including enhancing productivity, improving accuracy and communication among colleagues.

According to PYMNTS Intelligence research, 56% of those who have a positive view of AI’s potential impact on their work-life stating that it will help them be more efficient, freeing up valuable time for employees to focus on more strategic and creative aspects of their work.

Additionally, nearly half of consumers (46%) said leveraging advanced AI algorithms and machine learning capabilities can improve accuracy in the workplace, given their ability to analyze vast amounts of data with precision and make data-driven decisions. This not only leads to more accurate outcomes but also minimizes the risk of human error.

AI’s impact on work-life extends beyond time savings and accuracy improvements. The study reveals that 35% of consumers who see AI’s potential impact in a positive light believe that it can help them communicate with others more easily. AI-powered chatbots and virtual assistants provide instant responses to queries, enabling employees to access information and collaborate seamlessly. This enhanced communication fosters teamwork, improves efficiency, and contributes to a more productive work environment.

Overall, the adoption of AI assistants by financial institutions like Morgan Stanley and Bank of America signifies a step toward embracing innovation in the finance industry. These AI-powered tools are poised to enhance efficiency, improve client interactions, and empower finance teams to focus on higher-value activities despite varying consumer sentiments about AI’s potential in the workplace.