Most CFOs working on behalf of organizations earning at least $1 billion annually use multiple systems to manage their source-to-pay cycles, and nearly 60% of firms earning between $10 billion and $20 billion each year rely on at least five accounts payable (AP) systems.

Why does this matter? Because multiple systems can mean multiple points of vulnerability. Each system represents a door to potential interoperability or incompatibility problems that can ultimately cause AP processes to grind to a halt.

And that is exactly what is happening. As PYMNTS Intelligence revealed in “60 CFOs Can’t Be Wrong … AI Can Help Accounts Payable” — a report based on surveys with 60 chief financial officers representing U.S. companies that generate more than $1 billion annually — nearly two-thirds of the CFOs surveyed say that their companies were impacted by a source-to-pay cycle interruptions in the past year, and, as a result, the CFOs experienced payment execution and authorization delays.

Meanwhile, data also shows that only 17% of enterprise firms run their source-to-pay cycle largely free of human involvement, meaning the remaining 83% rely on manual processes rather than and may benefit from an automated, single-source AP system.

Inefficiencies such as these — multiple AP systems, manual processes — are likely the reason CFOs are increasingly embracing artificial intelligence (AI) to streamline their processes. Granted, some CFOs appear to be slower to implement AI depending on their past experiences with automation, which disfavors those with a larger number of systems in their AP processes. Among those CFOs who say that accessing AI for source-to-pay systems was not at all or slightly important to them, they all have two or more different AP systems.

But overall, most CFOs surveyed — 78% — say their access to AI technology is very or extremely important. Only 5% say the AI automation they are now using to support their AP cycle is not at all or only slightly important.

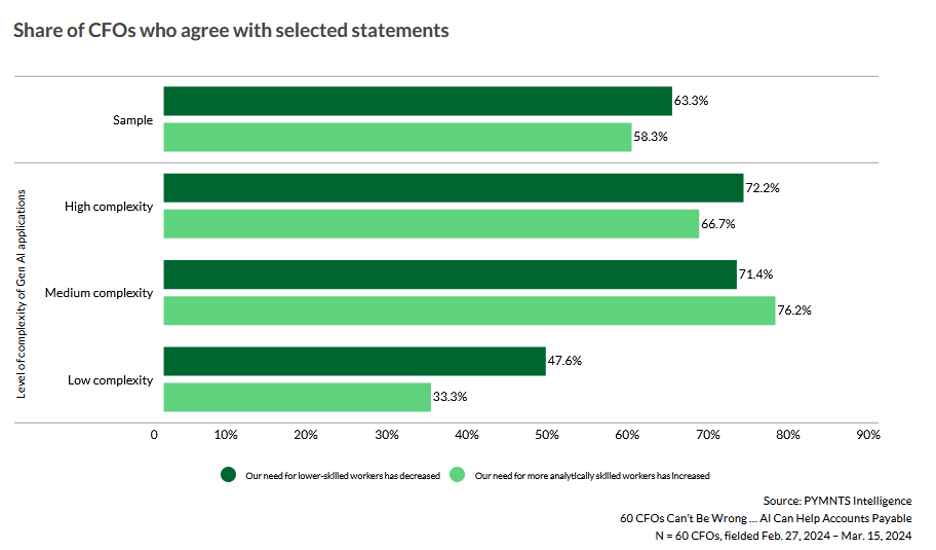

But AI is not only proving to be a preferred way for CFOs to manage their AP desks. Exclusive data that was not included in the report revealed that CFOs were deploying AI to improve a multitude of efficiencies across their organizations. As the figure above illustrates, 63% of CFOs say AI has reduced their need for lower-skill workers; however, the new technology may also require new skill sets. Fifty-eight percent of CFOs told us they need more analytically skilled employees.

As the figure below shows, personal needs vary depending on the complexity of the AI applications in use. Seventy-two percent of those with highly complex needs say their need for lower-skilled workers has dropped, while 76% of those using AI applications with medium complexities have had to increase their lower-skilled worker headcounts.

Despite the number of organizations already using AI, we are still on the front end of the AI revolution. The numbers findings from our report represent an early dispatch from that revolution. As applications for AI mature, the needs of all companies, large and small, will continue to evolve. However, one thing is clear: we are beginning to see the potential of AI.