It’s no surprise that GenAI is rapidly reshaping the landscape of customer service in the banking and payments industry. By automating repetitive tasks, improving personalization and enabling real-time support, the technology is becoming a cornerstone of customer engagement strategies.

However, its adoption is not without challenges, particularly around demonstrating a clear return on investment (ROI). Here are three key insights from recent research into how Chief Marketing Officers (CMOs) are leveraging generative AI to transform customer service.

One of generative AI’s most effective applications is assisting employees and customers in accessing information quickly and efficiently. According to recent PYMNTS Intelligence data, 97% of CMOs in July found the technology highly effective for this purpose, up from 72% in April. The data can be found in the PYMNTS Intelligence report, “AI in the Chat: Generative AI’s Growing Role in Customer Service.”

This surge underscores how GenAI is optimizing customer service workflows rather than replacing human agents. Automated tools powered by generative AI handle routine queries and requests, freeing customer service teams to focus on complex issues requiring a human touch. This balance has proven particularly advantageous in the payments sector, where fast, accurate responses are crucial to maintaining customer trust.

Generative AI is also playing a pivotal role in delivering real-time, automated responses to customer queries. However, its effectiveness lies in its collaborative potential. For instance, an AI-driven chatbot might handle initial troubleshooting before escalating unresolved issues to a human representative. By acting as a first line of defense, these systems reduce wait times and improve overall customer satisfaction while keeping human expertise in the loop.

Personalization has emerged as another critical area where generative AI excels. The ability to craft highly contextualized emails and recommendations is revolutionizing how companies interact with customers. In July, 94% of CMOs reported that AI was highly effective in this use case, a significant jump from 75% in April.

In the banking and payments industries, personalization extends beyond marketing emails to include tailored product offerings and proactive fraud prevention measures. For example, generative AI can analyze customer transaction data to recommend relevant financial products, such as credit cards with cashback features aligned to spending habits or investment opportunities matching risk profiles. Similarly, personalized fraud alerts—generated by AI analyzing transactional anomalies—enhance customer security and trust.

The growing use of AI to improve customer engagement reflects a broader industry trend toward delivering seamless, meaningful experiences. However, achieving these results requires significant investment in data integration and machine learning models capable of contextual analysis. These initiatives can be resource-intensive but are increasingly viewed as essential for staying competitive in a crowded market.

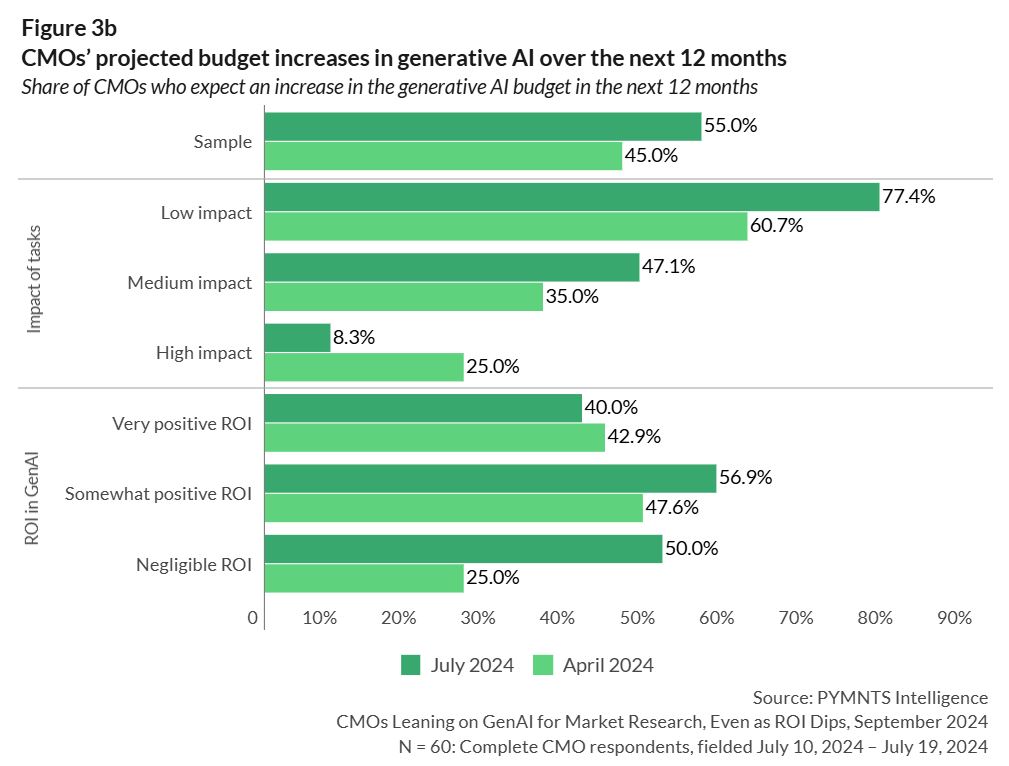

Despite a declining ROI, CMOs are doubling down on generative AI investments, signaling a shift in how they perceive the technology’s value. In July, 55% of CMOs reported plans to increase their generative AI budgets, up from 45% in April. Notably, only 8.3% of companies saw a positive ROI during the same period, a sharp decline from 23% in April.

This paradox reflects a strategic pivot: CMOs no longer see generative AI as a short-term revenue generator but as a foundational technology for long-term customer service innovation. For example, its ability to perform market research and provide insights into customer preferences has seen a 24% increase in adoption. These capabilities are invaluable in refining product strategies and anticipating customer needs.

In the payments and banking sector, this forward-looking approach aligns with broader digital transformation goals. Institutions are not merely deploying generative AI to address immediate challenges but are integrating it into their core infrastructure to future-proof their customer service operations. This strategic perspective positions generative AI as an enabler of sustained growth and competitive advantage, even if its financial benefits remain elusive in the near term.

As generative AI continues to mature, its applications in customer service will likely expand. Innovations in natural language processing and predictive analytics promise even greater levels of efficiency and personalization. However, organizations must address key hurdles, including ethical concerns, data privacy and the need for skilled personnel to oversee AI systems.

For financial institutions, the stakes are high. Customers expect fast, accurate and personalized service, and those who fail to deliver risk losing their competitive edge. GenAI offers a powerful tool to meet these customer service demands, but its successful implementation requires a thoughtful, long-term strategy.