Deep Dive: How Banks Can Solve Authentication Woes New Digital Customers Face

Online banking’s popularity has peaked over the past year, and a recent survey found that 80 percent of consumers prefer to handle their finances using digital channels rather than in person. This shift toward digital services is expected to grow even after bank branches return to full capacity, indicating that it is not just a passing fad. This trend is particularly notable among Generation Z consumers, 37 percent of whom prefer to use their phones to open deposit accounts.

Consumers’ desire for digital banking is currently going unmet by most financial institutions (FIs), however, with only 45 percent of those in the U.S. and the U.K. offering some form of digital account opening. Even the FIs that do offer this capability find that their customers face several onboarding challenges, including tedious application approval processes and excessive costs.

The following Deep Dive explores how these obstacles result in customer attrition and abandonment and details how banks are deploying biometrics and identity document scanning functionalities to make onboarding as seamless and secure as possible.

Onboarding Frictions And Obstacles

Customer onboarding processes are notorious for being cumbersome and frustrating, with many consumers giving up on the process entirely before they even open an account. This problem has grown more acute as digital banking grows in popularity and customers are offered a plethora of banking options. Thirty-eight percent of Europeans said they abandoned a digital bank application in 2019, for example, but this number swelled to 63 percent last year.

Customer onboarding frictions largely stem from regulatory checks that banks must conduct for applicants to ensure that they are not using their bank accounts for money laundering, fraud or other cybercrimes. These routine know your customer (KYC) checks require FIs to gather and authenticate users’ personal identity details, financial statuses and addresses, as well as more detailed information like credit checks, information requests and other data that often involves brick-and-mortar bank visits and reams of paperwork.

These checks can take days or even weeks to complete, whereas customers’ onboarding experiences with other apps or websites can often be completed in minutes or seconds. These onboarding processes can also result in massive expenses for the banks conducting them, as FIs spend more than half a billion dollars annually on KYC procedures. Even more revenue is lost due to customer abandonment, with banks reporting that this could cost them up to €150 million ($168.9 million) annually over the next five years in lost customer opportunities.

New technologies could simplify these onboarding processes, however, increasing customer satisfaction and potentially reducing churn. Biometrics and identity document scans have thus far shown the most promise in this regard, and they are popular among bank customers.

Simplifying And Streamlining Onboarding

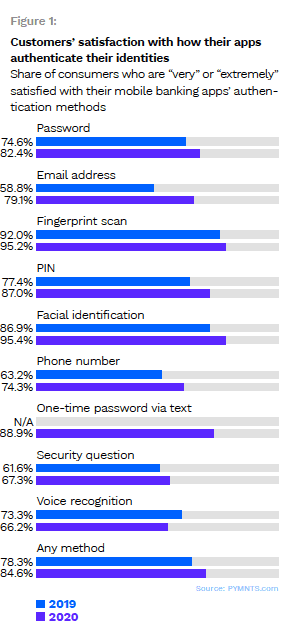

Biometrics come in many forms, ranging from behavioral analytics-based methods, like typing patterns, to options based on physical traits, such as voice recognition, facial recognition or fingerprint scans. All three of these physical methods are popular among bank customers, according to research from PYMNTS, with 66 percent of customers being “very” or “extremely” satisfied with voice recognition and 95 percent approving of facial recognition and fingerprint scans.

Biometrics are also being utilized more for individual payments in the form of credit cards with built-in fingerprint scanners to verify purchases. More than half of all customers said they would switch banks to obtain these cards, and 66 percent of those 18 to 35 years old said they would be interested in doing the same. Another 43 percent would be willing to pay extra for this ability.

Document identity scans can also accelerate onboarding processes, enabling customers to take pictures of their government-issued driver’s licenses, Social Security cards or other documents and submit them to artificial intelligence (AI)-powered systems for analysis. These systems then cross-reference IDs and their details with those stored in national databases to ensure their authenticity, providing a much faster alternative to visiting bank branches for manual inspections. These options are becoming particularly handy for FIs, considering the digital shifts at work in the banking space: 49 percent of Americans say they would be happy never to set foot in a bank branch again.

Digital methods are the way of the future for the financial industry, and banks looking to grow during this shift will need to ensure that their onboarding procedures can be performed digitally as well. The minority of banks that currently offer these solutions are well-positioned to dominate the industry for years to come, making the prospect of joining their ranks particularly appealing for FIs of all sizes.