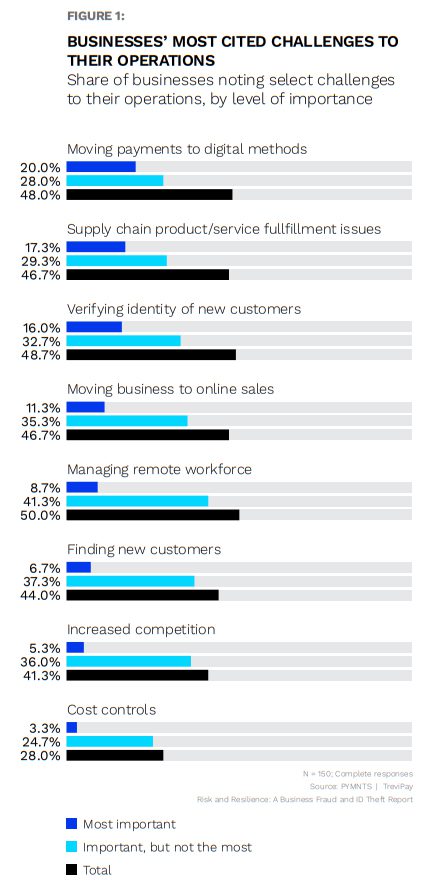

Forty-nine percent of businesses face challenges when it comes to verifying the identities of new customers. That makes it one of their most-cited challenges, second only to managing a remote workforce, according to “Risk And Resilience,” a PYMNTS and TreviPay collaboration based on a survey of 150 executives at companies with $10 million to $1 billion in annual revenues.

Get the report: Risk And Resilience: A Business Fraud And ID Theft Report

Sixteen percent of businesses say verifying the identities of new customers is the most important challenge to their operations, and another 33% say it’s important, but not the most important.

To help verify new customers’ identities, businesses use a variety of tools and methodologies, both automated and manual.

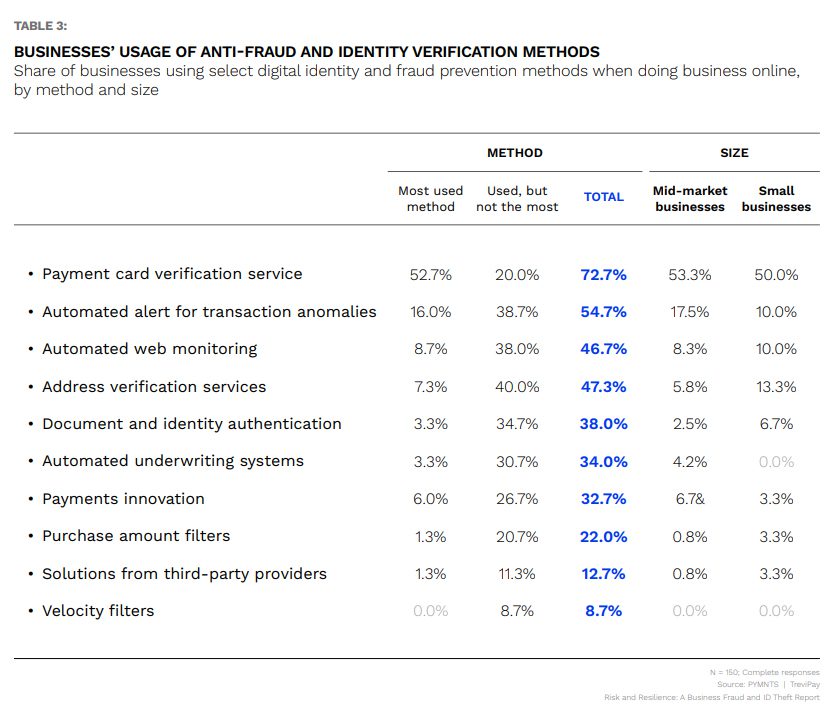

Seventy-three percent of businesses use a common method of identity authentication — payment card verification — as an anti-fraud measure when doing business online.

Other common tools and methods include automated alert for transaction anomalies (cited by 55%), automated web monitoring (47%), address verification services (47%), document and identity authentication (38%) and automated underwriting systems (34%).

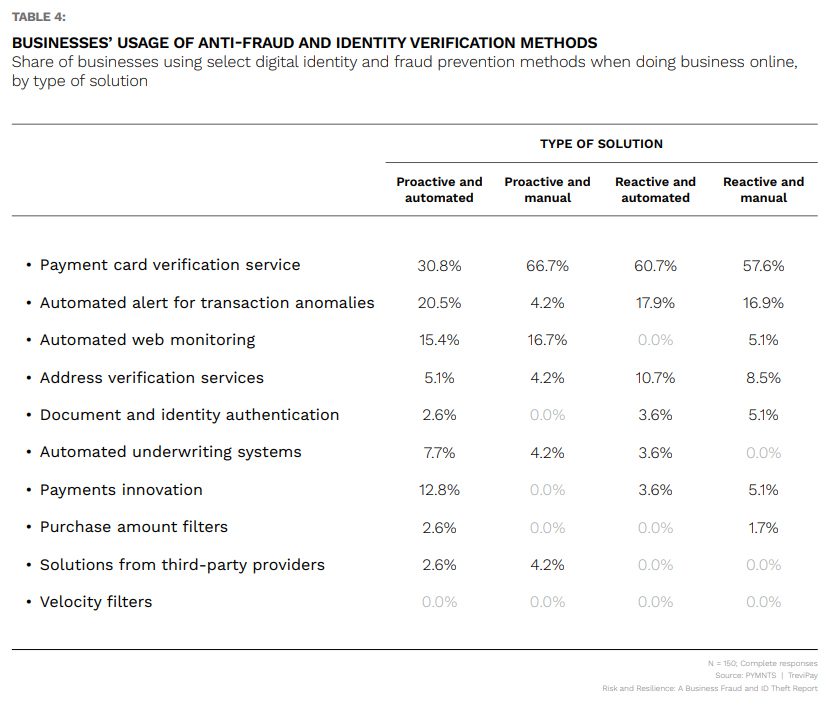

Organizations using proactive and automated anti-fraud methods were the most likely to consider all available anti-fraud methods as equally important to their security against fraud.

How organizations feel about their approaches to combating fraud is indicative of how they evaluate their current methods’ success and the urgency of their need to address fraud.

At a time when the industry is defined by uncertainty, sustainable growth is imperative for businesses — and fraud has exacted a significant toll on the viability of many.