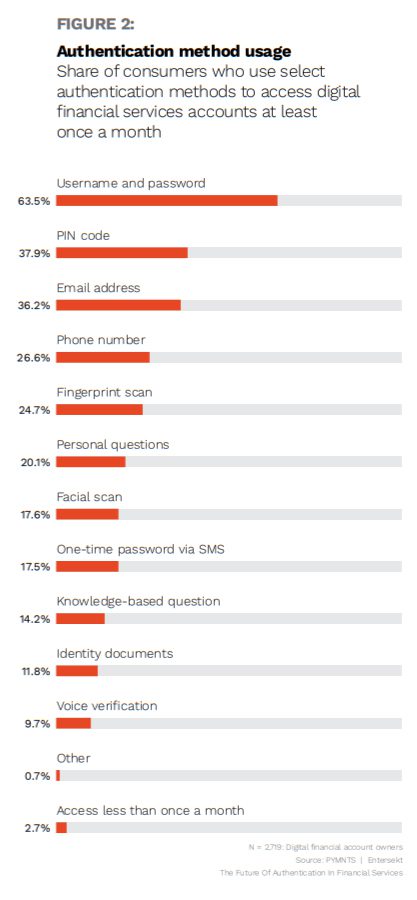

In fact, 64% of consumers still use username and password combinations to access their digital financial services accounts at least once a month, according to “The Future Of Authentication In Financial Services,” a PYMNTS and Entersekt collaboration that analyzes responses from 2,719 consumers.

Get the report: The Future Of Authentication in Financial Services: Using Authentication To Build Trust

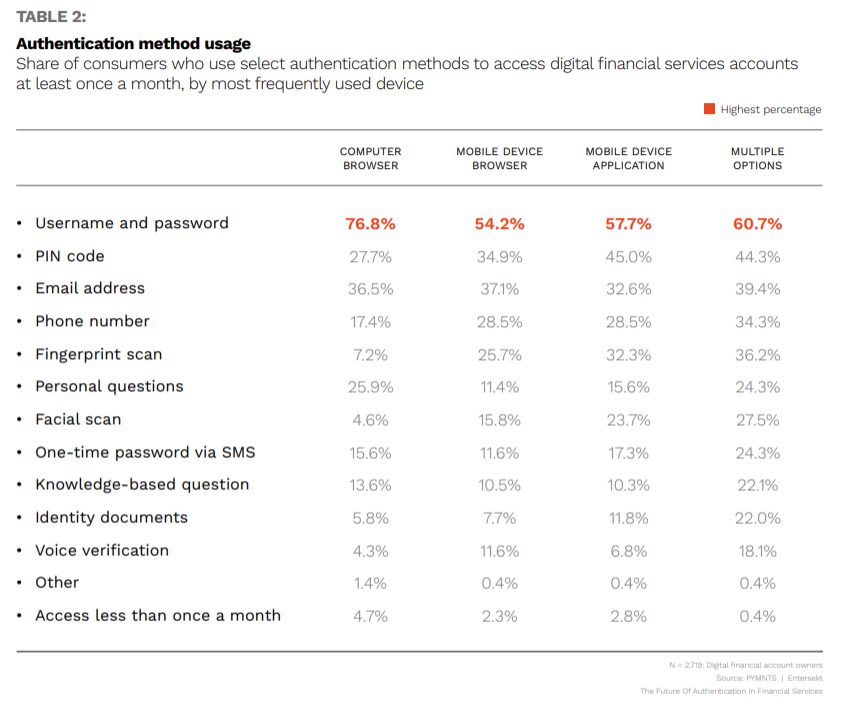

Consumers use several other authentication methods as well. Just over one-third of consumers use a PIN code or an email address to access digital financial services accounts at least once a month, about one-quarter use or phone number or a fingerprint scan and about one-fifth use personal questions.

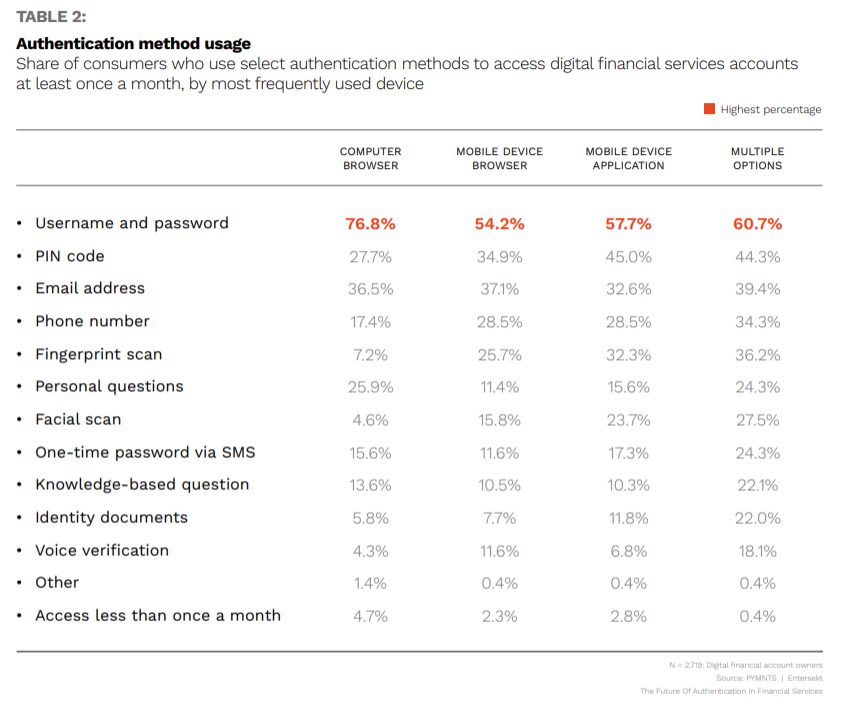

Username and password is the most commonly used authentication method on all devices and channels. It’s used by 77% of consumers who most frequently use a computer browser, 61% of those who use multiple platforms, 58% of those who use a mobile device application and 54% of consumers who use a mobile device browser.

Users of mobile device browsers and mobile devices apps are more likely than users of computer browsers to use biometrics such as fingerprint scans, facial scans and voice verification. Mobile app users in particular are more likely to use fingerprint scans and facial scans. This is not surprising, as many mobile apps are designed with easy-to-use interfaces that take advantage of the video and touch sensors that come standard with most smartphones.

Advertisement: Scroll to Continue

Despite the widespread use of passwords, most consumers are comfortable with the idea of ditching them. PYMNTS’ data indicates that 61% of consumers are willing to use non-password login methods and 45% are very comfortable with security using non-password login methods. What’s more, 47% believe that passwords will eventually no longer be used.