PYMNTS Intelligence: How Robust Identity Authentication Can Help FinTechs Meet Growing Cybersecurity Challenges

Today’s consumers are tapping nontraditional banking and payment solutions more often, turning to neobanks or alternative payment solutions such as mobile wallets to conduct many of their routine transactions.

Buy now, pay later (BNPL) alternatives have become the fastest-growing eCommerce payment method, for example, with PayPal reporting a 400% year-over-year jump in users of its BNPL solution during the Black Friday and Cyber Monday sales period in 2021. Research also points to rising use of digital-only banks, including online bank Chime, which now boasts more than 13 million United States customers, up from 7 million at the start of 2020.

These emerging solutions can offer users convenience and speed, resulting in greater customer engagement and satisfaction, but their advantages can hide cybersecurity gaps that make them attractive targets for bad actors. The boom in BNPL use, for example, coincides with a 66% surge in BNPL fraud between 2020 and 2021.

A lack of proper security or data privacy standards can ultimately erode trust and lead to customer dissatisfaction and abandonment, making it essential for alternative payment providers to upgrade their fraud protection measures accordingly. This month, PYMNTS scrutinizes the security weaknesses plaguing alternative payment methods and examines how adopting innovative and robust identity authentication solutions can help payment providers protect against increasing cybersecurity threats and fraud.

Alternative Payments and Growing Security Concerns

More and more consumers rely on digital channels for everything from banking to entertainment, and fraudsters are dogging their steps. According to one study, U.S. data breaches rose 38% from the first quarter of 2021 to Q2 2021. Quarter over quarter, phishing and ransomware attacks remain the top two sources of stolen personal details, such as emails, passwords or usernames. These breaches feed the growing problem of account takeover (ATO) attacks, in which fraudsters use stolen credentials to mimic legitimate customers.

Despite having reputations as savvy innovators, many emerging and alternative payment services show security lapses. One report found that FinTechs such as neobanks and robo-advisers have an average fraud rate of approximately 0.30% on their platforms — nearly double the average 0.15% to 0.20% reported for traditional credit cards and triple the average of less than 0.10% for debit cards.

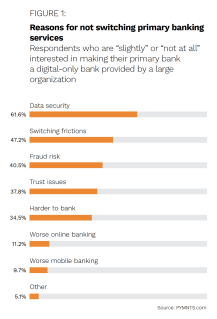

Alternative payment methods such as BNPL and cryptocurrency are also seeing higher levels of fraud as their solutions become more popular, leading to an erosion of consumer trust in fledgling services. A September PYMNTS report found that 25% of consumers cited data security concerns as the main reason for not using a digital or virtual-only financial institution (FI). Forty-seven percent named data security worries as their top deterrent to switching to digital-only entities provided by large-scale financial organizations.

Concerns regarding fraud are especially critical for digital-first entities, as legacy authentication methods remain prevalent even as they are proving less and less viable in protecting customers against breaches. PYMNTS data showed that most consumers still prefer to use either credentials or static usernames and passwords to access their online accounts, despite rising security concerns. The research also showed that most consumers are open to using more secure, modern verification solutions, including two-factor authentication (2FA) and biometrics, offering FinTechs a pivotal opportunity to recoup and keep consumers’ trust.

Identity authentication solutions that tap new technologies such as artificial intelligence (AI) or machine learning (ML) offer payment providers and merchants ways to keep their platforms secure while maintaining the seamless, personalized experiences their customers seek. Geolocation or biometric identifiers can help verify consumers’ identities without adding unnecessary customer frictions. They also enable providers to rely less heavily on credit data to verify new users, a must for BNPL or mobile wallet providers with user bases that may include customers with limited credit histories.

Alternative payment providers have ridden the crest of the pandemic wave to become formidable players in the payments market, but one too many security shortcomings could topple their success. Providers and merchants looking to maintain longtime user loyalty should swiftly adopt cutting-edge authentication measures to oust fraudsters and keep their digital-first users transacting smoothly and securely.