REPORT: Two-Thirds of US Digital Banking Customers Choose Security Over Convenience

As life becomes more digitally connected, consumers increasingly expect that all online transactions will be highly secure, simple and convenient. This standard is especially strong among consumers who use digital banking to access their accounts across multiple digital platforms, including mobile apps and mobile- and desktop-based browsers.

As life becomes more digitally connected, consumers increasingly expect that all online transactions will be highly secure, simple and convenient. This standard is especially strong among consumers who use digital banking to access their accounts across multiple digital platforms, including mobile apps and mobile- and desktop-based browsers.

Our research found that feeling secure while transacting online is a key  driver of consumers’ trust in financial services providers, as is a consistent user experience across different platforms. When push comes to shove, most consumers value security over ease of use and convenience. Providers may not need to choose between one or the other, however: By moving away from passwords and toward stronger authentication methods, financial services providers can support secure logins and transactions while also simplifying the consumer experience.

driver of consumers’ trust in financial services providers, as is a consistent user experience across different platforms. When push comes to shove, most consumers value security over ease of use and convenience. Providers may not need to choose between one or the other, however: By moving away from passwords and toward stronger authentication methods, financial services providers can support secure logins and transactions while also simplifying the consumer experience.

The Future Of Authentication In Financial Services: Finding the Balance Between Security and Convenience, a PYMNTS and Entersekt collaboration, examines consumers’ expectations that their financial experiences will be highly secure across a range of digital channels and devices. We surveyed 2,719 consumers between Sept. 10, 2021, and Sept. 27, 2021, to learn more about how these expectations vary across different type of accounts and how balancing convenience and security impacts consumers’ trust in their financial providers.

More key findings from the study include:

• More than half of consumers consider data security “extremely” important when sharing personal data online. Most consumers say their private data is valuable to entities other than their financial institutions (FIs). The security of personal data when transacting online is “extremely” important for 52% of respondents, while another 28% find it “very” important. Nearly four-fifths of consumers say their personal data is valuable to at least one entity other than their FIs, with 24% saying their personal data is valuable to all entity types.

half of consumers consider data security “extremely” important when sharing personal data online. Most consumers say their private data is valuable to entities other than their financial institutions (FIs). The security of personal data when transacting online is “extremely” important for 52% of respondents, while another 28% find it “very” important. Nearly four-fifths of consumers say their personal data is valuable to at least one entity other than their FIs, with 24% saying their personal data is valuable to all entity types.

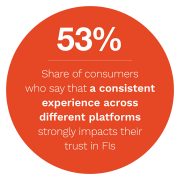

• Security and a good user experience are highly influential in building consumer trust in financial providers. Consistency across different platforms is also critical to most consumers’ trust. Security is “highly” important for 83% of respondents, and a good user experience is “highly” important for 80%. We also found that 53% of consumers say consistent experiences across different platforms have a “very” big or “extremely” big impact on their trust in FIs. This share is higher among consumers who access their accounts mostly using mobile apps or through multiple environments, at 60% and 58%, respectively.

• Six out of 10 consumers are willing to log in to their accounts with alternative authentication methods. While 61% of all consumers are willing to log in to their accounts with alternative authentication methods, 60% of those who use mobile apps, mobile browsers and computer browsers also say they would be “very” comfortable logging in using methods other than login IDs and passwords. This share rises to 73% for users who leverage multiple devices to access their accounts. Just under half of these users believe passwords will eventually be phased out as an authentication method.

• Six out of 10 consumers are willing to log in to their accounts with alternative authentication methods. While 61% of all consumers are willing to log in to their accounts with alternative authentication methods, 60% of those who use mobile apps, mobile browsers and computer browsers also say they would be “very” comfortable logging in using methods other than login IDs and passwords. This share rises to 73% for users who leverage multiple devices to access their accounts. Just under half of these users believe passwords will eventually be phased out as an authentication method.

To learn more about what consumers expect in terms of security and convenience in their financial experiences, download the report.