Half of Consumers Want More Security Measures From Banks

PYMNTS’ latest research finds that despite a general satisfaction with existing security measures financial institutions (FIs) use, half of all adult consumers feel their banks must take additional steps to protect their assets and personal information — especially for non-routine transactions. Banks tend to meet basic online security expectations but fail to deliver the security options and features their customers prefer.

Our study also reveals that nearly three times as many consumers now prefer to access their bank accounts using smartphones rather than computers, with security playing a pivotal role in this shift. While most consumers now view smartphones and computers as equally secure, many see biometric authentication measures, which smartphones tend to provide, as the most secure way to authenticate a transaction.

“Consumer Authentication Preferences for Online Banking and Transactions,” a PYMNTS and Entersekt collaboration, is based on a survey of 2,584 consumers that examined their authentication preferences for online financial transactions.

Key findings from the report include the following:

• Most consumers now believe smartphones and computers are equally secure for online financial activities.

While 57% of consumers view smartphones and computers as equally secure for online financial transactions, smartphones are becoming consumers’ preferred devices.  In the previous month, 71% of consumers used smartphones more frequently than other devices to send or receive money, and 63% did so to purchase goods and services online. Most consumers now trust using their smartphones to access bank accounts and pay bills, with 61% and 52% doing so, respectively.

In the previous month, 71% of consumers used smartphones more frequently than other devices to send or receive money, and 63% did so to purchase goods and services online. Most consumers now trust using their smartphones to access bank accounts and pay bills, with 61% and 52% doing so, respectively.

• Consumers view biometric tools as more secure than passwords for authenticating their transactions.

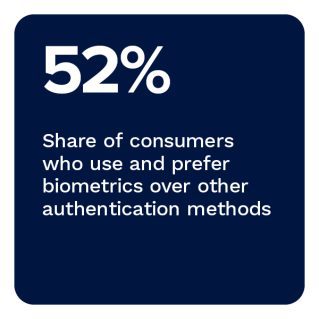

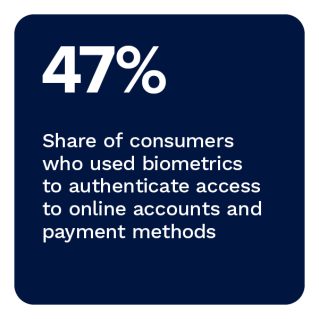

In the previous month, 47% of consumers used biometrics to authenticate access to online accounts and payment methods, while 65% used passwords. Although passwords are still the most commonly used security measure, 31% of consumers believe biometrics are more secure. Our data shows that 52% of consumers who use biometrics prefer this authentication method over other options, whereas just 25% of consumers who use passwords feel the same way.

• Most consumers are satisfied with their banks’ digital security measures, but half still believe that their FIs should do more.

While 83% of consumers trust their banks’ security measures, half believe their FIs should provide additional protection. Perhaps not surprisingly, this sentiment is particularly strong among consumers who are dissatisfied with the level of security offered by their banks: 66% of this subgroup strongly supports the implementation of additional security measures.

To learn more about the state of play for authenticating online financial transactions and what banks need to do to retain customers, download the report.