In today’s digital era, banking customers are asserting more control over their financial security and no longer relying solely on their banks to protect their identities and online transactions.

In “Consumer Behaviors and Perceived Security Across Devices,” PYMNTS Intelligence draws on insights gathered from a survey of over 2,5000 U.S. consumers to examine how their authentication and device preferences are linked to their perceptions of digital security when conducting online financial activities and transactions.

Findings from the research study done jointly by PYMNTS and Entersekt show that smartphones have become the device of choice for conducting online financial activities, particularly among younger generations, with 71% of Gen Z, 68% of millennials and 66% of bridge millennials favoring smartphones for online finance.

Even among Generation X, a majority (63%) prefer smartphones over computers more often than not. However, baby boomers and seniors still predominantly use computers for their online financial activities, with only 34% of this group opting for smartphones.

The study further reveals that while most consumers perceive both smartphones and computers equally safe for high-risk financial activities, trust in smartphones’ ability to provide greater security is growing. Nearly 60% believe both devices are equally secure for sending/receiving money and accessing bank accounts as well as accessing bank accounts. Yet, for bill payments or accessing bank accounts, there’s a slight preference for computers over smartphones among consumers.

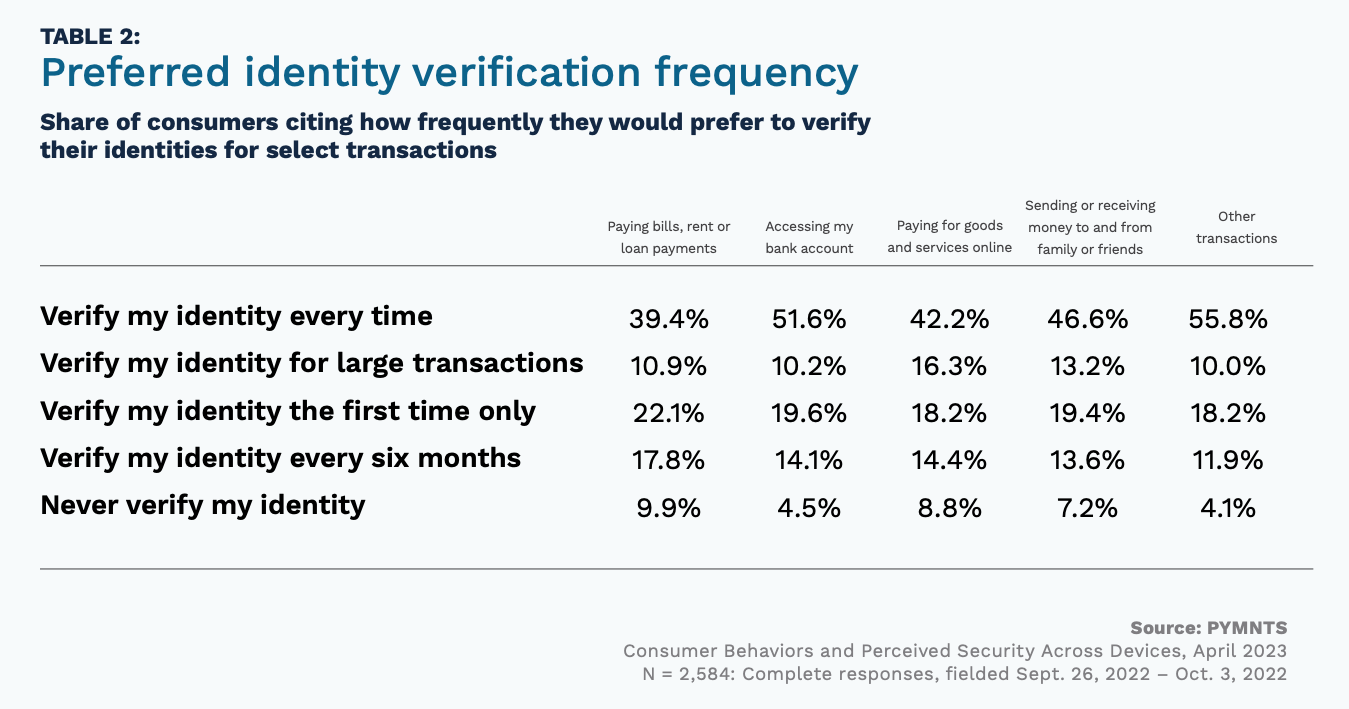

But despite trusting the security of their favored devices, approximately half of banking customers want to play an active role in verifying their identities for online financial transactions.

The study revealed that 52% and 47% of participants, respectively, want to manually authenticate their identities every time they log into their bank accounts or for money transfers to and from family and friends. “Even with the ubiquity of online transactions for goods and services, 42% of banking customers still prefer to authenticate their identities each time they finalize purchases,” the study noted.

Similarly, when it comes to everyday transactions like bill payments or low-risk purchases, over half of consumers opt for multi-factor authentication (MFA), while more than 80% want MFA when accessing a bank account from an unfamiliar device, modifying personal details in the account, or handling significant electronic money transfers.

To address these evolving needs and preferences of banking customers, financial institutions (FIs) must prioritize robust multi-channel authentication strategies, including offering MFA options for both routine and infrequent online transactions. FIs should also consider implementing authentication methods that align with consumers’ device preferences, as these preferences significantly influence their perceptions of digital security.

In summary, banking customers no longer want to be passive participants in their financial security and increasingly desire greater control over their identities and financial transactions. FIs must adapt to these changing preferences to enhance trust and empower customers in an increasingly digital financial landscape.