How Interoperability Is Fueling Blockchain Adoption

Nine in 10 of the world’s central banks are pursuing digital currency projects, but private sector expertise and buy-in will be pivotal to their success, Anish Jain, CEO of WadzPay, tells PYMNTS in the December edition of the “Blockchain Payments Tracker.”

Anish Jain, CEO of blockchain-based payment ecosystem WadzPay, tells PYMNTS how the marriage of blockchain innovation with established systems is giving rise to the next revolution in the payments industry.

—

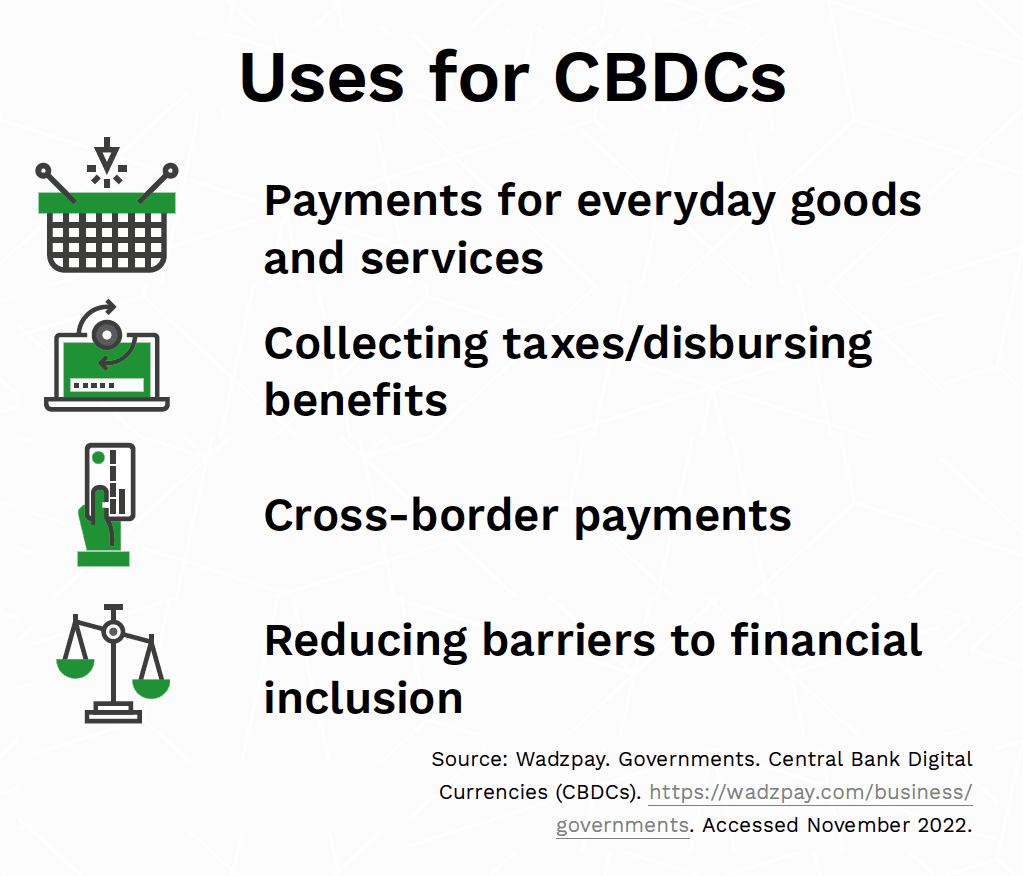

Innovation is best supported by a firm foundation in the traditional, according to Anish Jain, CEO of WadzPay. With more than 15 years’ experience at Mastercard and American Express, Jain recognized early on the potential for blockchain to revolutionize the payments industry by enabling faster payments, better security and a lower-cost alternative that reduces barriers to financial inclusion. Rome was not built in a day, however, so any revolutionary payments system must be interoperable with the current one.

Innovation is best supported by a firm foundation in the traditional, according to Anish Jain, CEO of WadzPay. With more than 15 years’ experience at Mastercard and American Express, Jain recognized early on the potential for blockchain to revolutionize the payments industry by enabling faster payments, better security and a lower-cost alternative that reduces barriers to financial inclusion. Rome was not built in a day, however, so any revolutionary payments system must be interoperable with the current one.

“We are trying to harness [blockchain’s benefits] in the technology that we are building,” he said. “What we are enabling at the same time is not shaking the entire boat or the entire payment ecosystem.”

Founded in 2018 in Singapore, WadzPay works with international payments processors and banks to enable digital and asset-based transaction processing and settlement. Interoperability is twofold, Jain explained. WadzPay connects to a bank’s mainframe ecosystem and becomes the default blockchain provider. This allows the financial institution (FI) to tap into any blockchain technology that currently exists or might emerge in the future. The other interoperability it enables is between blockchains. The WadzPay chain has the ability to jump between different blockchain protocols and process transactions based on a specific FI’s or customer’s needs.

“The beauty of the WadzPay ecosystem is it connects not just into one bank or one market. It’s a global system, which then gives access to different markets as well.”

That access is where WadzPay is gaining traction in multiple markets. Jain said that while central banks tend to mistrust private institutions, they are learning — fast. WadzPay is establishing its roots through a variety of programs with public institutions as well as commercial banks, payment service providers and large corporates, and the discussions have been encouraging. What is also helping is the emerging regulatory framework. Jain said that WadzPay is pro-regulations, and wherever regulations are emerging, they are helping to drive its business.

“We are getting regulated in certain markets through the central bank, which also then gives us a lot more credibility when working with public institutions,” he said. A state of “‘no regulation’ is always bad. It creates uncertainty [and] a sense of ‘We don’t know what we should do.’”

As a result of this cooperation, WadzPay’s presence is strong in Asia, which has taken a leading regulatory role in blockchain, as well as the Middle East and Africa. Already, Jain said, the landscape is changing.

“Last year, when we set up our Middle East operation, our early customers were like, ‘Why are you here?’” he said. “Because this is something very new. This is exotic. So, we were more of a ‘nice-to-have’ product that a financial institution might offer. But today, because the market has changed, we are becoming a must-have.”

Jain said one of the advantages of being the first mover in an industry is gaining perspective on how the market will move in times to come. Global adoption of blockchain is looking more and more possible.

“As a company, we are very relevant in the Middle East, in Africa and in Asia,” he said. “Our 2023 objective is to become relevant in the Western Hemisphere. Blockchain is a beautiful technology, and I would love to see it getting more adopted in the mainstream.”