PYMNTS Intelligence: The EU Takes the Regulatory Lead, With the US Following Closely

Blockchain is drawing government scrutiny worldwide as regulators seek to constrain fraudsters, limit its environmental impact and protect investors and enthusiasts from the technology’s potential drawbacks. The European Union and the United States are currently taking the lead in blockchain regulation, although other countries, such as China, have taken the simpler step of banning it entirely.

This relatively new technology will require a careful hand when it comes to regulation, however. Overly onerous restrictions could constrain its potential economic benefits, while a laissez-faire approach could enable fraud, money laundering and worse. This month, PYMNTS examines how the U.S. and the EU are threading this needle in their current and developing blockchain regulations.

U.S. executive action is kicking blockchain regulation into high gear.

Until now, cryptocurrency supervision was primarily based on the Securities and Exchange Commission’s (SEC’s) interpretation and enforcement of the Securities Act of 1933, the Securities Exchange Act of 1934 and the Investment Company Act and Investment Advisers Act of 1940. In most cases, cryptocurrencies have been considered securities, and cryptocurrency exchanges and issuers are required to register and disclose market activities to federal regulators in the same manner as other investments under the SEC’s oversight.

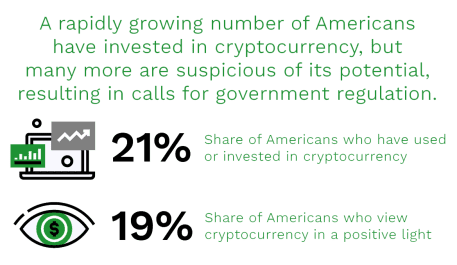

The President Joe Biden administration is looking into further cryptocurrency regulation, but the most pressing question is the clarification of whether cryptocurrencies should be defined as securities or commodities. Classifying them as securities would continue their current jurisdiction under the SEC, but a new congressional bill would change their classification to commodities, placing crypto under the control of the Commodity Futures Trading Commission (CFTC) instead. Both the SEC and the CFTC heads acknowledged, however, that not all cryptocurrencies are equal, and a case-by-case analysis may be needed.

Placing cryptocurrency oversight under CFTC control would be a game-changer, as industry players see the agency as a more crypto-friendly regulator than the SEC and more willing to issue new regulations. Still, if the CFTC were to obtain new powers to regulate crypto, it would likely assess new fees on crypto industry players to pay for the enforcement of new regulations, as the agency is much smaller than the SEC.

The EU is focusing on the blockchain’s environmental concerns.

The European Parliament Committee on Economic and Monetary Affairs recently endorsed the Markets in Crypto-Assets regulation, which requires crypto-asset service providers to disclose their total energy consumption. While it does not specifically mandate that cryptocurrency companies reduce their carbon footprints, the hope is that these providers will voluntarily become more energy-efficient under public pressure.

This energy-focused regulation follows initiatives in other parts of the world to limit cryptocurrency mining due to environmental concerns. China, for example, banned cryptocurrency transactions entirely, and the state of New York passed a cryptocurrency mining moratorium and began a study on the damage of proof-of-work (PoW) mining. Some cryptocurrencies, such as Ethereum, are already shifting to a proof-of-stake (PoS) technique to reduce these damages.