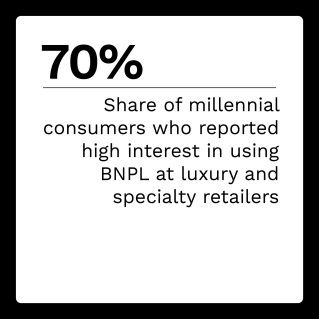

Buy now, pay later (BNPL) services are becoming popular in Australia, the United Kingdom, the United States and other countries around the world. BNPL usage varies significantly across different age groups, however. PYMNTS’ research found that 70% of U.S. millennials, 66% of bridge millennials and 65% of Generation Z consumers reported high interest in using BNPL at luxury and specialty retailers, but less than half of Generation X and less than one-quarter of baby boomers and seniors said the same. Nevertheless, older and higher-income demographics are some of the fastest-growing users of BNPL. Seventy-one percent of BNPL users with annual incomes greater than $100,000 increased their usage of BNPL in the past year, outstripping the rates for all lower income brackets.

BNPL appeals to older, more affluent demographics on several levels. Forty-three percent of financially “worry-free” individuals say that BNPL programs help them improve their credit scores, and 40% are drawn to BNPL’s lower interest rates compared to traditional credit options. Another 55% say BNPL is much easier to use than other financing options.

In the latest “Buy Now, Pay Later Tracker®,” PYMNTS explores the benefits BNPL services offer to younger, less affluent demographics and why its reduced impact on credit scores and lower interest rates are quickly growing in popularity among older and more financially secure generations.

Around the Buy Now, Pay Later Space

A recent study found that 59% of online shoppers said they were “somewhat” or “very” likely to leverage a BNPL option within the next six months, and 15% were open to using it at some point. This stands in stark contrast to the 67% of individuals who said they had not used the method as of  November 2021, indicating a rapid increase in the popularity of BNPL services. Experts attribute this growing popularity to heavy advertising. Forty-three percent of respondents said they had seen BNPL options advertised on social media services such as Facebook, Instagram and TikTok, with 42% seeing options offered at checkout for online retailers.

November 2021, indicating a rapid increase in the popularity of BNPL services. Experts attribute this growing popularity to heavy advertising. Forty-three percent of respondents said they had seen BNPL options advertised on social media services such as Facebook, Instagram and TikTok, with 42% seeing options offered at checkout for online retailers.

BNPL is still primarily the domain of third-party providers, but banks are slowly getting on the bandwagon due to customer demand. A recent PYMNTS study found that 60% of millennials, 57% of bridge millennials and 54% of Generation Z consumers said they would be more interested in a bank-backed BNPL option than one from a FinTech, and banks are listening, as these are the most likely generations to look into BNPL in the first place. PYMNTS’ research found that among BNPL users, 77% of bridge millennials, 75% of millennials and 64% of Generation Z users had increased BNPL usage in the past year.

For more on these and other stories, visit the Tracker’s News and Trends.

Sleepenvie on Why BNPL’s Future Rests With Older Consumers

BNPL has blazed through the payments space in just the past couple of years, rising from a little-known novelty to a widely used service among all types of consumers. BNPL’s popularity has significantly grown among older, more economically secure demographics, who use it not out of necessity but because of the added convenience it offers.

In this month’s Feature Story, PYMNTS talked with Joy Elena, founder of online mattress retailer Sleepenvie, about how the company leverages BNPL and why she believes older generations are the future of the service.

Exploring Varying Uses of BNPL Options Among Generations and Income Groups

BNPL solutions are the fastest-growing online payment method, not only in the U.S., but also in Australia, Brazil, the U.K. and many other countries. Merchants and payment providers are working hard to expand BNPL’s reach to older and higher-income demographics, leveraging the inherent advantages of BNPL systems to present an alternative to traditional credit card and financing options.

This month’s PYMNTS Intelligence examines BNPL’s growing popularity on the retail scene and explores why older and higher-income generations are quickly becoming a significant force in the BNPL space.

About the Tracker

In the “Buy Now, Pay Later Tracker®,” a PYMNTS and Splitit collaboration, explores the latest in the world of BNPL, including how and why different demographics are using BNPL and how FinTechs and BNPL providers can lean into BNPL’s inherent advantages to appeal to older and higher-income consumers.