Buy now, pay later (BNPL) services are commonplace in the modern economy, with 60% of consumers using them at one point or another. Retailers are also happy to offer BNPL services, especially in an economic environment that can generously be described as challenging. Inflation is up by 9.1%, according to the consumer price index, and supply chain disruptions mean inventory shortages that frustrate both merchants and consumers. Prices are at the top of shoppers’ minds as inflation curbs their spending power, with half of consumers saying they will switch brands to save money. Businesses that cannot afford to match their competitors risk losing customers and falling further behind, a negative feedback loop that could ultimately doom the merchant.

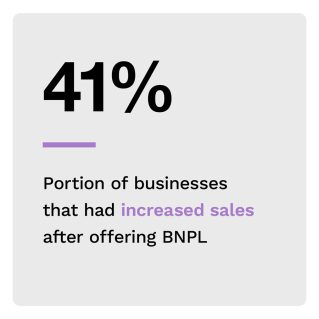

BNPL could be a valuable remedy in this climate, however. PYMNTS research found that 46% of customers that could not access traditional credit options used BNPL offerings to make purchases they could not have afforded otherwise, a rapidly growing group that could result in increased business revenue. Forty-one percent of U.S. merchants found that overall sales had increased once implementing BNPL, 33% saw higher-value transactions, and 30% reported higher online sales conversion. Just as important was that 43% reported a better experience for the customer, which is less quantifiable but vitally important for driving return visits.

This edition of the “Buy Now, Pay Later Tracker®” examines the challenges merchants face due to inflation, supply chain issues and other economic challenges. The tracker also explores BNPL’s growing popularity among consumers and how offering BNPL can help merchants grow their revenue and stay in business until the economy recovers.

Around the Buy Now, Pay Later Space

BNPL services are growing popular among various demographics, contributing to record sales in this channel. A recent report found that 2021 witnessed $120 billion in BNPL sales, accounting for 2.3% of the global eCommerce market, and this sum is expected to continue increasing for the foreseeable future. Total BNPL revenue is anticipated to hit $576 billion by 2026, fueled by increasing usage among younger generations. The report found that millennials and Generation Z are the most likely to engage in BNPL use in place of traditional credit, with 47% of U.K. consumers between the ages of 18 and 34 not possessing a credit card, for example.

BNPL services are growing popular among various demographics, contributing to record sales in this channel. A recent report found that 2021 witnessed $120 billion in BNPL sales, accounting for 2.3% of the global eCommerce market, and this sum is expected to continue increasing for the foreseeable future. Total BNPL revenue is anticipated to hit $576 billion by 2026, fueled by increasing usage among younger generations. The report found that millennials and Generation Z are the most likely to engage in BNPL use in place of traditional credit, with 47% of U.K. consumers between the ages of 18 and 34 not possessing a credit card, for example.

BNPL has become popular among merchants as well as consumers, with retailers relishing the increased ticket sizes and improved conversion rates. A recent study of retailers in the U.K. found that 69% said their sales improved since offering BNPL, with 61% reporting improved sales conversion. More than 17 million consumers in the U.K. have reported using BNPL at some point, with 59% of retailers saying they have acquired new customers from this group and 43% saying that BNPL users have made more frequent purchases.

For more on these and other stories, visit the Tracker’s News and Trends section.

Dentsply Sirona on Leveraging BNPL to Tackle Modern Economic Challenges

BNPL is popular for everything from regular grocery shopping to massive, big-ticket items like jewelry, electronics or luxury goods— and a variety of new industries are entering the fray, such as dentistry. This system is particularly useful for coping with rising interest rates, inflation and supply chain issues that plague the modern economy.

This month, PYMNTS talked with Erik Svenson, head of global consumer finance for dental supply company Dentsply Sirona, about how BNPL services help customers overcome hesitation for purchases and lead to higher ticket sizes and increased revenue.

How Retailers Are Leveraging BNPL to Navigate Current Economic Challenges

Retailers are having a rough go of it in 2022, with inflation at 9.1% according to the consumer price index and supply chain disruptions causing inventory shortages that frustrate both merchants and consumers. Businesses are turning to any lifeline they can find to navigate the current economic climate, and BNPL has proven to be quite effective at encouraging consumer spending and driving revenue.

This month, PYMNTS examines the multipronged obstacles that retailers are currently facing and how BNPL can help them weather the continuing storm.

About the Tracker

The “Buy Now, Pay Later Tracker®,” a PYMNTS and Splitit collaboration, examines the hurdles merchants face due to inflation, supply chain issues and other economic challenges. The Tracker also explores BNPL’s growing popularity among consumers and how offering BNPL can help merchants grow their revenue and stay in business until the economy recovers.