The only sureties in life, it is said, are death and taxes.

We can add higher interest rates to the list.

As stocks gyrate wildly on Wall Street, the Federal Reserve is poised to raise rates “soon” (possibly as soon as its next meeting in March), to tighten financial conditions in order to stem the rising tide of inflation.

Once the first rate hike since 2018 is in effect, the question remains as to what will happen to lenders.

The Impact on Traditional Lenders

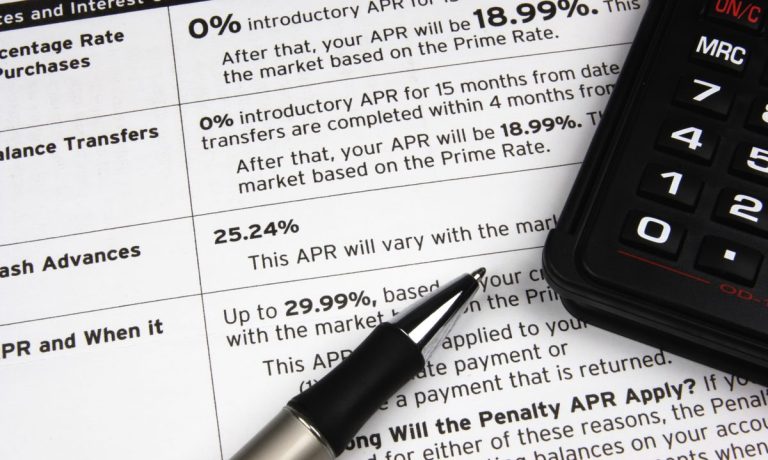

The general logic follows that debt becomes more expensive to borrowers as the benchmark rate upon which most interest rates take a cue is increased.

That includes credit card debt, of course. Right now, the average interest rate on credit card debt is a bit more than 16%, per creditcards.com. But because this is a form of variable rate debt, lenders — the banks, etc. — have the leeway to boost those rates. In addition, lenders/financial institutions (FIs) will want to offset the increased cost of deposits and other holdings that consumers carry that they must pay interest on, thus preserving (or expanding) net interest margins.

We’ll get a sense of the credit landscape when Mastercard and Visa report their earnings over the next few days. American Express showed in its own report that spending is indeed buoyant; consumers in the U.S. spent, on average, more than $6,500 in its most recent quarter.

Read also: American Express: US Cardholders Spent More Than $6,500 in Q4

The BNPL Impact

Now, the AmEx consumer is not typically the consumer who would typically embrace buy now, pay later (BNPL) options — but the results show the urge to spend remains unabated. We contend that rising rates will push consumers across all demographics and income to mull whether and how other financial products beyond traditional credit and debit might fit into their own daily financial toolboxes.

Previous PYMNTS research shows that second chance consumers are among the most visible demographics eager to embrace BNPL.

Per the study, “a second-chance consumer is not necessarily a consumer who would be an unreliable or undesirable shopper. We found that 65 percent earn more than $50,000 per year, with 30 percent earning above $100,000. The average second-chance consumer is 44 years old and has a FICO score of 662” but have traditionally not had access to traditional credit.

See: Study Confirms Love Match Between BNPL and ‘Second-Chance Consumers’

But with the continued emergence of BNPL offerings, and their continued embrace, the question must be asked: What happens to zero percent financing?

It’s likely that the option will get a closer look at the point of sale, in all cases — in brick-and-mortar retail and online, too. After all, as reported in this space recently, about 39% of consumers used BNPL to avoid credit card interest. Past PYMNTS studies have found that 29 million U.S. consumers have used BNPL at least once in the past year — and familiarity breeds increased usage. Pay in Four and o% financing might be top of mind in the weeks and months going forward.

Read more: Who’s Using BNPL and Why?

Nothing is Really ‘Free’

But for the BNPL providers themselves, a prolonged period of rising rates may bring its own challenges — beyond a surge in customers. These companies may find operational costs pushed higher, and may find that consumers (at least some of them) may be stretched a bit thin financially.

Money has essentially been “free” for so long that many of these companies will have to grapple with a new economic environment. Go back to the early years of the last decade (say in 2012) and the average interest rate was higher than it is now. Thirty-year rates as far back as, say 2013 or 2014 stood in the high 3% or near 4% range; last year they were below 3%. You get the picture — no matter where you look, rates are coming off of multi-year lows.

But rising rates may spell pressure for the BNPL model, which relies on deferred payments. For the loans that are charged at the point of sale, no interest is charged if the consumer makes timely payments (the merchant pays a fee).

But in the event that they miss payments, interest and fees can accrue. Some plans tie interest payments into the installment. As noted in this space last year, and by way of example, Affirm offers terms from six weeks to 48 months and interest rates of 0% to 30% annual percentage rate (APR).

See also: Affirm President Says Consumers Turn to BNPL for More Flexibility and Transparency

But the BNPL providers, especially the ones that have made a mark in extending 0% plans, may find that the cost of financing becomes a bit more onerous. Affirm, for example, notes in its earnings release that transaction costs includes funding costs; funding facilities related to financing the origination of loan receivables bear interest based on commercial paper rates and a spread that can range from 1.25% to 4.25%, per SEC filings made by the company. One way to offset this would be to charge higher fees to the merchants.

None of this is to say that the BNPL model is fundamentally flawed — just that the broader macro environment is shifting a bit (of course, if consumer spending falls off a cliff, all bets are off, for just about everyone).

More troubling for the BNPL providers at large — and it’s a big if — would be the impact to consumers that comes from other debt they carry, which, if it becomes more expensive, hobbles their ability to make timely payments on the installment plans they’ve taken out.

The balancing act for BNPL providers (and the consumers who love them), in the age of higher interest rates, may be just beginning.