Learn From an Education Provider How To Save With BNPL

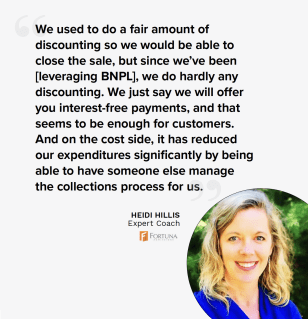

With 42% of consumers poised to use BNPL for medicine and prescriptions and another 38% for education, Heidi Hillis from Fortuna Admissions tells PYMNTS how installment plans can reduce costs and discounting while also maintaining value for students.

An interview with Heidi Hillis, expert coach at Fortuna Admissions, on how BNPL is changing the education field.

—

Education has long been an impetus for taking out personal loans, including those for tuition, books and room and board, making it a natural fit for buy now, pay later (BNPL). Even education players outside the schools themselves are dipping into BNPL, including Fortuna Admissions, a consulting and counseling service for prospective business school applicants.

“Our clients are generally professionals, and our packages that we sell are pretty high-ticket, so customers often paid for them over a period of three to six months, and we were managing it ourselves by charging them in three invoices. But that became very burdensome for us to handle, and we found Splitit to help us handle client payments.”

Implementing BNPL allowed Fortuna to improve its profits in two different ways. Not only did the lack of interest payments allow the company to drop its discounts and still offer an appealing value proposition. Outsourcing the payments to a third party also enabled it to save administrative costs that were formerly spent on managing the company’s own installment payments system.

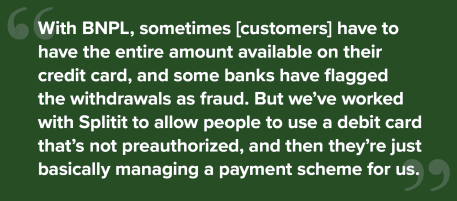

Implementing BNPL came with its own set of challenges, however, particularly when it came to customers from certain countries. These countries’ banking systems often mistakenly identified users’ BNPL payments as fraudulent due to their financial laws, making BNPL difficult to leverage. Fortuna helped develop an innovative solution to work around these roadblocks, however.

Implementing BNPL came with its own set of challenges, however, particularly when it came to customers from certain countries. These countries’ banking systems often mistakenly identified users’ BNPL payments as fraudulent due to their financial laws, making BNPL difficult to leverage. Fortuna helped develop an innovative solution to work around these roadblocks, however.

Currently, 55% of Fortuna’s customers use BNPL, according to Hillis. Continued ease of use in the education field could improve this rate across the entire industry.