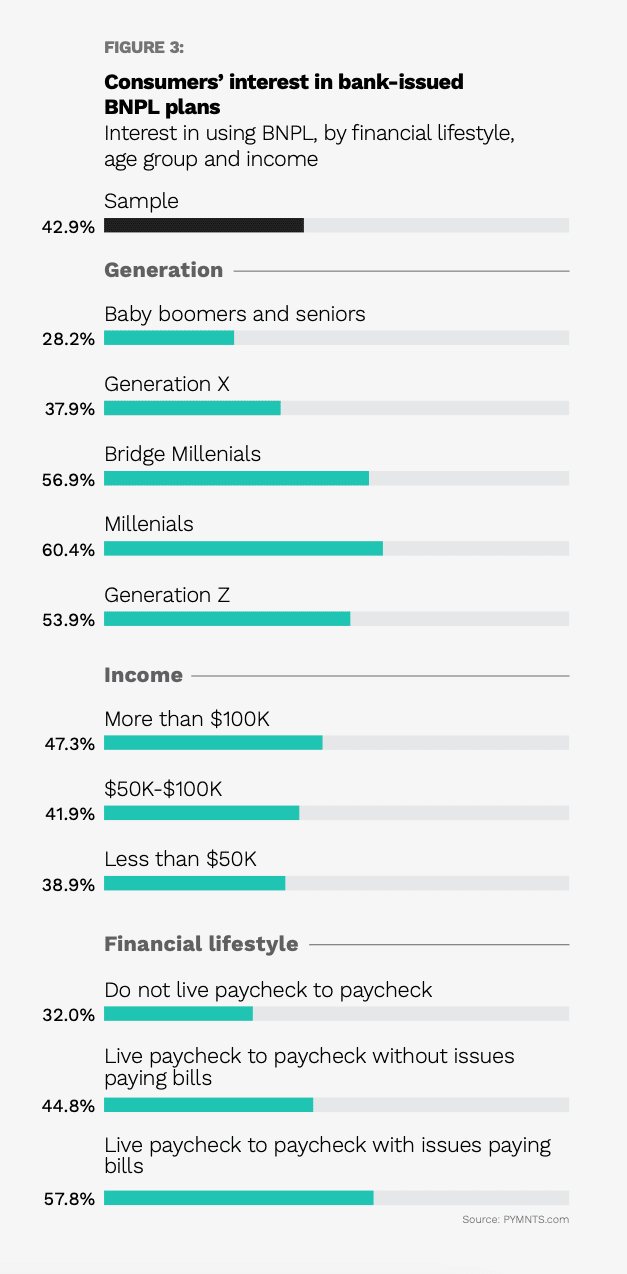

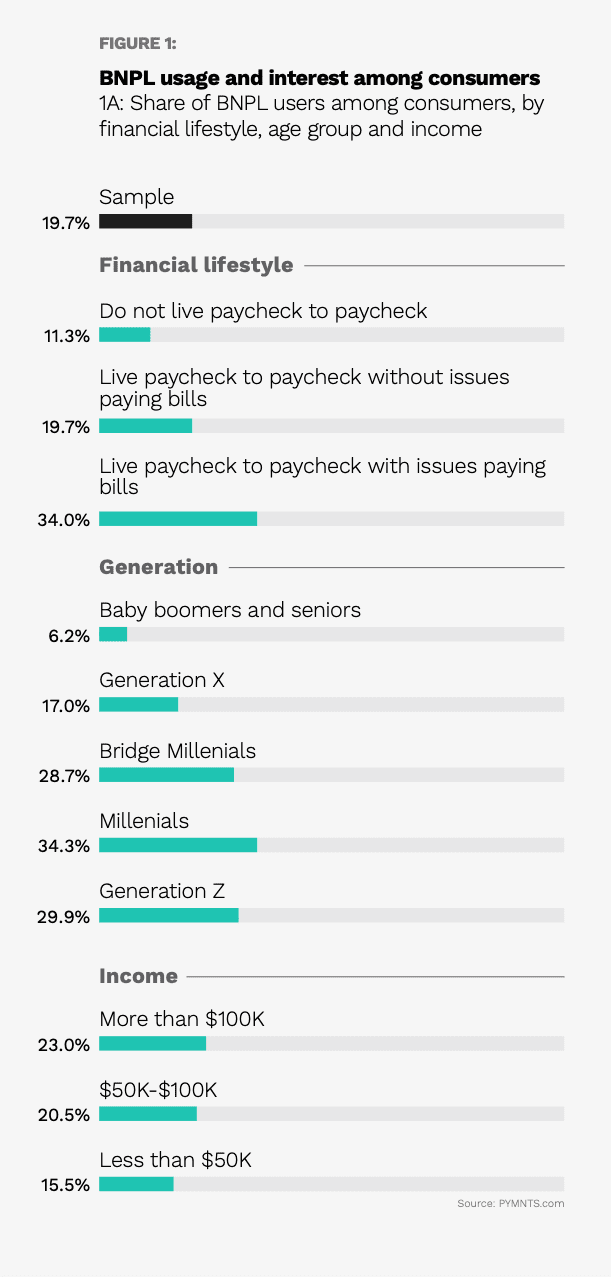

Buy now, pay later (BNPL) plans are quickly changing how consumers today pay for products and services. About 20% of U.S. consumers are currently using BNPL, according to Banking On Buy Now, Pay Later, a PYMNTS and Amount collaboration that surveyed 2,237 U.S. consumers.

Get the report: Banking On Buy Now, Pay Later: Installment Payments And FIs’ Untapped Opportunity

The percentage of consumers using BNPL varies by financial lifestyle, generation and income. The greatest share of consumers in each of those groups using BNPL are those who live paycheck to paycheck with issues paying bills (34% of whom use BNPL), millennials (34%) and consumers with an income of more than $100,000 (23%).

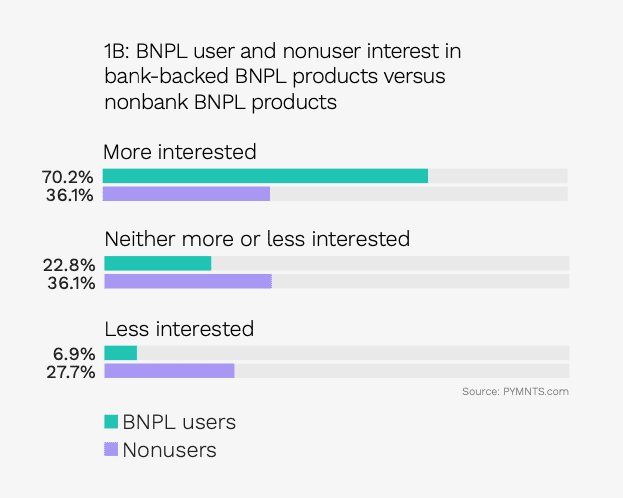

The bulk of today’s BNPL users go for the flexible payment plan options FinTechs offer, but there is significant interest in using BNPL plans offered by traditional banks instead.

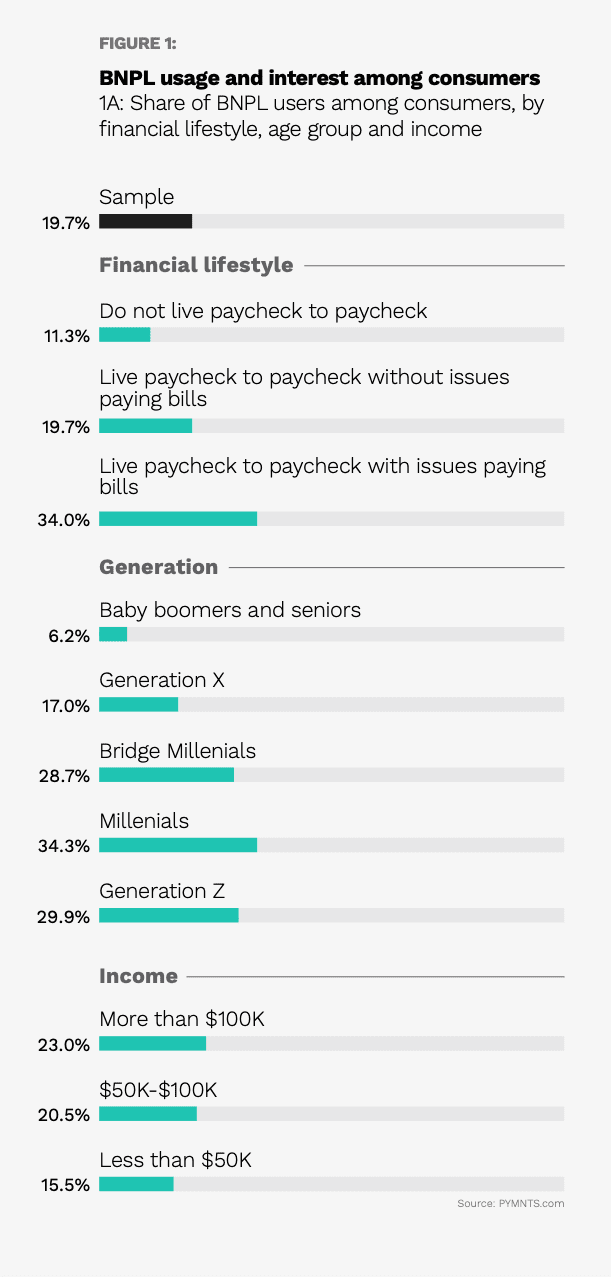

PYMNTS’ research shows that 70% of consumers who currently use BNPL are interested in payment plan options from banks over those FinTechs offer. Another 23% say they are neither more nor less interested.

Interest in using bank-backed BNPL is also high among those who do not currently use BNPL plans, with 36% saying they are more interested in bank-backed BNPL products than nonbank BNPL products. Another 36% are neither more nor less interested.

Advertisement: Scroll to Continue

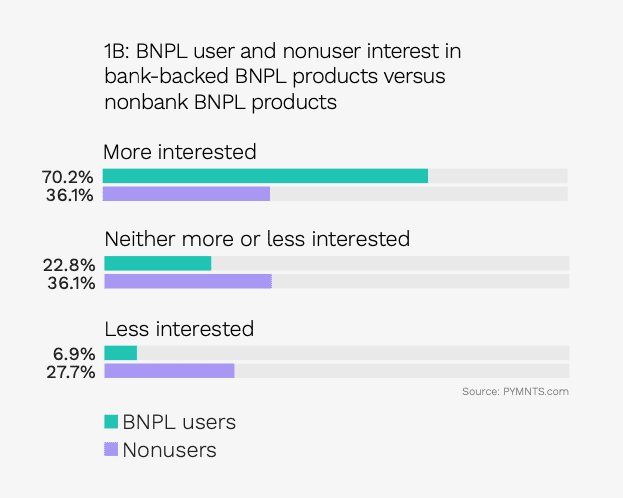

Younger generations are most interested in bank-backed BNPL plans. Sixty percent of millennials, 57% of bridge millennials and 54% of Generation Z consumers say they are interested in using bank-issued BNPL plans.

Among financial lifestyles, consumers who live paycheck to paycheck with issues paying bills are most interested, with 58% saying they are interested in bank-issued BNPL plans.

When the survey results are sorted by income, consumers who are earning more than $100,000 annually show the most interest in bank-issued BNPL plans, at 47%.