Traditional credit is more difficult to access and increasingly expensive to maintain as the Federal Reserve keeps raising rates, driving some consumers are seeking alternative ways to make purchases.

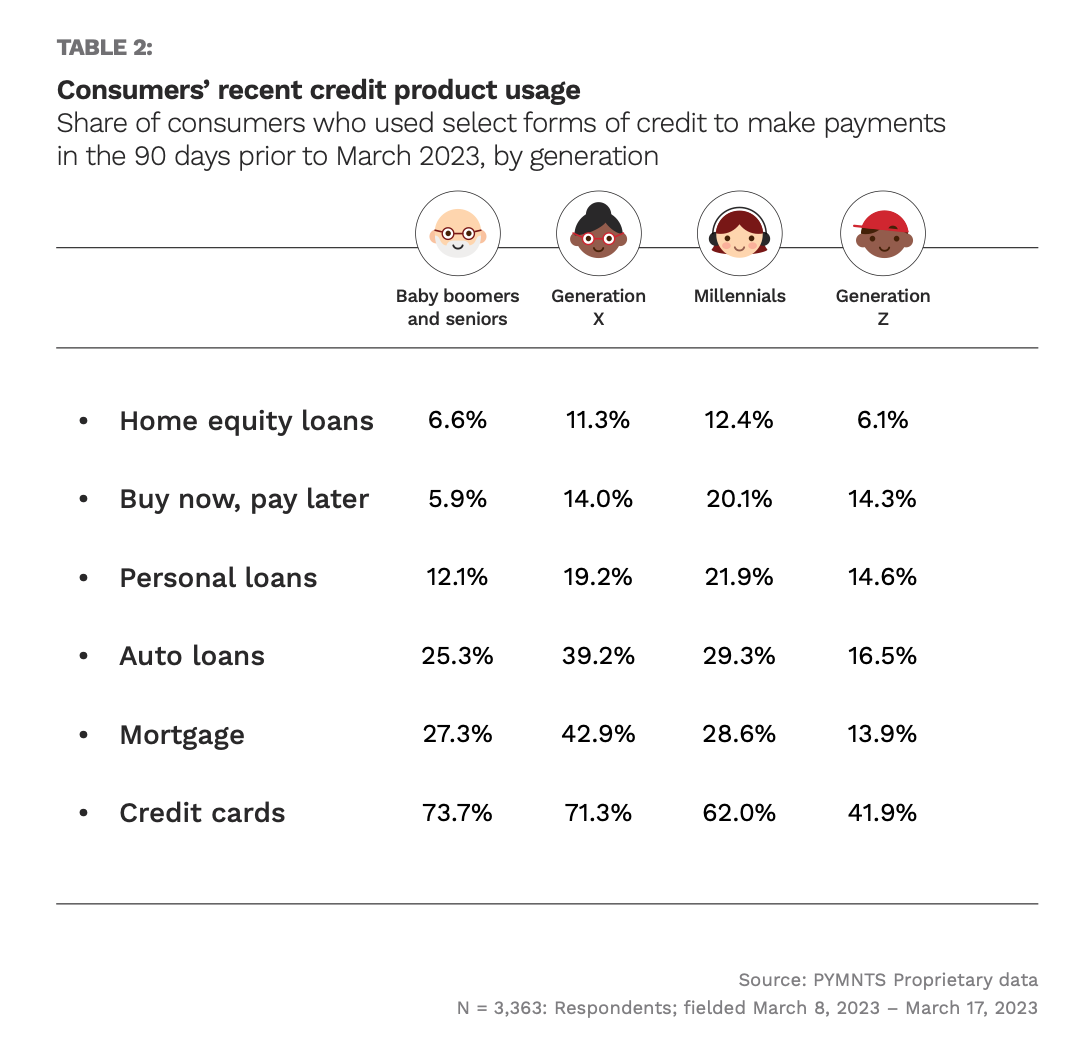

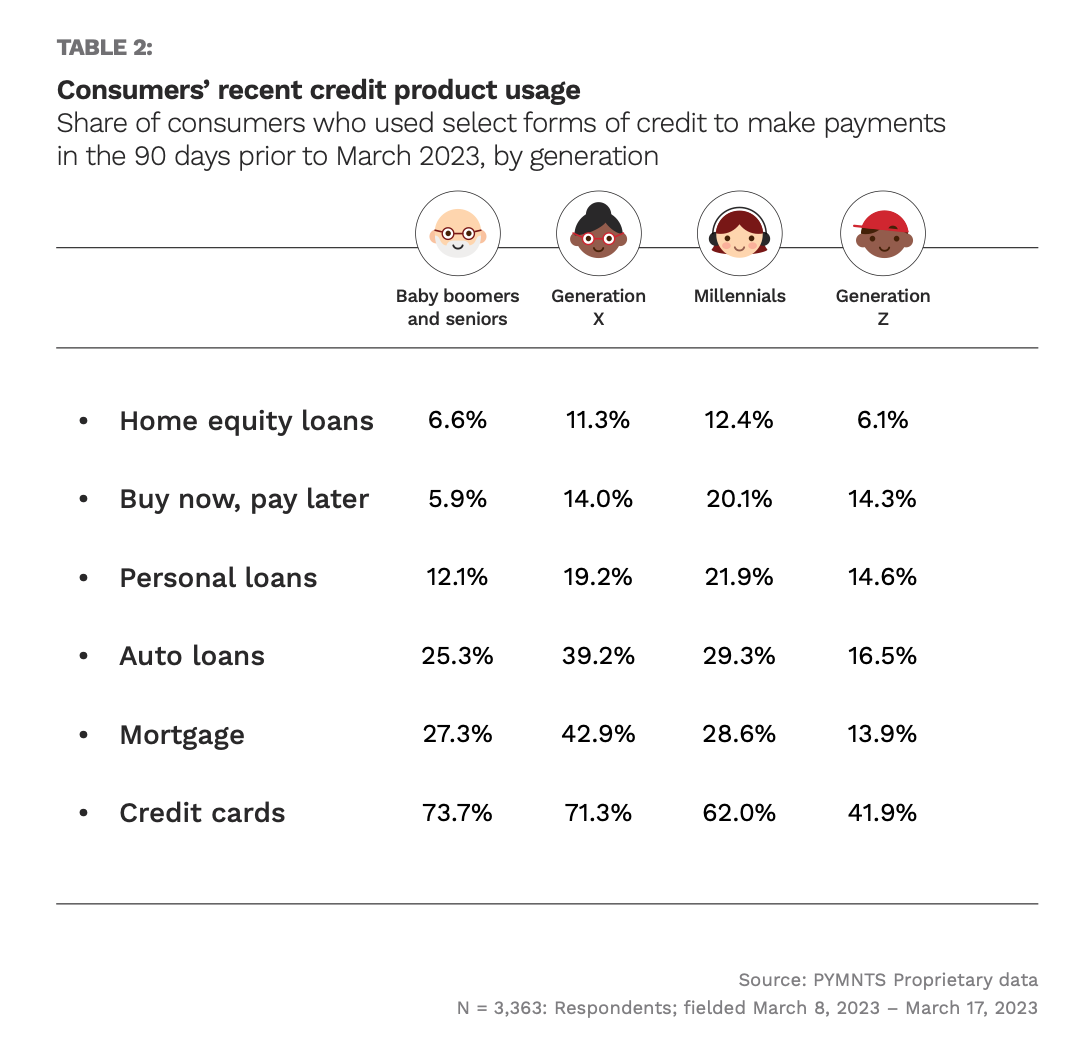

As illustrated in the recent PYMNTS collaboration with Sezzle, “The Credit Economy: How Younger Consumers Make Credit Decisions,” buy now, pay later (BNPL) use spans generations. Gen Z, whose adult members were born after 1997, has a 14% share of consumers using this credit product.

Credit card interest rates, which rise with every Fed hike and now average more than 20%, are considered a main driver behind the rate of BNPL use across demographics. These higher rates could be affecting Gen Z’s much lower level of card and personal loan use compared to other generations and in turn drive BNPL’s popularity among this age cohort.

However, an additional benefit for Gen Z in using BNPL as a payment option is the allures of better spend management and greater control of cash flow. Further PYMNTS research has found these features to be a contributor towards 53% of surveyed Gen Z consumers using credit products overall.

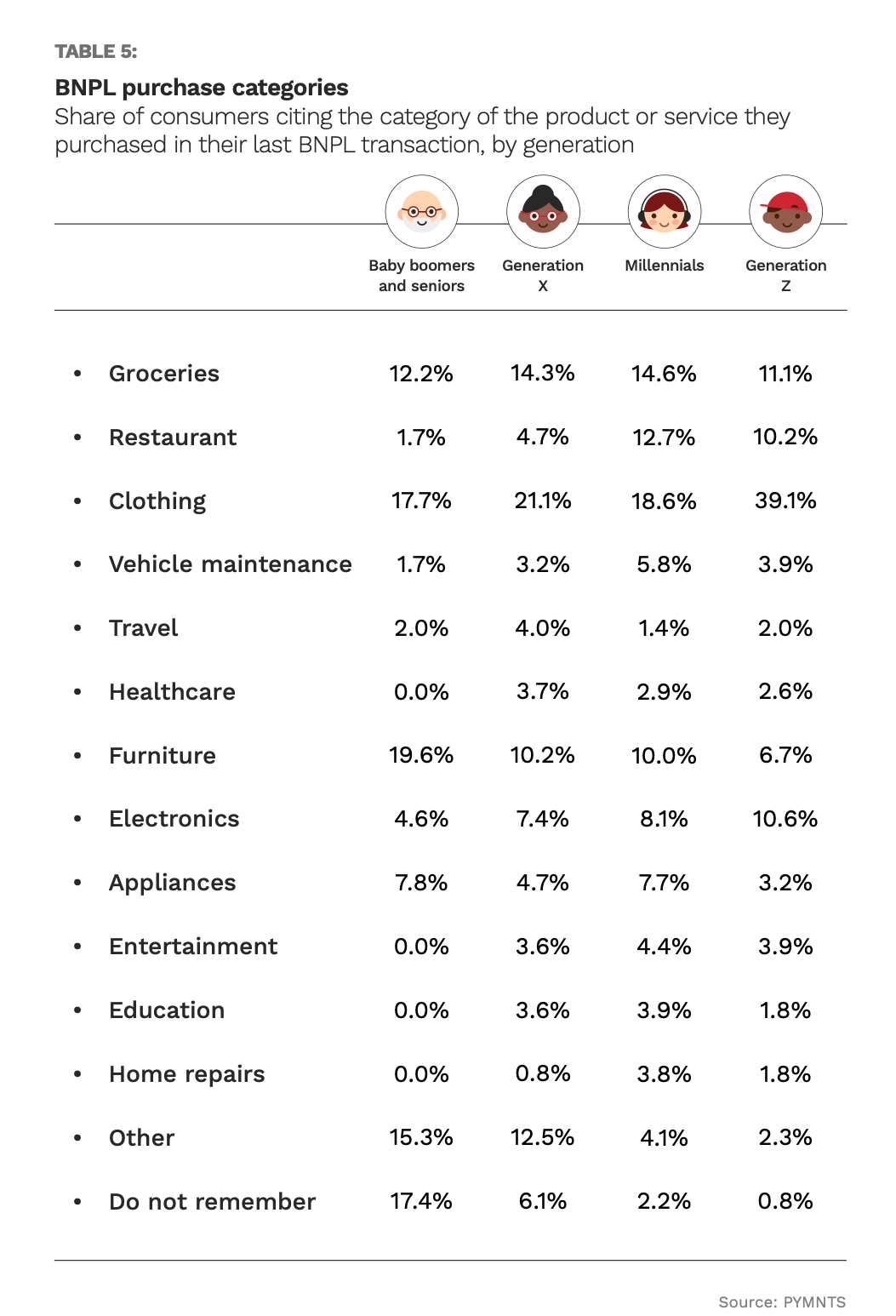

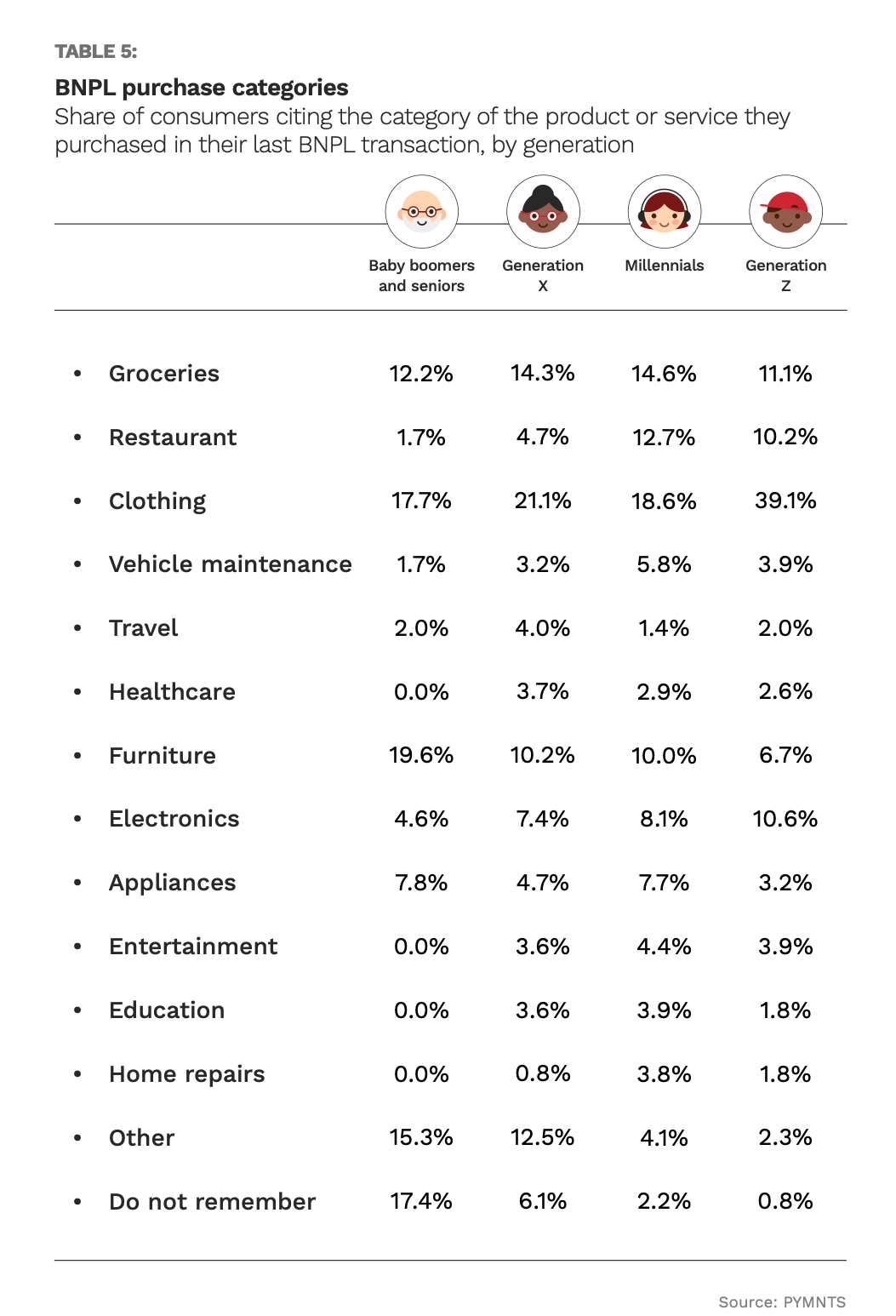

A further chart for “The Credit Economy” notes what categories consumers were most likely to use BNPL for purchases. We found that 39% of Gen Z consumers use BNPL to buy clothing, representing the greatest rate of BNPL use across purchase categories and generations.

As electronics is Gen Z members’ second-favorite category to make purchases via BNPL, it seems that the generation is mainly limiting its use of the credit product to discretionary items.

Advertisement: Scroll to Continue

Supporting the notion that Gen Z mainly views BNPL as a tool for nonessential purchases is data from PYMNTS’ collaboration with i2c, “The Credit Accessibility Series: BNPL’s Wide-Ranging Impact on Consumers and Merchants.” The report found that if BNPL were unavailable for a given purchase, 27% of Gen Z would opt not to buy the item. Other options such as finding a cheaper substitute or borrowing money from family imply purchase necessity, whereas ultimately opting not to purchase at all implies the opposite.

With interest rates unlikely to come down anytime soon, consumers across ages and income brackets are searching for alternative lending options. For Gen Z, using BNPL is one way to being able to afford the extras. Or, for over one-quarter of this cohort, they’d rather go without these discretionary purchases.