In recent years, the financial landscape has witnessed a transformative wave with the rise of buy now, pay later (BNPL) as a popular and widely embraced deferred payment option for consumers. This innovative approach has revolutionized traditional purchase patterns, enabling individuals to enjoy the flexibility of splitting payments into manageable installments.

In “Tracking the Digital Payments Takeover: What BNPL Needs to Win Wider Adoption,” PYMNTS Intelligence draws insights from a survey of over 3,100 consumers to explore consumer enthusiasm for deferred payment options like credit card installments and BNPL, while uncovering ways in which BNPL services can align with consumer preferences and achieve the same level of usage as credit card installment plans.

According to the research study, approximately 28% of consumers, almost a third of the surveyed group, opted for deferred payment arrangements in the three months prior to the study. Among these individuals, 19% chose BNPL options, while 18% favored credit card installment plans.

There was a notable inclination toward increased usage of BNPL, with 43% of existing BNPL users expressing their intent to continue utilizing this method in 2024. An additional 15% of individuals who haven’t yet explored BNPL are also contemplating doing so.

Consumers cite three primary reasons for their adoption of deferred payment plans: convenience, financial security and expanded purchasing capability. Specifically, 37% of consumers leverage these plans for their convenience, 28% to maintain a financial buffer, and 27% to facilitate the acquisition of more products.

Consumers anticipate these same attributes — convenience, financial flexibility and increased purchasing power — from BNPL options as much as they expect from credit card installment plans.

Yet, credit card installment plans currently see more frequent use, especially for larger purchases, when compared to BNPL. This preference is due to the additional features inherent in credit card installment plans that BNPL offerings lack.

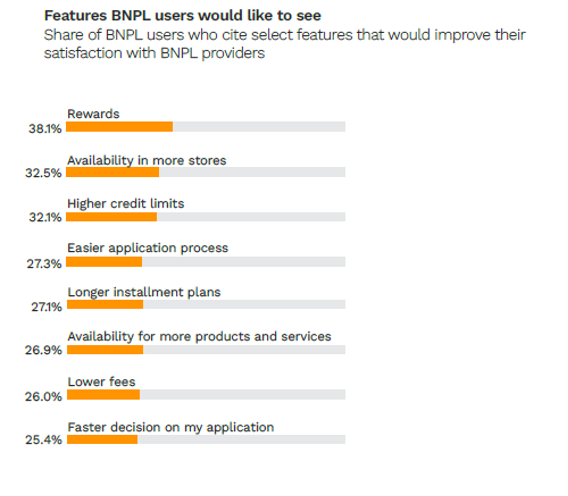

According to the survey’s findings, a significant share of BNPL users express a desire for rewards programs similar to those offered by credit card installment plans. Specifically, nearly 40% of BNPL users pinpoint it as the primary feature that would significantly enhance their satisfaction with BNPL providers.

Roughly one-third of consumers also highlight the significance of both increased in-store availability and higher credit limits as features they would like to see to enhance satisfaction with BNPL providers. This is closely followed by approximately 27% of users who desire an easier application process and longer installment plans.

BNPL users also want lower fees and swift decisions on their applications. In fact, the convenience of applying for BNPL and receiving prompt responses is a crucial feature desired by nearly one-fourth of BNPL users.

To maintain a competitive edge in the booming market, BNPL providers must prioritize meeting these consumer demands, from integrating rewards programs, extending higher credit limits and simplifying application processes to expediting decisions and expanding availability.

Such strategic measures would not only cater directly to consumer needs but also position providers at the forefront of this competitive landscape, ensuring sustained growth and success in the constantly changing consumer finance industry.