For Growth Corporates, commonly referred to as middle-market firms, in the North American region, accessing external working capital solutions has been critical to improving their operational efficiency and sustaining growth in a challenging macroeconomic landscape.

According to the recently released “2023-2024 Growth Corporates Working Capital Index (WCI): North America Edition,” 71% of regional firms have accessed these solutions, including working capital loans, overdraft from corporate bank accounts and virtual credit cards, in the past year. This utilization rate ranks third among the five regions analyzed in the study, behind Latin America and the Caribbean (LAC) and Europe.

The report, a collaboration between PYMNTS Intelligence and Visa, also shows that access to working capital solutions has been crucial in supporting planned growth, managing cash flow shortfalls and driving digital transformation efforts.

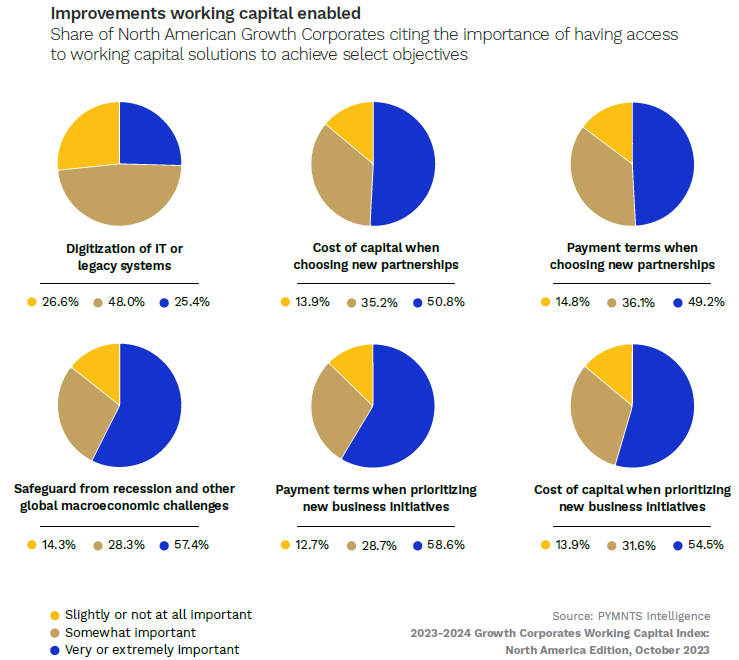

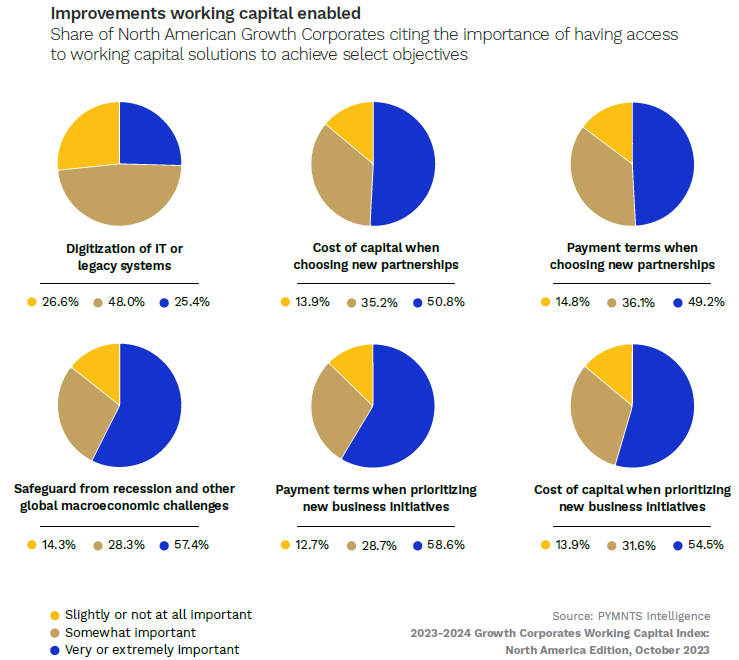

In fact, 72% of middle market firms in the region reported improved business metrics due to utilizing external working capital solutions, while nearly 9 in 10 companies achieved favorable payment terms for new business initiatives. Furthermore, 85% of CFOs used working capital solutions to safeguard their businesses from macroeconomic challenges and more than 70% credited access to working capital solutions for driving the digital transformation of IT and legacy systems.

The report further sheds light on how leading Growth Corporates strategically utilize working capital solutions. These firms prioritize employing external working capital for both growth investments and to manage anticipated cash flow gaps. For instance, all top-performing Growth Corporates in the fleet and mobility sector leveraged external working capital to expand their operations. Similarly, top performers in healthcare demonstrated higher-than-average usage rates for strategic growth purposes.

Examining the data further shows that the utilization of working capital solutions varies across different industries. The commercial travel sector, for instance, has a higher rate of utilizing these solutions to address expected cash flow gaps compared to the global average for the industry. Similarly, agricultural Growth Corporates had the highest utilization of working capital solutions for seasonal cash management, highlighting the diverse needs of these companies.

Advertisement: Scroll to Continue

Looking ahead, the report indicates that 90% of North American Growth Corporates plan to access financing in the coming year. Working capital loans, bank credit lines, and corporate overdrafts are the primary external capital sources they intend to tap. Additionally, there is a growing interest in using virtual cards as a working capital solution, with one-third of Growth Corporates planning to access them in the future.

Overall, North American Growth Corporates have shown resilience despite economic challenges like persistent inflation and tight monetary policies, efficiently managing operations through external working capital solutions. These solutions are poised to continue playing a pivotal role, steering companies through economic headwinds, supporting growth objectives, and ensuring market viability across industries.