Installment Payment Plans To Spur Merchant Growth In 2021

The pandemic has heaped financial hurt on millions of consumers globally, prompting them to trim their shopping lists and seek flexible ways to make purchases.

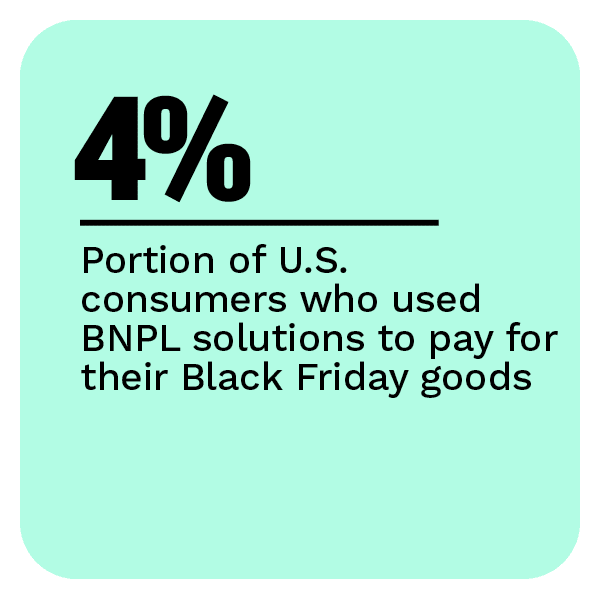

Evidence reveals that these habits picked up steam during the 2020 holiday shopping season, with PYMNTS research finding that 4 percent of Americans used buy now, pay later (BNPL) methods for their Black Friday purchases.

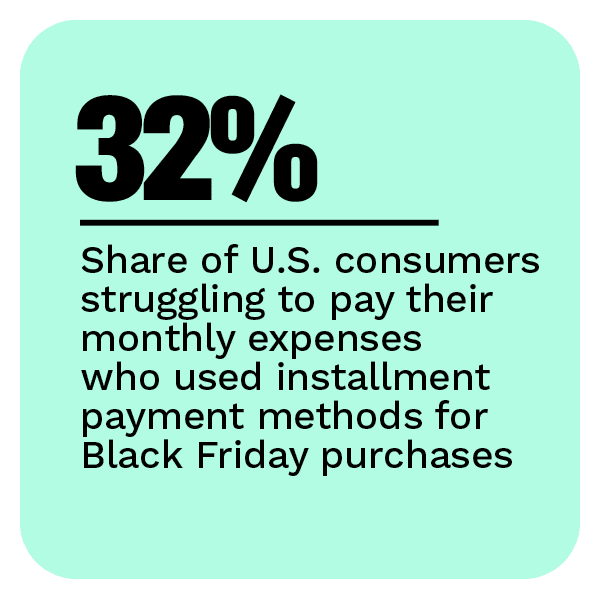

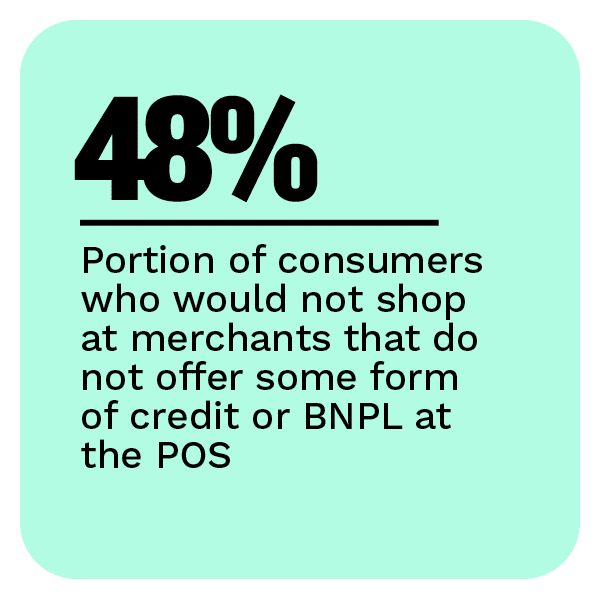

The trend toward BNPL solutions is particularly notable among certain consumers groups. Data shows that roughly one-third of respondents who have struggled to afford their routine monthly expenses used BNPL solutions for their Black Friday purchases, for example. Other polls show that nearly half of all  consumers who use point-of-sale (POS) financing solutions — including BNPL — would not shop with merchants that did not offer them.

consumers who use point-of-sale (POS) financing solutions — including BNPL — would not shop with merchants that did not offer them.

The December edition of the “Buy Now, Pay Later Tracker®” explores how consumers’ shifts toward using BNPL solutions in stores and online accelerated during the holiday shopping season, as well as how this trend is poised to grow in the year ahead.

The Latest Buy Now, Pay Later Developments

Installment payment provider Afterpay announced that it facilitated $1 billion in sales in the United States for the month of November, fueled in part by Black Friday and Cyber Monday shopping. The record number saw it surpass its native Australia — where sales totaled $900 million — for the first time, signifying that the U.S. could become an even more competitive market for BNPL solutions in the future. Afterpay also reported that 80 percent of its annual sales worldwide were digital.

The use of BNPL solutions is also expanding in the United Kingdom. A survey found that 15 percent of the nation’s consumers are using the payment method for their purchases, compared to just 4 percent in 2019. Twenty-three percent of respondents stated that they used BNPL solutions to help them meet their financial needs, demonstrating that more consumers are focused on budgeting when shopping.

Research also shows that BNPL methods are proving especially appealing to younger consumers and parents. One study found that 41 percent of U.S. shoppers who have used BNPL options are between the ages of 18 and 34, putting them in the millennial and Generation Z categories. It noted that installment payment plans could be especially popular for these two groups because they tend to be more digitally savvy compared to older consumers and because they are likelier than other generations to value the financial flexibility such solutions offer.

Research also shows that BNPL methods are proving especially appealing to younger consumers and parents. One study found that 41 percent of U.S. shoppers who have used BNPL options are between the ages of 18 and 34, putting them in the millennial and Generation Z categories. It noted that installment payment plans could be especially popular for these two groups because they tend to be more digitally savvy compared to older consumers and because they are likelier than other generations to value the financial flexibility such solutions offer.

For more on these stores and other BNPL headlines, download this month’s Tracker.

A Look At BNPL Solutions’ Growth During The Holiday Season And What It Means For 2021

The pandemic has forced consumers to reexamine their cash flows, and many looked for ways to boost their financial flexibility heading into the holiday shopping season. Consumers not only searched for discounts but also sought out emerging payment methods such as installment payment plans in stores and online.

In this month’s Feature Story, PYMNTS examines 2020 holiday spending trends and consumers’ growing use of BNPL solutions for their purchases, as well as how these trends could affect consumers’ spending going forward. We also examine why more merchants are making BNPL solutions available at checkout to keep customers from taking their business elsewhere.

Deep Dive: The Trends That Drove More Consumers To Fle xible Payment Plans in 2020

xible Payment Plans in 2020

Consumers hit hard by the pandemic were still expected to show up in force during the holiday shopping rush, with spending predicted to rise by 5 percent year over year in November and December. BNPL checkout options were also poised to offer in-store and online shoppers a little financial breathing room to make their holiday purchases with monthly payment plans.

This month’s Deep Dive examines how the ongoing pandemic is shifting consumers’ payment behaviors online and at brick-and-mortar merchants and details how these changing behaviors could boost the role of BNPL solutions.

About The Tracker

The “Buy Now, Pay Later Tracker®,” an Afterpay collaboration, offers coverage of the most recent news and trends in the BNPL ecosystem.