Over half of the U.S. population reported they live paycheck to paycheck, according to PYMNTS data, including 25% of consumers who have used buy now, pay later (BNPL) in the last 12 months, pointing to the payment option as a potential on-ramp for credit while managing risk.

“We want to be able to provide that as an option to them and with the clarity of exactly how much they’re paying to get it now versus what it would mean to save up money and buy it later,” Affirm President, Technology, Risk and Operations Libor Michalek said in an interview. “That’s a trade-off that everybody makes on a regular basis.”

Michalek said a large part of this shift has been a change in consumer preferences for more flexible and innovative digital payment solutions.

Read also: 53% of Upper-Income Americans Live Paycheck to Paycheck

Speaking with Karen Webster and Mark Smith, head of Payments Market and Business Development at Amazon Web Services (AWS), for PYMNTS TV, Michalek said that Affirm wants to help people understand how credit works and how data is used to make lending decisions as they pay over time.

“It’s actionable around how they understand their behavior over time and its impact on their creditworthiness and their ability to access more credit in the future,” Michalek said.

Advertisement: Scroll to Continue

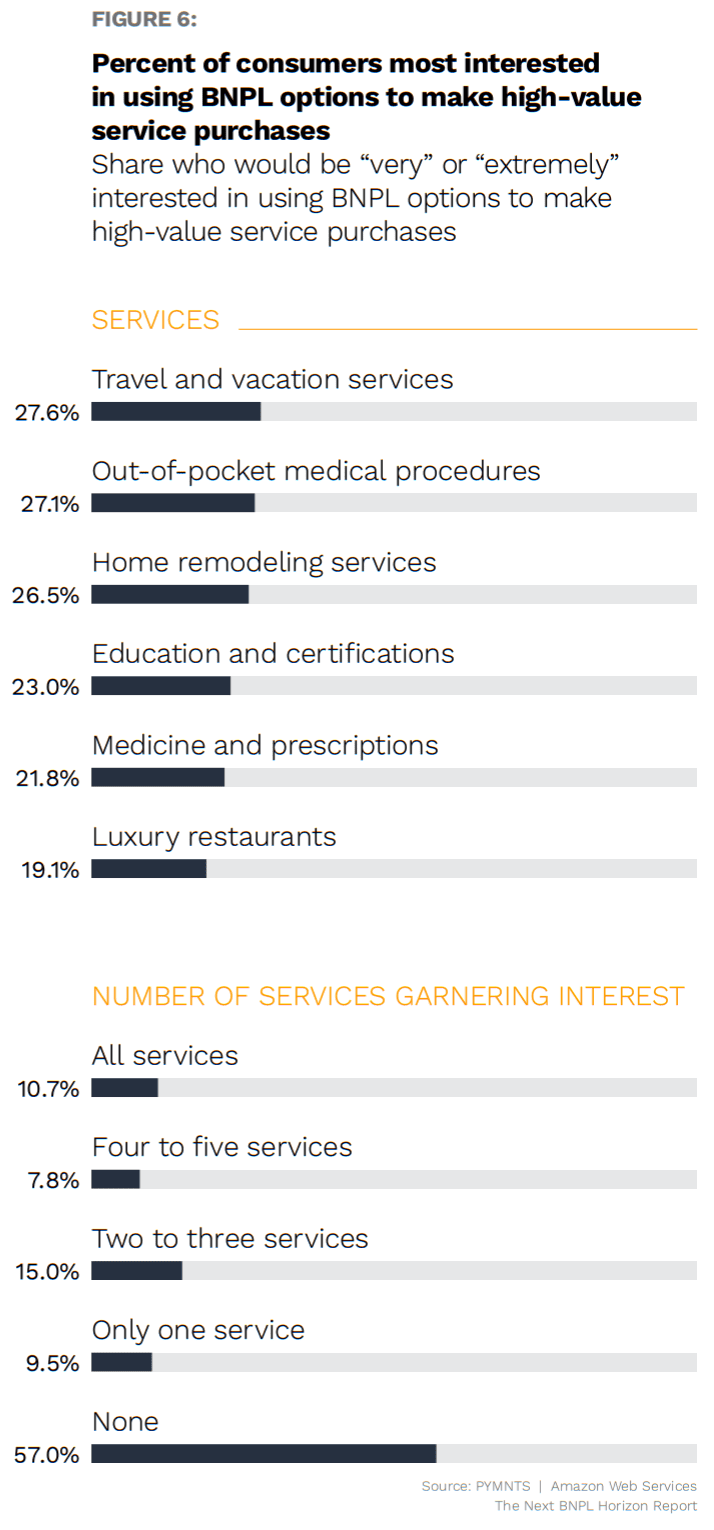

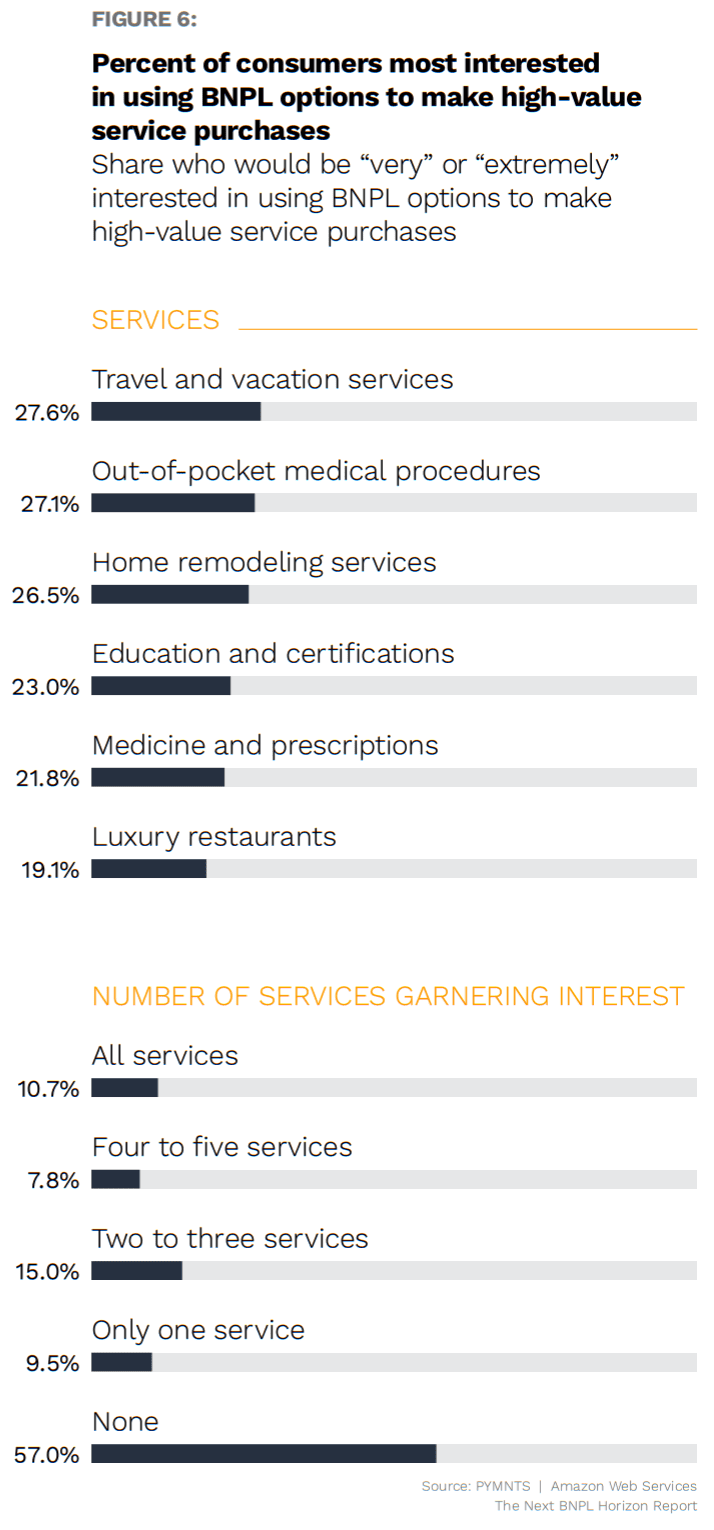

Already 29 million U.S. consumers have used a BNPL solution, and some 43% of the adult population, or 111 million consumers, said they are interested in using the payment option to pay for big-ticket service purchases such as travel, remodeling and medical expenses.

PYMNTS research found that 83% of consumers who want to use BNPL to make a big-ticket purchase said it’s a practical alternative to using personal loans and credit cards.

See also: The Next BNPL Horizon Will Expand Access to 83% Who Want to Make Big Ticket Purchases

“What’s really resonating with them is this transparency, this clarity up front that they know exactly what they’re getting,” Michalek said. “They know what it’s going to mean for their pocketbook and what it’s going to mean over the longer period.”

Room to Grow

PYMNTS data showed that 27% of consumers would be willing to use BNPL services from banks where they have an account, compared to 23% who said they’d be willing to use BNPL providers.

What sets Affirm apart from many banks and other BNPL offerings is that Affirm doesn’t charge late fees. It outlines the payment installment plan up front, which Michalek said provides greater clarity and transparency, which in turns leads to better consumer decisions and value.

PYMNTS research also found that over 25% of consumers saw BNPL options as ways to prevent tying up their credit line, and 26% preferred to keep a high-dollar purchase off their credit card. Smith said in talking to card-issuing banks early in the pandemic, he found that an increasing number of consumers were paying their credit card balances off in full for a similar reason: People wanted to save their credit lines “for a rainy day.”

“They didn’t know if their job situation, their financial situation was going to change, and they wanted that safety net,” Smith said. “I thought that was really interesting. The pandemic has definitely fueled the catalyst around buy now, pay later and interest in the option.”

He added that while few U.S. banks currently offer a BNPL product, he expects more will enter the space as consumer awareness continues to grow.

“It’s early days for buy now, pay later in the U.S., at least,” Smith said. “There’s a ton of room for growth.”

Driven by Data

Michalek said Affirm only asks for a few pieces of information up front to make sure it knows who the customer is before looking at third-party sources to provide an initial loan approval. The company then follows users as they continue to shop using BNPL.

“As consumers use the product, as they navigate their lives using the product across more and more of their purchases, it really creates a rich tapestry of understanding exactly what they’re capable of [managing],” he said.

Forty percent of consumers said they would be at least “somewhat” interested in providing personal transactional data to earn more favorable BNPL payment terms, with willingness to share personal data most common among those most interested in BNPL options overall. Thirty-eight percent of millennials said they would be “very” or “extremely” interested, according to PYMNTS data, as did 21% of Generation Z.

For high-value purchases, Affirm empowers merchants with the ability to solve for affordability without resorting to discounts, and to offer consumers the flexibility to pay over time with payments that fit within their budget. Affirm’s underwriting model has absorbed years of repayment data from various purchases across sizes and consumer behaviors. This allows it to offer payment terms from six weeks to 48 months and interest rates of 0% to 30% annual percentage rate (APR), allowing various merchants to meet their customers’ needs, Michalek said.

From an operations perspective, AWS enables Affirm to collect and analyze a large volume of data at scale, pulling information on consumer shopping, payment and purchasing power across a wide range of merchant verticals and products.

“For buy now, pay later customers … as well as really any payment customer that’s originating credit on AWS, data’s key,” Smith said. “You can take third-party data, you can take credit bureau data, but the more data you have, and the ability to store, catalog, manage, and then, most importantly, glean insights from that data, is huge.”

This availability of data, Michalek told Webster, is what helps power Affirm’s new Adaptive Checkout feature, launched last month to provide consumers with biweekly and monthly payment options for each transaction side-by-side when completing a purchase.

Read more: BNPL Company Affirm Rolls out Adaptive Checkout

“What is comfortable from a consumer perspective on a monthly basis changes from consumer to consumer, and actually from purchase to purchase and even time of year,” Michalek said. “Adaptive Checkout is really looking at that and trying to put the best options in front of the consumer.”