The race to be the top buy now, pay later (BNPL) player heated up once again Thursday (June 10) as European FinTech and BNPL powerhouse Klarna announced its latest funding round a short three months after announcing its last fundraising round. As of that earlier round Klarna came out with an implied valuation of $31 billion — a figure left behind in the dust as of today’s announcement, with this new round bringing the firm’s valuation to a staggering $45.6 billion.

Eight months ago, by comparison, Klarna was valued at a little over $10 billion. With the latest update, it’s the big fish in the BNPL pond in terms of valuation, as Klarna’s valuation is now three times that of Affirm and more than twice that of Afterpay.

Growth for Klarna has come at the price of profitability, which the firm had for its first 14 years on the market — but hasn’t in the last two years. That was a sacrifice made intentionally in the name of growth, Klarna CEO and founder Sebastian Siemiatkowski told TechCunch, as Klarna has expanded into 20 markets, with more than 90 million global active and more than 2 million transactions a day conducted on its platform. As of 2020, Klarna hit over a billion in revenue.

“We’ve scaled up so massively in investments in our growth and technology, but running on a loss is very odd for us,” Siemiatkowski said. “We will get back to profitability soon.”

Longtime payments peeps have heard the promise of profitability “soon” many times before, particularly in markets that are highly crowded and competitive. Klarna certainly has a history of profitability — but it also faces a market that is getting increasingly competitive by the day.

The Valuation Report Card

With a valuation pushing toward $50 billion, Klarna is the most highly valued player in the BNPL space by a comfortable margin. It is not, however, wholly unique, as valuations have been creeping up in the marketplace. Afterpay, for example, currently holds a market valuation of about $21 billion, while Affirm’s valuation clocks in at over $16 billion.

And even outside those tiers, valuations in the segment continue to creep up. Afterpay rival — also Australia-based — BNPL firm ZipPay currently claims a valuation north of $3 billion while Sezzle is knocking on the door to unicorn status with a valuation just shy of a $1 billion.

And that competition leaves out PayPal’s entrance into the BNPL segment — which according to its last earnings report has made something of a splash. In response to an analyst query on the program’s growth, PayPal President and CEO Dan Schulman noted PayPal’s BNPL has done nearly $1 billion in volume, with more than 14 million loans to 5 million unique borrowers via 330,000 merchants on the platform.

The Expanding BNPL Market

Once a niche subset of consumer payments, BNPL has seen a veritable explosion of consumer interest over the last 12 to 18 months, driving sky-high valuations. PYMTS BNPL data from earlier this year demonstrated some 37 percent of U.S. shoppers have tried installment payment services and that BNPL use grew more than 200 percent year over year in the U.S. alone. It also found that North American consumers are especially likely to tap BNPL solutions that allow them to pay a portion of their purchases’ costs at checkout and pay off the rest in biweekly or monthly installments.

PYMNTS’ most recent BNPL data demonstrates it’s a payment method that still has a lot of room to grow: 39 percent of those not currently using BNPL report they would like to, while 48 percent of BNP users are sufficient committed to the product such that they will not buy from merchants who do not offer it as an option.

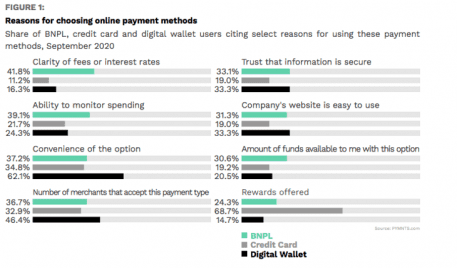

As for what is pushing those customers to BNPL, the data seems to show clarity on fees and interest rates, amount of funds available, ability to monitor spending and convenience are the categories where BNPL payment options are starting to beat out credit cards and digital wallets.

The race for BNPL position, it seems, is set to keep on spinning along for quite some time, given the high level of consumer interest and the greenfield opportunity remaining in the sector.

And the competition remains, as always, highly active. Just as Klarna was announcing its latest big funding round, for example, Affirm was announcing an expanded tie-in with Shopify that will see Affirm installment payments made available to a larger number of Shopify merchants.

Installment pay, apparently, is here to stay — and the race is on to be the dominant players.