Consumers Turn To Installment Payment Plans For Premium Purchases

The pandemic drove dramatic changes in the retail landscape, with 144 million United States-based shoppers shifting their purchasing power from brick-and-mortar stores to eCommerce alternatives. Those changes are likely to persist long-term, too, as 80% of consumers expect to retain their digital habits long after the pandemic has subsided.

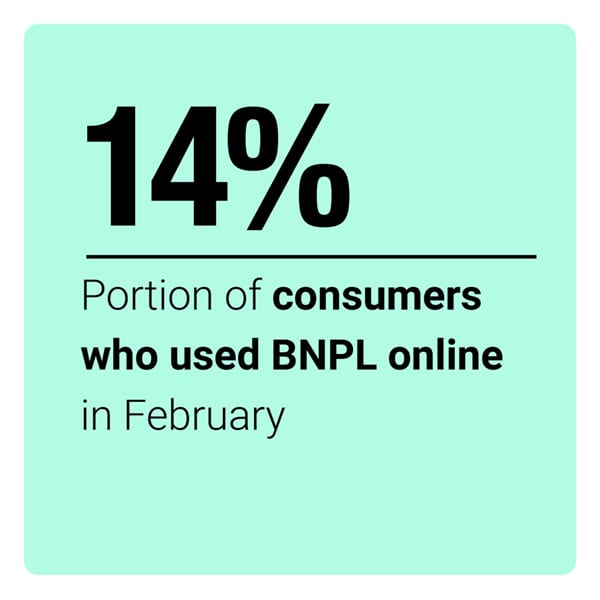

The heavy reliance on online shopping has put renewed focus on digital-friendly payment options like buy now, pay later (BNPL) plans. This latter method appears to have particular sway among younger U.S. shoppers and has attracted customers in countries worldwide. The latest “Buy Now, Pay Later Tracker®” explores these growing trends, identifying BNPL’s core customer bases and uses, and examines the role the installment payment plans are likely to play in the future of retail.

Around the BNPL World

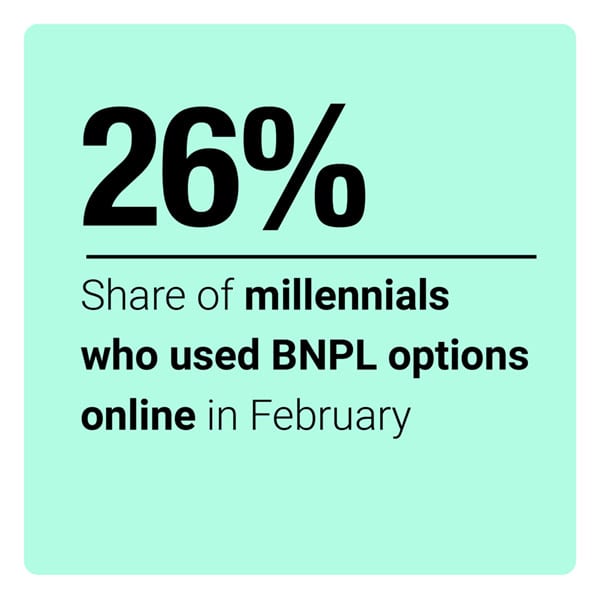

Young U.S. shoppers are particularly likely to turn to BNPL payment options. The se consumers’ financial educations were shaped by coming of age during the Great Recession, which has made many of them wary of using credit and incurring debt, especially if they believe that policies around how much they could end up owing are unclear, said Wisetack CEO Bobby Tzekin in a recent PYMNTS interview. These consumers often feel that credit card bills and charges are murky, leading them to prefer the more straightforward late fees and fines that some BNPL plans offer.

se consumers’ financial educations were shaped by coming of age during the Great Recession, which has made many of them wary of using credit and incurring debt, especially if they believe that policies around how much they could end up owing are unclear, said Wisetack CEO Bobby Tzekin in a recent PYMNTS interview. These consumers often feel that credit card bills and charges are murky, leading them to prefer the more straightforward late fees and fines that some BNPL plans offer.

This and other reasons could be spurring a growing trend toward BNPL in the U.S., with recent research finding that BNPL use in the country grew by more than 200% last year. The study also predicted that the use of installment payment plans and other points-of-sale financing online would continue to expand worldwide, and reach $680 billion worth of eCommerce spending globally by 2026, nearly double the value today.

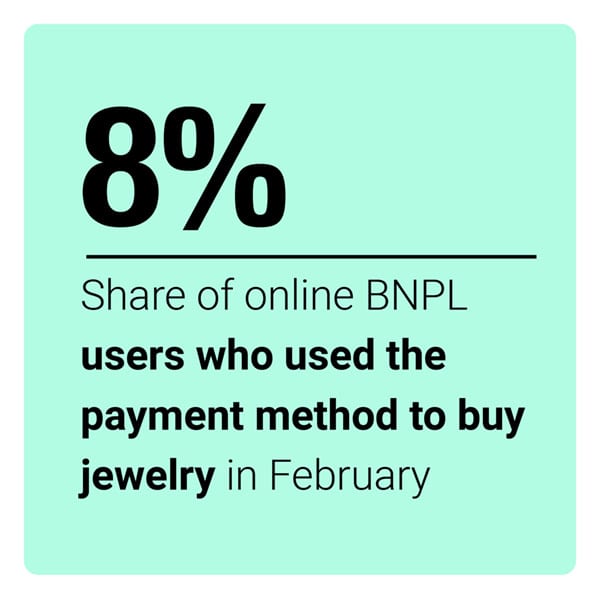

BNPL is particularly popular for certain types of transactions. A December survey found that 47% of U.S. shoppers used these plans to purchase home furnishings and 20% used them to pay for electronics. Researchers found 44% of respondents said they turned to installment payment methods because they lacked the cash for the purchases, while other consumers preferred BNPL options because they saw them as more appealing than other credit options or wanted to avoid credit card debt.

For more on these and other BNPL news items, download this month’s Tracker.

How BNP L Plans Can Bring Premium Feminine Care Products To Cash-Strapped Shoppers

L Plans Can Bring Premium Feminine Care Products To Cash-Strapped Shoppers

Reusable menstrual products can save consumers money in the long term by sparing them from having to buy disposable products every month. Still, such premium items also carry higher price tags that may put them out of reach of the shoppers who most need budget savings. This is a problem that Thinx — a provider of washable, menstrual blood-absorbent underwear — has aimed to tackle by offering BNPL plans, explained Alice Warren, the brand’s director of customer experience. In this month’s Feature Story, Warren discussed with PYMNTS how BNPL plays a critical role in helping shoppers overcome their initial sticker shocks and enabling premium brands to become more accessible and convert new customers by giving them greater flexibility in how they purchase.

Get the full story in the Tracker.

Deep Dive: Predicting BNPL’s Role In The Future Of Retail

COVID-19 has caused shoppers to shift purchasing online and reconsider which  payment methods are best suited for their eCommerce transactions. Some shoppers are also coping with tough financial times and uncertain economic futures during the pandemic, which could lead them to be more judicious about using credit options. PYMNTS findings reveal how BNPL usage has been evolving over the past months and the Deep Dive delves into the latest data for insights into how the installment payments plans are being used across generations and purchasing categories.

payment methods are best suited for their eCommerce transactions. Some shoppers are also coping with tough financial times and uncertain economic futures during the pandemic, which could lead them to be more judicious about using credit options. PYMNTS findings reveal how BNPL usage has been evolving over the past months and the Deep Dive delves into the latest data for insights into how the installment payments plans are being used across generations and purchasing categories.

Find the Deep Dive in the Tracker

About The Tracker

The “Buy Now, Pay Later Tracker®,” a PYMNTS and Afterpay collaboration, brings you the latest news and research from the buy now, pay later space. The April edition offers new insights into the role that installment payment plans could play in the future of retail.