In 2021, we became acquainted with the “second-chance consumer” who uses buy now, pay later (BNPL) alternative credit to build or rebuild FICO scores. Anther cohort of BNPL fans doesn’t need a financial second chance. They’re drawn to BNPL for other reasons.

In The New Credit Model: Why Financially Worry-Free Consumers Still Want Alternatives To Traditional Credit, a PYMNTS and Sezzle collaboration, we note that among “worry-free” consumers who average FICO scores of 768, “40% say they do not use credit cards because the cards encourage them to spend money. Of worry-free consumers without a credit card, 35% choose not to use credit cards because interest rates are too high, and another 25% say fees are too high for them to apply for one.”

These FICO all-stars got that way by being shrewd with money, and research finds them seeking out BNPL options for similar reasons — they see it as a smarter way to spend in certain cases.

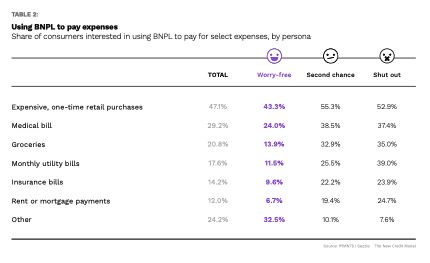

Per the study, “Even if not motivated to use BNPL because of barriers to traditional credit, these shoppers are interested in the payment option when a potential purchase reaches a cost threshold,” adding that “43% of financially worry-free consumers are interested in using BNPL to pay for expensive, one-time retail purchases and 24% wanting to use it to pay medical expenses.”

Get the study: Why Financially Worry-Free Consumers Still Want Alternatives To Traditional Credit

Different Strokes

Of the three cohorts identified — “worry-free,” “second-chance” and “shut-out” — all showed interest in using BNPL for personal finance management, albeit to varying degrees.

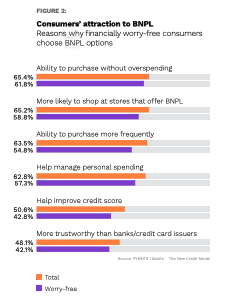

The worry-free, for example, “value BNPL as a way to manage their finances and live within their budgets. Our research finds that 62% of financially secure consumers who have used or would like to use BNPL believe these programs can improve their ability to buy things they want without overspending. In addition, 57% of financially secure consumers believe that BNPL programs can help them manage their personal spending.”

Among the worry-free, the presence or absence of BNPL is having similar effects as seen in other consumers groups. In brief, they prefer retailers offering it, avoiding those that don’t.

According to The New Credit Model, “59% of worry-free consumers who use or would like to use BNPL say seeing it as a payment option makes them more likely to shop with those retailers.”

Room to Grow for BNPL

Considerable headroom remains in BNPL despite its seeming ubiquity, with The New Credit Model noting that “Approximately 29 million American adults (14% of online shoppers) have paid for online purchases with BNPL options at least once during the last 12 months, yet merchants have a substantial untapped audience in new BNPL users. There are 7.6 million consumers who have not used BNPL but are interested in using it in the future.”

A percentage can be gained by increased use of BNPL credit by those who have access to revolving credit but see advantages in fee structures and the convenience of paying over time.

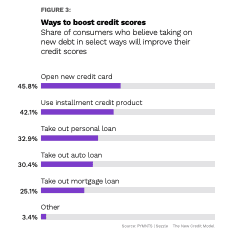

“Our data also finds that 46% of respondents who think taking on new debt will improve their credit scores believe that opening a new credit card will improve their credit scores. In addition, 42% believe that an installment plan credit product linked to their debit cards that is used to make a purchase and pay it off in three to four scheduled monthly payments will improve their credit scores. Such an installment plan is seen as a more viable credit-repair option than taking out a bank, auto or home loan.”